The U.S. government is back to driving our energy economy under President Joe Biden and the Democrat-controlled Congress.

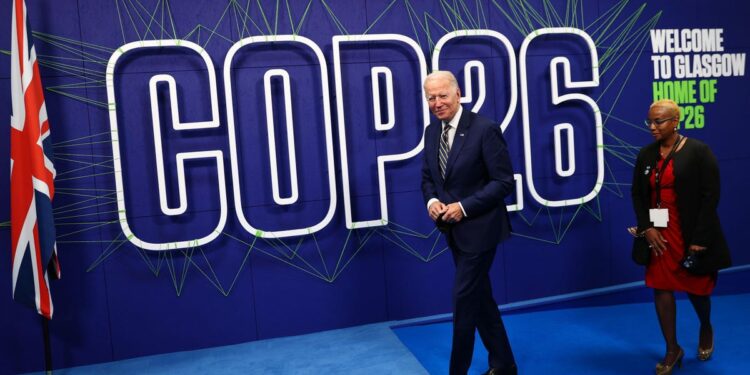

Biden is touting a $1.75 trillion framework for climate and social reforms in the Democrats’ budget reconciliation bill as he attends the UN climate talks in Glasgow this week.

But Biden’s progressive agenda ignores the fact that American consumers, not the federal government, are the best stewards of the economy. Consumers, not elected officials or bureaucrats, should drive investment, production, and buying decisions. That is the foundation of the American free enterprise system.

Biden has kicked these principles to the curb in America’s energy industry in the name of tackling climate change.

The framework includes $555 billion in climate spending, consisting of new and expanded tax incentives to promote clean energy technologies. Biden said the package would mark the “most significant investment to deal with the climate crisis to ever, ever happen — beyond any other advanced nation in the world,” and that it would slash more than a billion metric tons of carbon emissions.

He said the investments are “enough” to position the United States to meet its climate target of cutting emissions roughly 50% from 2005 levels by 2030.

Left unsaid is that Washington is back to picking winners in the American economy, an adventure that has never gone well, particularly in the energy sector.

The package includes expanding tax credits for utility-scale and residential clean energy, transmission, storage, and electric vehicles (EVs) through 10 years, a program totaling $320 billion.

There are also $110 billion in incentives for clean energy technology, including solar, batteries, and advanced materials; $20 billion in government procurement boosts for emerging clean technologies; and EV incentives to lower the cost of U.S.-manufactured EVs by $12,500 for a middle-class family.

Why so many tax credits and incentives? Because many of these technologies can’t compete with their fossil fuel-derived rivals in the American marketplace on their own.

Lest we forget, the United States is one of the three largest producers of oil and gas globally, alongside Saudi Arabia and Russia. That is the reason why America has been largely spared from the energy crisis and price spikes that are now rocking Europe and Asia.

Biden is trying to accelerate the energy transition to low-carbon sources here, but free markets were already moving to decarbonize the economy.

Overall, U.S. emissions fell to 5,160 million tons in 2020. That left American greenhouse gas levels 21.5% below 2005 levels.

And while some of that can be attributed to the economic slowdown from pandemic lockdowns last year, U.S. emissions have been on a downward trajectory this century thanks mainly to cleaner-burning natural gas — which America has an abundance of — displacing coal in power generation.

But Biden’s first year in office tells us he believes the right way forward for the economy is more government intervention, higher taxes, more regulation, and subsidies — and that is where America is headed.

History shows this probably won’t end well. Picking winners through government programs and incentives has rarely worked. After decades of trying to wean the American economy off oil and gas through federal involvement, we should know this by now.

The black eyes belong to both parties and extend well beyond Solyndra and the ill-fated 1705 energy loan program, which became a symbol of the problems with federal involvement in energy markets during the Obama administration.

A shortlist of federal missteps over the years would include so-called “clean coal,” the Synthetic Fuels Corporation, the Clinch River Breeder Reactor, National Ignition Facility, Superconducting Super Collider, FutureGen, Partnership for a New Generation of Vehicles, FreedomCAR, and the Yucca Mountain nuclear waste repository.

It’s time for policymakers to recognize that allowing the marketplace to determine winners and losers is preferable to a politicized, top-down approach that has produced more costly failures than benefits.

Simply put, government bureaucrats lack the incentives that private investors have to manage funds well. Giving subsidies to some businesses puts other businesses that do not receive such subsidies at a disadvantage, distorting investment and other economic activity. Moreover, government subsidies increase the incentive to lobby the government for special treatment rather than compete in the open market.

The Biden administration’s drive to eradicate gasoline-powered vehicles and jettison natural gas-fueled electricity generation and heating in homes, buildings, and factories will have a cost.

All one needs to do to see that cost is to look at our allies in Europe right now. Their over-reliance on renewables and low-carbon energy programs has them grappling with record gas and power prices and left them praying for a warm winter — or that Russia will save them by opening its gas taps further.

Yes, it could have been worse.

Thankfully, moderate Democrat Senator Joe Manchin of West Virginia blocked Biden’s signature Clean Electricity Payment Program, which would have not only paid utilities to move to renewables but also punished them for failing to do so. But serious damage to America’s free-market energy economy has still been done.