Right now, outsiders of various stripes up to and including the U.S. president are attempting to direct Saudi oil policy. Unfortunately, two threads essentially contradict each other. Numerous politicians, scientists, and climate activists are insisting that Saudi Arabia should not invest in additional oil production capacity, while at the same time, politicians, economists, and consumer activists are calling for them to increase production.

This is evidenced by dueling headlines: “Saudis resist calls to cut oil investments.” WSJ 10/23-24/21 a9 and “White House calls on OPEC to boost oil production as gasoline prices rise” CNBC 8/11/21. In response, the Saudis have announced a plan to achieve net zero carbon emissions by 2060, but in the near term, they have chosen not to raise production beyond what has already been agreed to with its colleagues in OPEC+.

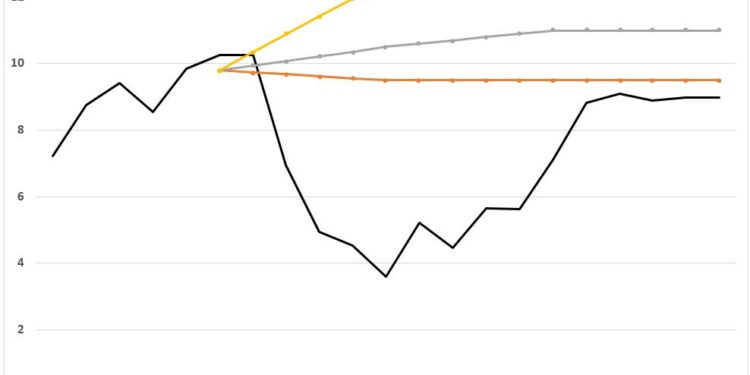

It brings to mind the 1978 visit by U.S. Secretary of Energy James Schlesinger, who explained to the Saudis that oil in the ground was worth more than money in the bank, at the same time he was calling on them to invest in more production capacity. In other words, urging them down a path he thought unwise..[1] They did not accede to his request, fortunately for them, because the demand for OPEC oil collapsed shortly afterwards, when the Iranian Revolution tripled prices and sent the world into recession. (Figure below)

And the advice that oil should be left in the ground because it’s value would increase more than a financial investment like Treasury bills was not very good. As far as I can tell, it was based on one article which looked at oil prices over a four year period when U.S. inflation was high, the dollar declined in value and T-bill returns were thus poor for overseas investors. When oil prices are high, it does seem as if holding oil provides a good return, especially if compared to a period of low prices: from 1998 to 2008, the price rose by 19.1% per year above inflation. From 2010 to 2020, the price declined by 8% per year.

Until recently, the EIA used an assumption that whatever oil demand could not be met by the rest of the world would be met by Saudi Arabia. The figure below shows how DOE assumptions about future Saudi Arabian production capacity evolved (actual production was not broken down by OPEC countries). As global oil demand rose, it was assumed that Saudi production would need to grow enormously; instead, the need for oil from Saudi Arabia repeatedly trailed expectations—often dramatically.

It is not clear how much money Saudi Arabia lost investing in capacity that went unused, but even though they hardly treated the DOE (and other) forecasts as reliable, it was surely in the tens of billions—money they would no doubt wish to have now. (I sure would.)

Which brings us to the present and the argument that investment in oil production needs to cease if global ‘NetZero2050’ goals are met. As I mentioned before (and an upcoming EPRINC paper will detail), even in the highly unlikely event that scenario occurs, it more likely will mean less investment in the private oil industry and a shift of production to the Middle East and Russia. However, if the Saudis and other Middle Eastern producers accept the IEA NetZero2050 scenario (which seems doubtful) and allow their capacity to decline, other producers such as Russia are likely to maintain production. Because, after all, demand is not driven by supply: if the Saudis, Exxon or anyone doesn’t produce oil, consumption will not be affected except if no one produces the oil and prices soar. More likely, the war on oil supply will be as successful as the war on narcotics supply.

So what should the Saudis do? Certainly they should diversify their economy, that is almost always a winning economic strategy. But all past economic leaps have required capital, and while the U.S. got much of it from British lenders (sometimes fraudulently), the Saudis should treat petroleum income as a vital resource for their economic program. Oh, wait, that’s what they’re doing already.

[1] Described in Adelman Genie Out of the Bottle, M.I.T. Press, 1995.