As a group of invited oil company CEOs prepare for Thursday’s scheduled meeting with Energy Secretary Jennifer Granholm and other Biden administration officials, the heads of two U.S. majors, ExxonMobil

XOM

and Chevron

CVX

, made stage-setting public remarks on Tuesday.

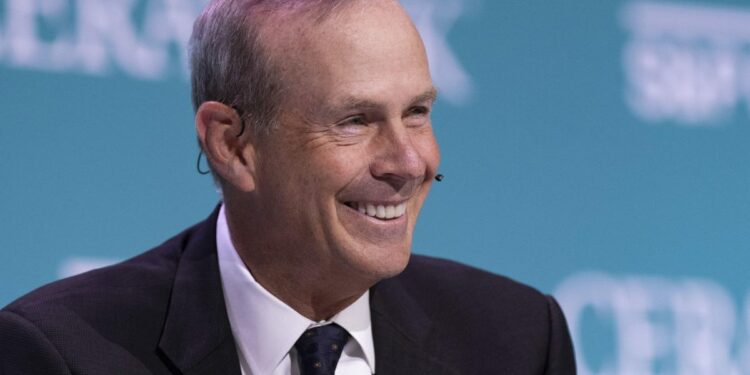

In a public letter to President Biden, Chevron CEO Mike Wirth detailed investments his company has made to raise both production levels and refinery throughputs in the U.S. in recent months. Wirth pointed to the fact that, in the Permian Basin alone, Chevron expects its crude oil output to reach 750,000 barrels of oil per day (bopd), an increase of 15% over its 2021 levels. Wirth also pointed to the fact that “Chevron’s U.S. refinery input grew to 915,000 barrels per day on average in the first quarter of this year from 881,000 in the same quarter last year.”

Acknowledging that high prices for oil, natural gas and gasoline have been impacted by an array of geopolitical factors during Biden’s presidency, Wirth also expressed concerns that the President’s administration “has largely sought to criticize, and at times vilify, our industry. These actions are not beneficial to meeting the challenges we face and are not what the American people deserve.”

Striking a conciliatory tone, Wirth pledged Chevron’s active participation in Thursday’s meeting and expresses hope that Biden will also send his senior advisors to the meeting to ensure “a robust conversation” takes place. “The U.S. energy sector needs cooperation and support from your Administration for our country to return to a path toward greater energy security, economic prosperity, and environmental protection,” he added.

Wirth also urged Biden and his officials to promote “clarity and consistency on policy matters,” and to encourage “an honest dialogue on how to best balance energy, economic, and environmental objectives – one that recognizes our industry is a vital sector of the U.S. economy and is essential to our national security.”

Somewhat predictably, President Biden sarcastically responded to Wirth’s comments by calling the CEO “mildly sensitive,” adding “I didn’t know they’d get their feelings hurt that quickly.”

Also on Tuesday, ExxonMobil CEO Darren Woods, who sent a similar letter to the President last week after Biden had called his company out for making “more money than God” during the first quarter of this year, told the audience at the Qatar Economic Forum that “You are probably looking at three to five years of continued fairly tight markets. How that manifests itself in price will obviously be a big function of demand, which is difficult to predict.”

Woods also echoed Wirth’s theme about the need for clear and consistent energy policies, saying that “We are going to see a lot of volatility and discontinuity in the market place if we don’t get to more thoughtful policies.”

Speaking at the same event, Qatar’s Energy Minister Saad Sherida Al-Kaabi also spoke out about what he called the “demonization” of oil companies, pointing specifically to proposals in the U.S. and elsewhere for various forms of windfall profits taxes on oil companies, many of which are making profits for the first time in three years. “I don’t see the governments coming to pitch in when they (oil companies) were losing money and borrowing when the oil price was negative in Texas,” he said.

Woods made another key point that deserves noting: “The investment plan that we [ExxonMobil] laid out five years ago is the plan we are currently on and the pipeline of the projects that we have are continuing; they are very robust,” he said. That pipeline of projects includes a projected 25% increase in the company’s Permian Basin production during 2022, rapid ongoing expansion of production volumes from its prolific developments offshore Guyana, a 250,000 bopd expansion in refining capacity, and huge investments in a rapidly expanding carbon capture and storage portfolio of projects.

Taken together with the details of Chevron’s expansion and investment plans laid out in Wirth’s letter, what we see here from America’s two largest oil majors is companies that are not planning to be part of a contracting industry. They are planning for ongoing growth in oil demand for the foreseeable future, in spite of the fervent efforts of Biden’s administration and governments in other western nations to try to subsidize a rapid energy transition into quick existence.

These are not companies that plan and enter into such massive new investments in years-long projects hastily. These are multi-billion dollar decisions involving projects with years of lead times, made through careful research and consideration of the energy reality laid out before them. That reality indicates a robust and likely expanding oil and gas industry for years to come.

It’s a reality that Biden and his officials would do well to treat more seriously than they have to this point, and Thursday’s meeting would be a great place to start. But Biden’s flippant response to Wirth makes it clear that the President is still in blame-shifting mode, and that his ongoing efforts to treat “big oil” as a boogeyman in advance of the coming November elections are unlikely to change before then.