Topline

The stock market moved higher on Wednesday as investors nervously look ahead to the conclusion of the Federal Reserve’s upcoming policy meeting, with the central bank now expected to hike interest rates by a more aggressive 75 basis points in an effort to deal with surging inflation.

Key Facts

Stocks bounced back Wednesday morning after five losing sessions in a row: The Dow Jones Industrial Average rose 1.2%, over 300 points, while the S&P 500 gained 1.4% and the tech-heavy Nasdaq Composite 1.6%.

After a much hotter-than-expected inflation report last week—with consumer prices jumping 8.6% in May compared to a year ago, experts are now calling on the Fed to hike rates more aggressively than previously forecast.

Markets are now overwhelmingly betting on a 98% chance of a 75-basis-point rate hike, with a 0% chance for a smaller 50-basis-point rate hike—down from 86% a month ago, according to CME Group’s FedWatch tool.

The last time the Federal Reserve raised interest rates by 75 basis points was under the leadership of Alan Greenspan in November 1994, when the central bank orchestrated a soft landing and avoided a recession despite hiking rates seven times in 13 months.

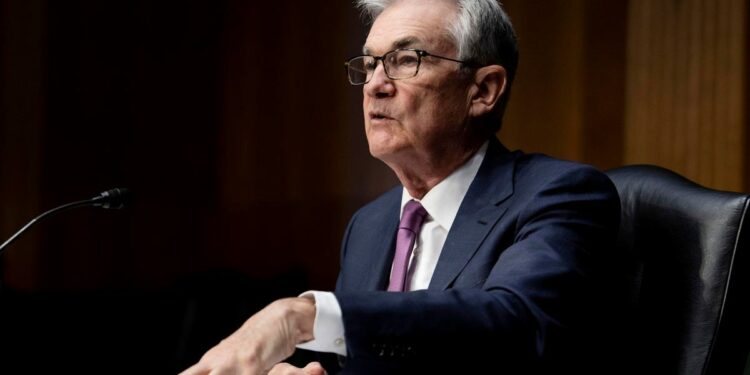

Investors will be watching closely for any new hints on the path for monetary policy going forward when Fed Chair Jerome Powell gives a press conference at 2:00 p.m. EST.

Rates on government bonds moderated somewhat on Wednesday after surging higher earlier in the week, with the 2-year and 10-year Treasury yields recently hitting their highest levels since 2007 and 2011, respectively.

Crucial Quote:

“Don’t be fooled by this Wed morning rally – the overall attitude is still very gloomy, and most people look at a recession and further equity downside as being inevitable,” says Vital Knowledge founder Adam Crisafulli. “The one area of anxiety concerns bear market rallies and there is a worry that one may happen at some point this week around the Fed (most people think any such rally will be ephemeral but violent).”

What To Watch For:

“While markets now expect a 75 basis point rate hike by the Fed, the press conference following the release of the statement this afternoon will help analysts assess the Fed’s ability to navigate Chairman Powell’s so-called ‘softish’ landing as it takes a more aggressive approach in stanching inflation,” says Quincy Krosby, chief equity strategist for LPL Financial.

Tangent:

The price of Bitcoin, meanwhile, fell to around $21,000 as the cryptocurrency market continues to be hard-hit by a massive selloff this week as several firms halted exchanges or announced layoffs in what experts are calling a “crypto winter.”

Key Background:

The benchmark S&P 500 fell deeper into bear market territory on Tuesday, now sitting roughly 22% below its record highs in January. All three major averages are coming off the back of their worst down week since January, falling by roughly 5% or more after last week’s red-hot inflation report led to a spike in recession fears.

Further Reading:

Here’s How Markets Reacted Last Time The Fed Hiked Rates By 75 Basis Points (Forbes)

Stock Market ‘Carnage’ Set To Worsen As Fed Rate Decision Looms—Here’s How Bad It Could Get (Forbes)

Here’s What The Crypto ‘Bloodbath’ Means For The Stock Market (It’s Not Good) (Forbes)

Dow Plunges Nearly 900 Points, S&P 500 Enters Bear Market Territory As Inflation Fears Roil Markets (Forbes)