He already restricted imports of crude oil on his first day in office when he cancelled the Keystone XL Pipeline project with a stroke of the presidential pen. Many are now pressuring President Joe Biden to use a declaration of a “climate emergency” to similarly restrict U.S. crude oil exports with another executive order.

Keeping with the strategy of never letting a good crisis go to waste, the President will travel to a retired power plant in Massachusetts in the midst of a national heat wave on Wednesday to serve as the backdrop for a speech detailing his next plans where energy and climate are concerned. Some members of his party in congress have urged Mr. Biden for months now to act to restrict crude oil exports, though the reasoning behind such advocacy is frankly absurd. But declaring a national emergency would provide the President elevated powers to take such action.

White House press secretary Karine Jean-Pierre said Tuesday that “This climate emergency [decision] is not going to happen tomorrow,” but added that it is a potential action that is still “on the table.”

However, Politico notes that, before Biden could issue any such order, he would need his Departments of Commerce and Energy to deliver formal reports claiming that “oil exports have directly caused domestic supply shortages or sustained oil prices above world market levels.” Making any such claims would strain all credibility, to put it politely, but given this administration’s demonstrated penchant for taking irrational energy policy actions, no one should discount the possibility entirely.

Biden’s speech on Wednesday comes amid Democratic concerns that they will be unable to move a legislative package under Senate reconciliation rules that would contain hundreds of billions in new subsidies for the wind, solar and electric vehicles industries that have become some of the most prolific federal rent-seekers in modern times. More than $550 billion in such spending was contained in last year’s version of the so-called “Build Back Better” bill, but Senate Majority Leader Chuck Schumer was unable to work a deal that West Virginia Sen. Joe Manchin or Arizona Sen. Kyrsten Sinema were willing to support.

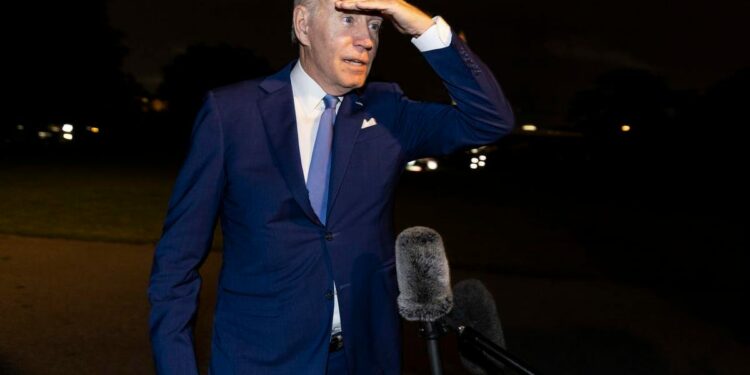

In the wake of last week’s report of record-high inflation during the month of June, Sen. Manchin made it clear again that he would not support any package that contains this profligate spending, which Manchin believes would lead to even higher rates of inflation in the future. That all happened just as the President was departing on his mission to the Middle East, where he and his team had hoped to secure commitments from Saudi Arabia for dramatic increases in oil production. But Mr. Biden returned home empty-handed late Saturday, facing even more pressure from his own party to take additional executive actions ostensibly designed to lower oil and gasoline prices in advance of the November mid-term elections.

It is crucial to understand, though, that restrictions on U.S. exports of oil would have exactly the opposite impact. With its recent focus on the refining sector, it is a point that officials in this administration should clearly get by now.

The simple fact is that America has a shortage of overall domestic refining capacity. Even more to the point, though, is that the country has a severe shortage of refining capacity that is set up to process the grade of light, sweet crude oil produced from shale formations in Texas, New Mexico, North Dakota, Colorado and other basins around the country. This grade of crude makes up the preponderance of U.S. production today, and millions of barrels of it must be exported each day to find a refining home.

This looming mismatch between U.S. oil production and domestic refining capacity is what motivated the 2015 congressional repeal of the 1970s era ban on U.S. oil exports. A decision to reinstate such a ban would force producers to shut-in thousands of shale wells, immediately take millions of barrels of U.S. crude off the market entirely, sending both oil and gasoline prices skyrocketing.

Many have wondered if the many seemingly irrational energy actions taken by this President and his advisors can be attributed to simple ignorance about how energy markets work, or if they are part and parcel of an intentional plan to raise the cost of fossil fuel energy to make wind, solar and EVs more competitive in the marketplace. Should President Biden accede to calls to restrict oil exports, all doubt will have been removed.