Topline

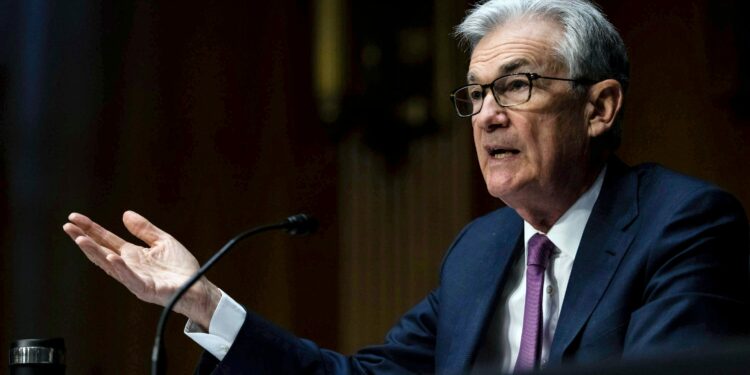

While worries over a Russian invasion of Ukraine, which Western officials say has “already begun,” drag stocks lower in the short term, markets face a bigger problem on the horizon with the Federal Reserve aggressively tightening monetary policy and raising interest rates in a bid to fight surging inflation, experts warn.

Key Facts

Stocks have taken a beating this month amid the Russia-Ukraine conflict: All three major indexes have plunged 5% or more in February, with the S&P 500 falling into correction territory on Tuesday.

Geopolitical risks often cause “short-term volatility” and can change the market’s day-to-day direction in a flash based on the latest headline, says Dan Kemp, chief investment officer for Morningstar Investment Management.

Though the Russia-Ukraine tensions have caused volatility in recent weeks, history shows that market fallout is likely to be short-lived, according to experts who argue investors should be more concerned about the Federal Reserve’s hawkish turn as it looks to fight surging consumer prices.

“Equity markets are more at risk from the fallout from the war on inflation than on a potential invasion of Ukraine,” says Sam Stovall, chief investment strategist at CFRA.

“While Russia/Ukraine continues to dominate the headlines, the outlook for Fed policy is still the number one macro issue facing equities,” says Vital Knowledge founder Adam Crisafulli, who adds that “stocks must still grapple with the approaching monetary tightening process” even after geopolitical risks fade.

While the possibility of a Russia-Ukraine war has spooked investors, “It’s important to understand that the impact on the U.S. economy isn’t likely to be significant,” though higher oil prices will be the “biggest constraint” and consumer confidence could take a hit, says Lindsey Bell, Ally’s chief markets & money strategist.

Crucial Quote:

“Stimulus withdrawal remains the most important macro topic in the market, and that’s actually feeding into the geopolitical worries,” says Crisafulli. He points out that in past instances, stocks could usually rely on easier fiscal and monetary support, “but in the present environment, no such aid will be forthcoming.”

Key Background:

With bond yields spiking this year amid concerns about the Federal Reserve’s tightening monetary policy, markets were already under pressure before Russia-Ukraine tensions spooked investors. The S&P 500 is down more than 10% this year, falling deeper into correction territory on Wednesday. The Dow Jones Industrial Average is down more than 8%, the tech-heavy Nasdaq Composite 16%.

What To Watch For:

Whether the Federal Reserve’s planned rate hikes in 2022 are affected by the Russia-Ukraine situation, which has sent energy prices into the stratosphere. With the price of oil and gasoline rising in recent weeks, a further surge could severely dent U.S. consumer confidence and make inflation worse, economists warn. “It’s really about oil,” says Mark Zandi, chief economist at Moody’s Analytics. “Oil is probably up $10 or $15 a barrel because of the conflict. . . . That will probably add, if sustained, about 30 or 40 cents a gallon to unleaded,” he describes. Such an increase would add as much as 0.5% to year-over-year consumer inflation, Zandi predicts, which “really complicates the Fed’s efforts to rein in inflation and get back to full employment.”

Contra:

Other economists are warning about the impact of higher energy prices, which could create a “polar vortex for the economy and earnings,” destroy demand and “perhaps tip several economies into an outright recession,” according to a recent note from Mike Wilson, Morgan Stanley’s chief U.S. equity strategist.

Further Reading:

Stocks Plunge, Oil Prices Surge After Putin Orders Troops Into Eastern Ukraine (Forbes)

Recession Risks Are ‘Rising’ As Federal Reserve Scrambles To Fight Inflation, Experts Say (Forbes)

Stocks Fall For Second Week In A Row As Russia-Ukraine Tensions Weigh On Markets (Forbes)

Dow Falls 600 Points As Russia-Ukraine Tensions Reach A ‘Crucial Moment’ (Forbes)