Uber’s investment in Chinese ride-hailing company Didi has outlived its usefulness. Didi’s share price may have jumped nearly 50 per cent this month following reports that a Chinese government probe is coming to an end. But Uber is right to continue with plans to sell down its stake.

In 2016 Uber sold its Chinese operations to Didi in return for an 18.8 per cent stake — a deal valued at about $7bn at the time. Swapping lossmaking investments in competitive markets for a stake in dominant local businesses has enabled Uber to keep a foot in overseas countries. Instead of racking up losses in Indian food delivery, for example, it has invested in rival Zomato.

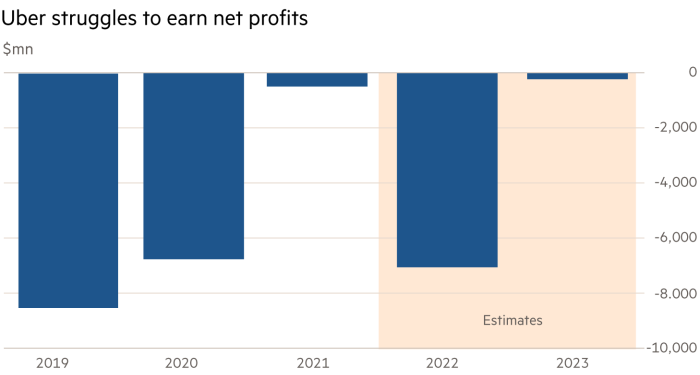

But the investment in Didi has done little to help Uber break even. After listing in New York last year, Didi was walloped with a Beijing cyber security probe that left it unable to add users. That knocked the share price down 90 per cent. Uber was forced to write down its investment. It is now valued at $1.4bn.

There have been other disappointments. Uber sold its flying taxi project to Joby in exchange for a stake in the businesses. That allowed Uber to retain an interest in potentially market-moving technologies. Unfortunately, Joby’s share price has dropped more than 50 per cent since it listed via a Spac last year.

Combined, Uber’s grab bag of equity stakes is worth just under $7bn. That is equal to about 13 per cent of the company’s market value. But as it pointed out to potential shareholders when it went public, stakes in other companies involve significant risks that are outside Uber’s control. Its own share price has more than halved over the past year.

Its chief executive Dara Khosrowshahi insists that his focus is on positive net income and cash flow. The company says that its core business is already profitable. Analysts do not anticipate the group earning a net profit before 2024.

Uber has waited too long to gain any returns on sideline equity investments. The stakes made sense at the time. Now what makes more sense is to sell them.