Chinese ride-hailing group Didi has notified the New York Stock Exchange it will move to delist in the US after shareholders overwhelmingly backed the plan designed to get the company’s services back on to Chinese app stores.

The company said more than 95 per cent of shares cast in the Monday vote approved of its delisting plan, almost a year after Didi pushed ahead with a $4.4bn initial public offering in the US despite signals from Chinese regulators cautioning against the move.

The botched IPO, which occurred on the eve of the Communist party’s centennial, has plunged the company into a months-long crisis. Didi’s shares have fallen 90 per cent since its IPO, wiping $60bn off its market value.

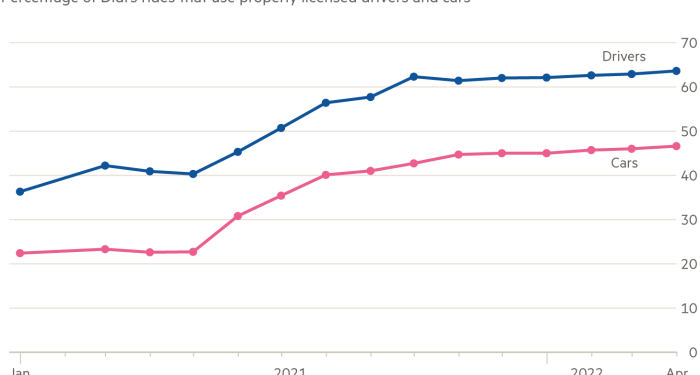

Beijing’s cyber security probe, launched just days after the IPO, has left Didi unable to sign up new users, shrinking its revenues and widening losses, while lay-offs have added to sagging morale.

Didi’s founders Cheng Wei and Jean Liu, who have both retreated from the limelight, hope leaving the US market will spur Beijing to wrap up the regulatory probe. Didi said the executives, who together own about 10 per cent of the company’s shares, would vote in favour of delisting.

The company’s board of directors, which includes representatives from large shareholders including tech groups Alibaba, Tencent and Apple, had also backed the measure. Didi said it would file paperwork with the US Securities and Exchange Commission to begin the delisting process as early as June 2.

However, Didi said this month that it “remains uncertain” if all of the company’s proposed rectification measures, including delisting, would mollify Beijing and allow it to “resume normal operations”.

The company had at one time hoped to list its shares in Hong Kong before delisting in the US but the ongoing regulatory probe sidelined such plans.

Cherry Leung, an analyst at Bernstein, said Didi was in limbo while Beijing’s regulatory crackdown persisted. “Didi is currently in a deadlock situation until the cyber security investigation in China is over,” she said.

“Regulators on the China side want Didi to limit disclosures to the SEC,” she said, noting that moving to over-the-counter trading would allow the company to stop filing financial reports with the US regulator and put its audit papers beyond the reach of the US Public Company Accounting Oversight Board. Beijing does not allow the PCAOB to conduct inspections of audits done in China.

Leung cautioned investor class action lawsuits in the US and compliance issues with Didi’s ride hailing business would be additional obstacles to a Hong Kong listing once the cyber security probe was settled.

The delisting comes despite repeated pledges by top economic officials, including vice premier Liu He, that China would wrap up the regulatory onslaught targeting its top tech companies.

But the probe into Didi has been led by the Cyberspace Administration of China, a Communist party body that answers to China’s president Xi Jinping.

The regulator has been at the forefront of China’s tech crackdown, and in the past two years has expanded its regulatory remit from propaganda and online censorship to control of data and network security.

Additional reporting by Nian Liu in Beijing