Seemingly determined to repeat every energy policy error of the last half century, Joe Biden’s war on the domestic oil and gas industry gained new steam last week even as gasoline and diesel prices rose to new record highs.

AAA reported Sunday that the average national price for a gallon of regular gas rose to a new record of $4.85, recording a 24-cent increase for the week ended June 4. The average price for diesel fuel, a major driver of inflation for consumer goods, also hit a new record high on the same day of $5.64.

Despite the reality that a shortage of refining capacity is a cause of high diesel prices, Biden’s EPA carried the administration’s assault on the industry to its downstream sector late in the week. On Friday, EPA announced additional biofuel blending mandates not just for 2022, but also retroactive mandates that will force refiners to make up for 2020 and 2021 volumes that were previously suspended due to the COVID-19 pandemic.

“Together, these actions reflect the Biden administration’s commitment to reset and strengthen the RFS (U.S. Renewable Fuel Standard), bolster our nation’s energy security and support homegrown biofuel alternatives to oil for transportation fuel,” EPA spokesperson Tim Carroll said. How the move provides any benefit to the nation’s energy security is a real mystery, and Mr. Carroll wasn’t providing details.

The EPA edict will not just raise the cost of refining and distribution of gas and diesel – and thus result in even higher prices at the pump – it will also take millions more tons of corn out of the food supply during a time of growing global food shortages. As such, it is a policy action that prioritizes the making of biofuel that many believe serves no useful environmental or economic purpose over efforts to prevent starvation in developing nations.

At the same time the administration is increasing troubles for refiners, the White House is considering having the President issue an executive order to release diesel from the federal Northeast Home Heating Oil Reserve (NHHOR). Such a release would provide only limited relief to East Coast diesel shortages, since the reserve contains just 1 million barrels of fuel. It would also be highly questionable from a strategic standpoint, since the NHHOR, like the Strategic Petroleum Reserve, was intended as a reserve of fuel for times of national or regional emergencies.

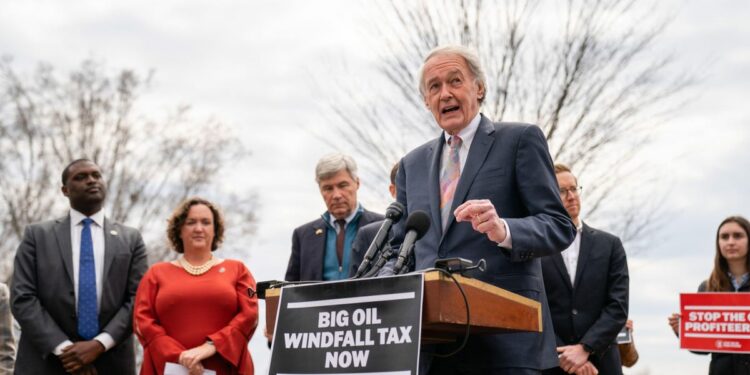

Also on Friday, Deputy Director of the National Economic Council Bharat Ramamurti told reporters that the administration is actively weighing support for various congressional proposals to impose a windfall profits tax on the industry. “There are a variety of interesting proposals and design choices on a windfall profits tax,” he said. “We’ve looked carefully at each of them and are engaging in conversations with Congress about design.”

One proposal the White House is considering is a bill that I wrote about in March. That bill, initially sponsored by Senator Sheldon Whitehouse (D-RI) and Congressman Ro Khanna (D-CA) and now backed by dozens of Democrats in both houses, would levy a tax via the same kind of complex rubric featured in the Jimmy Carter-era Windfall Profits Tax. A fraction of the proceeds from the tax would then be returned to some consumers on a means-tested basis in an annual check that would amount to a few hundred dollars, thus allowing the politicians who vote in favor of the bill to boast about “doing something” in return for voters’ support.

The counter-productivity of such a tax should be obvious to anyone with even the most rudimentary understanding of the market fundamentals causing crude oil and gasoline prices to keep rising: Mainly, the global market for oil is chronically under-supplied. A massive new tax on oil company profits would inevitably result in less oil production in the U.S., which is one of a handful of countries with remaining capacity to increase its own production. Less oil production would only cause prices to rise further and faster.

It is a policy move with no foundational real world logic, but given the performance of this President and his administration’s wishful-thinking-based energy policy to this point, no one should be surprised that it is under serious consideration. Given that Mr. Biden seems determined to repeat every policy mistake of the past, we can only wonder what he might do next:

- Give Richard Nixon’s disastrous move to invoke oil price controls another try?

- Revive Carter’s Natural Gas Policy Act of 1978 to set ceiling prices on a dozen classifications of natural gas?

- Take another go at the Power Plant and Industrial Fuel Use Act of 1978, which discouraged the use of natural gas in power generation and incentivized the building of a new fleet of hundreds of coal-fired plants around the country?

If such policy actions sound absurd to you, rest assured you are correct. But where energy is concerned, the Biden administration appears to be in full panic mode, and no policy move, no matter how ridiculous it might appear, seems out of the question.