Chinese tech stocks are starting to show signs of life after nearly a year of being battered by Beijing’s crackdown that began with the cancellation of the record $37bn initial public offering of the fintech giant Ant Group.

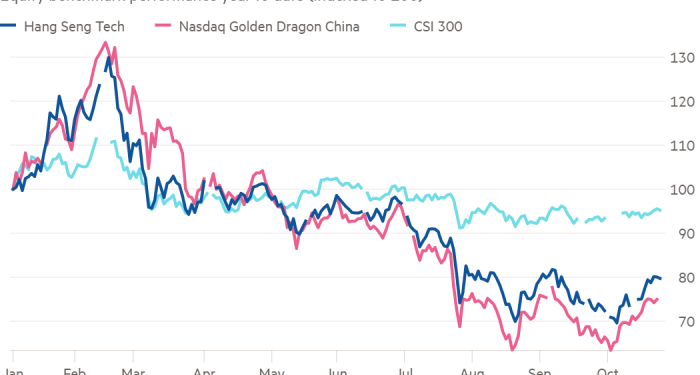

Equity benchmarks tracking the biggest names in China’s internet sector have notched double-digit gains since hitting lows in early October, writes Hudson Lockett, the FT’s Asia Capital Markets Correspondent. The Nasdaq Golden Dragon China index has climbed by 18 per cent, while Hong Kong’s Hang Seng Tech index has jumped more than 13 per cent.

The lower-than-expected fine on food delivery group Meituan and Alibaba founder Jack Ma’s re-emergence in Hong Kong and sojourn to Europe have helped lift Chinese tech stocks, as investors wager that the worst of Beijing’s punishments on the industry is over.

But just as investors begin to look beyond Beijing’s regulatory onslaught, Washington is gearing up to take action on Chinese companies listed in the US through variable interest entity structure, which could force an exodus of players such as Alibaba, Tencent, Didi Chuxing and Baidu from the US stock markets.

The VIE is a complex legal structure used by more than 80 per cent of Chinese companies listed in the US. It allows companies in sensitive industries such as tech and education to get round Beijing’s restrictions on foreign ownership.

The idiosyncratic structure means that investors buying New York Stock Exchange-listed Alibaba shares are not purchasing a stake in a China-based operated company, but rather shares in a shell company (typically incorporated in the Cayman Islands) that in effect controls the Chinese owned entity through a complex web of contracts.

Until last year, investors’ main qualm with the VIE structure was uncertainty over how Chinese courts would rule in a legal dispute. Since VIEs have never received an official blessing from the Chinese government, critics warned judges could deny foreign investors had any legitimate ownership claims on a mainland-based company.

The passage of the US Holding Foreign Companies Accountable Act in December has created fresh concerns about the VIE structure’s viability. The act mandates that the Securities Exchange Commission delist Chinese companies from 2024 if officials in China (citing national security concerns) continue to block their US counterparts from viewing the companies’ audit papers. The body’s chair Gary Gensler said he expects the SEC to start identifying non-compliant issuers from next year.

For shareholders of some Chinese American depositary receipts, the delisting process will be relatively pain-free. They can simply exchange their ADRs for corresponding shares traded on Hong Kong’s stock exchange. In preparation for the regulatory change, Chinese companies with primary listings in the US have been pursuing secondary ones in the preferred location of Hong Kong. In March, Baidu became the last of the so-called BAT stocks to list in Hong Kong after Chinese internet groups Alibaba and Tencent.

But not all Chinese US-listed companies have secondary listings in Hong Kong. The city’s stock market authorities require companies to have a record of “two full financial years of good compliance” and a market capitalisation of HK$40bn ($5.1bn) on their primary listing before pursuing a secondary listing in Hong Kong. For now, that rules out Didi, which only IPOed in June. It also rules out New York-listed TAL Education, which today has a market cap of $2.85bn, down from $59bn in February before the market began hearing rumours of restrictions on the Edtech companies.

For shareholders of US-listed Chinese tech firms without a secondary listing, the spectre of delisting by the SEC could end up being more costly than any regulatory move made throughout China’s year-long onslaught on the tech sector, a risk worth bearing in mind as Chinese tech stocks begin to rally.

The Internet of (Five) Things

1. Sequoia’s bold restructuring

Sequoia Capital, one of Silicon Valley’s oldest and largest venture capital firms, has launched a restructuring to create a single overarching fund. The Sequoia Fund will take in capital from investors and funnel it to Sequoia’s traditional venture funds, which invest in US and European start-ups. It will also hold Sequoia’s stakes in publicly listed companies, such as Airbnb. It will also charge a management fee of under 1 per cent, and potential performance fees, adding an extra layer of fees on top of its existing venture funds.

2. Apple’s ESG troubles

Apple is fighting to prevent shareholder votes calling for more transparency about the use of forced labour in its supply chain and about how it decides which apps to delete from its App Store. The sensitive issues are among six petitions from shareholders, also call for the company to take action on how easy it is for its devices to be repaired, its use of non-disclosure agreements and on incorporating more sustainability measures. The number of petitions is the highest that Apple has faced since 2017, suggesting that pressure on governance and sustainability issues is growing.

3. GM feels the chip crunch

General Motors chief executive Mary Barra said during the company’s earnings report session that while she expected the worldwide semiconductor shortage to ease somewhat by the end of this year, the carmaker will feel the impact through the first half of 2022. The shortage squeezed sales and profits in the third quarter as dealers struggled with inventories too low to meet consumers’ demand for new cars and trucks. Third-quarter revenue tumbled 25 per cent to $27bn, while adjusted earnings before interest and taxes fell 45 per cent to $2.9bn.

4. Cyber attack on Iran’s petrol stations

A cyber attack has disrupted the sale of fuel across Iran by targeting its electronic card payment system, according to the state television channel, forcing motorists to form long queues at petrol stations nationwide. Authorities said the attack was probably carried out by a “foreign country” but did not name a nation.

5. Private equity swooping into to buy song lyrics

The explosion of music streaming on platforms such as Spotify has transformed the scale of the business, increasing the appeal of music rights as an investment in an era of ultra-low interest rates. In the past month Blackstone, KKR and Apollo have poured more than $3bn into buying song copyrights, as a revived music industry hums back towards CD-era revenue levels.

Tech tools

Jamie Waters from How to Spend It reviews four travel gadgets for business travellers, including the “palm-sized” Picopresso espresso-maker that can be fit into carry-on luggage. Waters writes this contraption allows users to “manually pull espresso shots worthy of a Melbourne barista from your beachside shack or remote cabin.”

In addition to the slick black canister, which is made up of a series of stainless-steel parts, you’ll need boiling water, coffee beans, a hand-grinder, and a dose of patience. (If you do want to take a shortcut, you could buy very finely pre-ground beans.) Via a 23-step process of grinding, tamping and pulling, it produces consistently smooth and rich double shots and, while it is a touch finicky, when surrounded by nature the process can be meditative. Indeed, the drive to finesse your routine may prove as addictive as the caffeinated drink it creates.

Wacaco Picopresso, £131.88