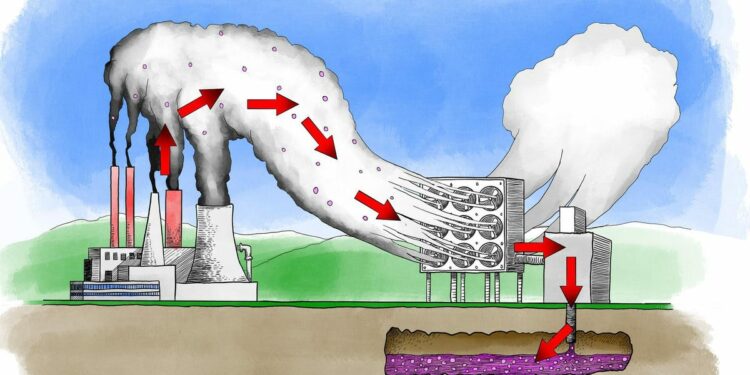

Honeywell and The University of Texas at Austin (UT-Austin) announced today that they are forming a collaborative effort to capture carbon emissions from power plants and heavy industry installations like steel and cement plants. In the venture, Honeywell will combine its proven carbon capture technology with UT-Austin’s proprietary advanced solvent technology to dramatically reduce carbon emissions from these types of facilities and either sequester the carbon or target it for other uses.

Honeywell is already capturing 15 million tons of CO2 in existing projects each year for use in storage utilization applications, and had a capacity to raise that to 40 million tons/year through those installed projects prior to this collaboration with UT-Austin. Under current carbon policy frameworks in North America and Europe, this collaboration with UT-Austin would enhance the economic viability for additional projects.

According to the joint release, “For a typical power plant (650 MW capacity), applying advanced solvent carbon-capture technology would enable the capture of about 3.4 million tons of CO2 annually, equivalent to removing nearly 735,000 cars from the road each year.”

The International Energy Agency (IEA) recently estimated that CCUS project capacity would need to increase more than 20 times to enable capture of 840 million metric tons per year of CO2 by 2030 in order to meet its Sustainable Development Scenario (SDS). The SDS demonstrates IEA’s pathway to limit global temperature increase in this century to less than 1.65 degrees C.

“We recognize that carbon capture technology is an important lever available today to reduce emissions in carbon-intensive industries that have few alternative options, such as steel plants and fossil fuel power plants,” said Ben Owens, vice president and general manager, Honeywell Sustainable Technology Solutions. “By working with UT Austin, our advanced solvent carbon capture system will enable lower cost of CO2 captured post-combustion.”

I’ve written a great deal about the rapid advancement of various CCUS-related technologies and projects this year, since this growing industry represents a pathway to ongoing viability and survival in a greener power mix for the oil and natural gas industry. The more emissions in the power and transportation sectors can be captured and either effectively sequestered or the carbon used for other purposes, the more viable fossil fuels will be able to remain into the future.

If we can successfully eliminate carbon from our existing energy mix to such a large extent, why spend the trillions of dollars that will be required to move to an entirely different set of energy-generation sources like wind, solar and electric vehicles? Or, as Kimmeridge Managing Partner and Chairman of the Board for Civitas Resources Ben Dell told me in an interview earlier this year: “One of the things I ask people is if all the E&Ps were net-zero and have no carbon footprint, or if you could sequester carbon for a dollar, would you change any of the energy infrastructure you have today? And most people say ‘no.’ Because, why would you change it? It works well; it’s very functional. Why would you invest trillions of dollars in something else if what you already have works?”

Certainly, the climate change lobby hates that entire concept, since it is so focused on obtaining ever-rising government subsidization for those three specific industry segments. But it is a perfectly reasonable question to pose.

Those renewables and EVs have carbon emission profiles of their own, especially when you follow the carbon trail across their entire supply chains, starting with the mining of the array of critical minerals on which they all remain so reliant. To be successful in maintaining the energy mix status quo, CCUS projects would not need to capture 100% of carbon emissions from existing sources in order render those sources competitive in the emissions profile market – they would simply have to lower those emissions below those of the competition to render the energy transition argument less viable or even non-viable.

Given that reality, one might ask why it is that the roughly $600 billion of Green New Deal funding contained in President Biden’s “Build Back Better” Bill focuses so heavily on new subsidies for renewables and EVs, and almost not at all on funding to help make the nation’s existing energy mix more viable in the climate change equation. It’s a good question.

Unfortunately, the most accurate answer seems to come in a single word: Politics.