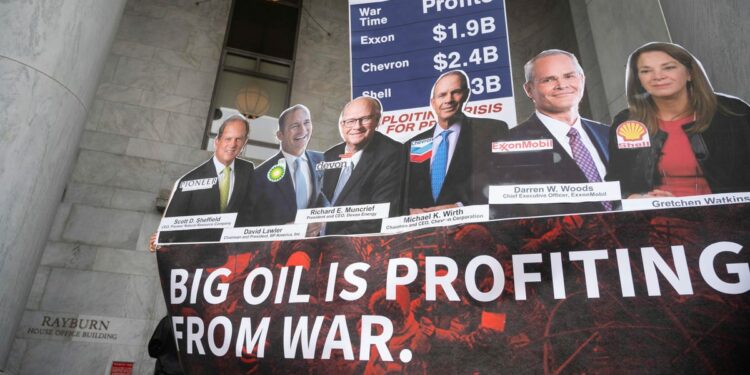

On April 6, the House Committee on Energy and Commerce held a hearing on “GOUGED AT THE GAS STATION: BIG OIL AND AMERICA’S PAIN AT THE PUMP.” There was pain at the hearing as non sequiturs, red herrings, tired tropes, and myths were paraded by both parties for the benefit of their re-election campaigns back home. Democrats blamed the high prices on profiteering oil companies even as they acknowledged the companies’ losses two years ago and that just last year, they had extracted commitments from some of the very same executives to reduce oil production. Republicans blamed ESG and poor policies promulgated by the Biden administration. The oil company execs showed up via Zoom and took their beatings like champs. But like all such sound bite hearings, and with apologies to the late Tom Kennedy, it is not what they said that mattered, it is what they did not say.

First off, General H. R. McMaster made an appearance to reinforce the fact that the current disruption in the global crude oil market is a result of war. Further, he said that it could have been prevented, but he did not quantify the costs of prevention. This was done in our paper “Crude Oil Imports and National Security” some years ago. President Eisenhower thought strategically about U.S. dependence on foreign oil markets having imposed crude oil import quotas, but no president since LBJ has thought about anything but “cheap” oil from OPEC and Russia with all the vagaries and volatility that goes with it.

Not one of the Congressmen complained that there are gasoline lines. There are none. There are no shortages even if they did conjure the Nixon-era gasoline lines and rationing—all of which were caused by President Nixon’s wage and price controls. No. The Congressmen are just unhappy with the price.

Committee members raged at the six oil companies present because they had reported profits of more than $70 billion last year. If that is a problem, then the four companies with even more profits, Alphabet (Google), Amazon, Apple, and Microsoft, should be terrified. Drip coffee at Starbucks is more than $15 per gallon.

Not one of the Congressmen acknowledged the obvious problem that short run supply disruptions are a normal risk of business in a global market. They did acknowledge that prices were set on the global market and begrudgingly conceded that the big oil companies do not collude because of antitrust laws (dating back to John D. Rockefeller’s Standard Oil) and do not set the retail prices because they do not own the gasoline stations that sell their fuels.

Not one of the Congressmen acknowledged that the process of drilling for oil is one fraught with uncertainty: dryhole risk; capital markets; rates of return; prices that go up can certainly go down making any well drilled today unprofitable by this time next year.

Not one of the major oil company executives pointed out that a sizable percentage of their profits come from plastics, fertilizers, and the polymers that make the 21st century possible.

Not one Congressman or oil company executive acknowledged that the higher oil prices and profits were also generating higher tax revenues for local governments, state governments, and the federal government itself. Furthermore, the gains to shareholders benefit retirees and savers in our capitalist economy even as they also pay taxes on their gains. Even CalPERS has been able to enjoy gains after hanging onto oil stocks for so many years.

No one acknowledged that price volatility is higher than that of the workforce in the industry. Just last week, the nurse who took my vitals for the annual exam explained that she had been a geophysicist interpreting seismic data (to find oil) with the oil service giant Halliburton. She is not going back.

No one acknowledged that, just maybe, the consumer, aka voter, could also be to blame for their troubles. No one driving today did not experience firsthand or, at worst, secondhand via their parents, the oil price of $147 per barrel in 2008. Why, then, is the Ford F-150 the bestselling vehicle in the United States? It is not politically correct to blame the victim whose vote you need in November.

No one acknowledged the big elephant in the room. If President Biden and Congress pursue their proposals to renege on long-standing tax law and commercial transactions for federal oil leases that they would fall into the same pantheon of autocracy as Venezuela, Russia, Mexico, and Israel—all countries that lured American oil companies into multibillion dollar investments only to yank them away once oil and gas are found.

The level of energy literacy displayed by the committee members was up to the level of their interns and junior staff: recent BAs in political science. Their research consists of gathering talking points from lobbyists and special interest groups at the cheap bars inside the Beltway.

The nation deserves better leadership. Until the voters of both parties hold their elected representatives accountable, we will, as General McMaster decried, continue to pass shortsighted laws and regulations that really are counterproductive for national security both militarily and economically.