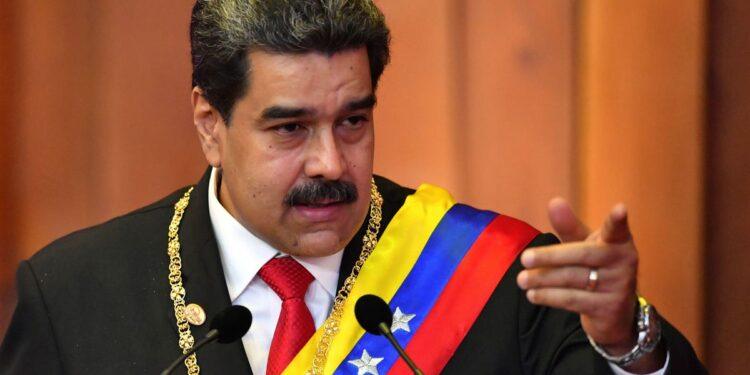

News that Venezuela’s president Nicolas Maduro will visit the Islamic Republic of Iran soon could hardly be more symbolic. That’s because few countries are so well paired when it comes to economic mismanagement.

If the visit augers even more “cooperation” between the two countries, then observers should expect both countries to shrink further into oblivion.

Let’s go through the similarities.

Both countries have huge reserves of oil. Venezuela’s is the largest in the world with approximately 300 billion barrels, while Iran holds 158 billion barrels.

Incredible Shrinking Economies

Yet despite the oil wealth both countries have disastrous economies that have shrunk substantially over the past few years. For instance, Venezuela’s GDP per capita, which measures the average income per person fell to $3,411 in 2018 (the latest available) from $10,568 in 2015, according to World Bank data. Iran has taken a similar route south. In 2011 GDP per capita in the Islamic Republic was $18,009, but that fell to $13,333 last year.

Meanwhile, inflation is devastating both countries. Venezuela’s inflation rate peaked at 350,000% and was recently running at around 1,200%, according to data provided by the country’s central bank. (However, given that the country’s lack of transparency, that’s likely inaccurate.)

Iran’s inflation is more subdued according to the official rates, but still high running at 36% recently, down from almost 50% in April. Again, these are official stats, so should be taken with a heap of salt given the repressive nature of the regime in Tehran.

In both bases the high inflation has led to problems with many people in each country being unable to afford a suitable level of nutrition.

In short, these are two oil-rich economies suffering from high inflation and seeing their economies steadily shrink.

Both at Odds with the U.S.A.

The closeness of the two goes further. Both are also at odds with the U.S. ideologically, and Iran has been assisting Venezuela in increasing its oil output amid sanctions from the U.S. That’s notable because Venezuela’s state-owned oil company, PDVSA, is known to appoint petroleum engineers based on their political affiliation rather than their ability to extract oil. In other words, Venezuela needs the help in drilling oil.

Still, despite the “help” Venezuela’s oil production has remained well below 1 million barrels a day for the last year or so, far below the peak of 4 million in 2016. And the economy remains a mess.

Iran’s output is limited by OPEC quotas and was recently around 2.5 million bpd.

What happens next? Likely, collaboration between the two countries will result in some more oil output by Venezuela. How much depends very much on whether Venezuela gets serious about running its oil company efficiently or whether it continues to appoint “‘experts” based on political connections.

It’s worth watching closely. But my bet is both countries continue to descend into economic oblivion until their respective regimes get ousted.