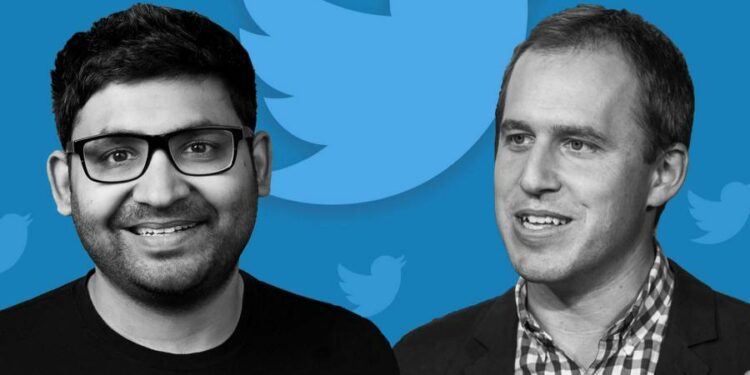

Twitter chief Parag Agrawal faces a potential investor revolt over his $30.4mn pay package at the company’s annual meeting later this month, after the two biggest shareholder advisers recommended voting against his remuneration plan.

Both Institutional Shareholder Services and Glass Lewis raised concerns about the design of pay packages at the social media company, adding that there was a “misalignment between CEO pay and company performance”.

The concerns come as Elon Musk, who has been critical of Twitter’s leadership, continues to advance his $44bn takeover of the company, promising to loosen its content moderation policies plus boost revenues and product innovation. Musk is Twitter’s second-largest shareholder, giving him significant sway at the annual meeting.

Both advisers have also said Egon Durban, co-chief executive of venture capital firm Silver Lake, should not return to Twitter’s board of directors because he is on too many other company boards. Durban serves on seven public boards, up from six last year, said ISS.

In a report shared with the Financial Times on Thursday, ISS said that Agrawal, a longtime engineer at Twitter who replaced Jack Dorsey as chief executive in November, “received a large promotion award that lacks performance-vesting criteria”.

“Some investors may question the magnitude and design of special one-time awards,” said ISS.

Agrawal, who is relatively unknown on Wall Street but respected internally, received a one-time promotion award of stock-based remuneration worth $12.5mn, as well as a salary increase from $600,000 to $1mn plus other bonus increases — together totalling $30.4mn.

ISS warned that Twitter’s bonus programme had “poor disclosure” around “individual performance”.

Earlier this week, Glass Lewis outlined what it said were “concerning pay practices” and called for “more robust disclosure” around Agrawal’s pay. “Given the size” of the executive’s promotion award, “we believe shareholders should be concerned”, it added.

Twitter did not immediately respond to a request for comment.

The social media company has long been criticised for its sluggish growth relative to peers such as Meta, with activist investors such as Elliott Management previously raising concerns about its leadership under Dorsey.

Last month, Twitter’s board agreed to sell the company to Musk for around $44bn, or $54.20 in cash for each share, after initially attempting to hamper Musk’s advance by implementing a poison pill.

If Musk ultimately takes Twitter private, shareholder agitation over the board and pay will not matter. Still, Musk has been critical of the company’s leadership, particularly the board, writing on Twitter that he would reduce their salaries to zero if the deal closes.

For the past several years, Dorsey declined a salary from Twitter. By contrast, Glass Lewis said that Agrawal’s total reported rem in 2021 “is nearly double that of the median of Glass Lewis peers”.

Historically, Twitter has won more than 90 per cent support for executive pay every year since going public.