Although we didn’t know it at the time, Virgin Galactic’s New York Stock Exchange listing via Spac way back in late 2019 was a sign. A warning from the market gods of the madness to come.

The merger of Richard Branson’s boyhood fantasy business with Chamath Palihapitiya’s first listed cash shell, Social Capital Hedosophia, had all the ingredients we’re familiar with in Spac-land today: a company with no revenue, an untested business case, a merger deck with bonkers projections, and a share price that defied gravity.

Yet, like many of the born-of-Spac stock market listings, it was a painful 2021 for Virgin Galactic shareholders. Shifting market sentiment, successive cashing out of shares by Chamath and then Branson, and a delay to its first commercial space trip caused the shares to crumble 77 per cent from a high of $59.41 in February, to $13.38 on New Year’s Eve.

On Thursday, matters got even worse, with Virgin Galactic announcing before market open that it plans to raise up to $425m of convertible debt, with the potential for an extra $75m, maturing in 2027.

Shareholders, perhaps realising there was now someone ahead of them in the queue for the company’s yet-to-be-realised profits, shouted “mayday”. The stock tumbled another 19 per cent to $10.30. Just 30 cents above its pre-merger stock price.

Talk about a round trip — from a $13.9bn market cap less than a year ago to just $2.6bn today:

We have a couple of observations to make here, but first, a quick primer on what a convertible bond is from an article FT Alphaville penned a few years ago:

Got that? Good.

OK so first off, Virgin Galactic announced after the bell that the convertible had been priced at an interest rate of 2.5 per cent, and the notes could be exchanged for equity if the share price hit $12.79. So a 27.5 per cent premium to where the shares closed Thursday. That’s roughly in line with the average convertible premium over the past decade, according to Mayer Brown. All well and good so far.

The problem here though is that conversion price only represents a 4 per cent premium to where the shares closed on Wednesday. In effect, the share price drop induced by the announcement of the deal meant the convertible bond buyers arguably got an unusually small conversion premium and, therefore, the shareholders an even rougher deal.

Second, while convertible bonds are a popular means of raising capital among fast-growing companies with little profits — due to the lower interest costs and lack of immediate equity dilution — they also have a history of weighing heavily on companies that struggle to become profitable, and therefore meet their interest payments.

Take pot stock Tilray. During the height of 2018’s great cannabis bubble, it raised a $450m convert at a 5 per cent interest cost. At the time, it meant its interest costs were higher than its revenues the previous year. While the business has grown sales rapidly since — to $590m over the past 12 months — successive operating losses, including a $144m hit during the same period, has meant the company has had to fund its interest payments out of cash, partly raised through divestitures and equity issuance. Indeed, since May 2019 the firm has tapped shareholders for an extra $372m of cash. Virgin Galactic shareholders might be hoping it gets its house in order quicker than Tilray has, or risk further dilution if it can’t meet its estimated $12.5m annual interest payments (assuming it sells the full $500m of notes).

Yet, judge Virgin Galactic by its ability to meet its own revenue and profitability targets, and it’s hard to make the case that will happen any time soon.

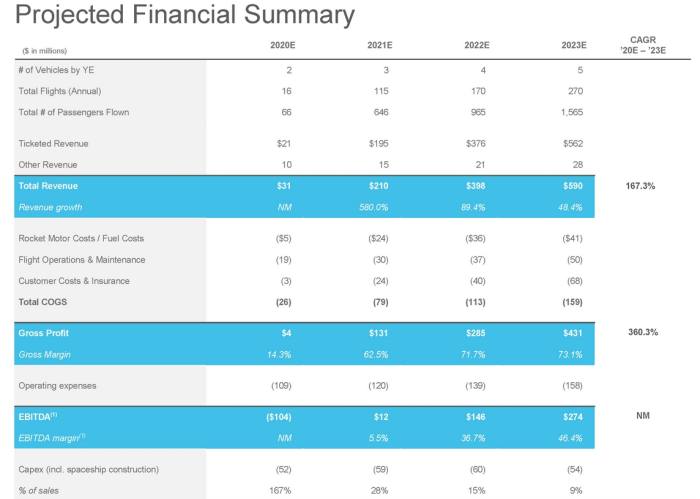

In its Spac-deck, Virgin Galactic said that it expected to generate revenues of $210m in 2021, $398m in 2022, and $590m in 2023 and be profitable, on an ebitda basis at least, by 2021:

Fast-forward to today and analyst estimates for Virgin Galactic’s revenue for 2021 are $3.4m, $7.9m in 2022, and $41.1m in 2023. The estimated ebitda loss in 2021? $303m.

Let’s just hope their aerospace engineering is a touch more precise than their financial engineering. For their customers sake.

Related Links:

Virgin Galactic is rocketing, when’s it returning to earth? — FT Alphaville

Virgin Galactic channels Thomas Piketty — FT Alphaville

Tilray’s $450m game of chicken — FT Alphaville

AppHarvest’s Spac forecasts go splat — FT Alphaville