The United States has not imported any petroleum gases from Russia since 2019 and, as I previously reported, only imported 3.5% of the more important category of oil from there in 2021.

So, the impact of President Biden’s ban on these two categories of energy imports on Tuesday, part of a global effort to tighten the metaphorical noose about President Vladimir Putin as his military continues its unprovoked and barbarous assault on Ukraine, was largely symbolic. It was also largely supported by Americans, including me.

What does not appear to be affected by Biden’s decision is gasoline and other refined petroleum products, though I am not entirely sure after reading initial coverage from a host of other sources. (Associated Press was most definitive.)

If it were to be included, that would pack a punch: As I also previously reported, Russia is the United States’ No. 1 source for imported gasoline, according to U.S. Census Bureau data I analyzed.

Presumably, it would also send gas prices, already rising rapidly in an environment of high inflation, soaring.

But it makes me wonder. Why not just call the ban what it was, essentially? A ban on oil imports. I presume someone in the Administration knew that and could have made it clear.

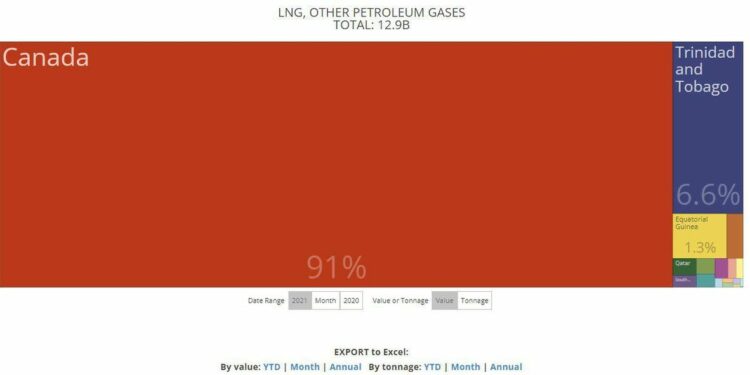

When it comes to petroleum gases, which includes natural gas and liquified natural gas — the former generally transmitted through pipeline, the latter converted to a liquid form for more efficient shipment over the seas — better than 90% of U.S. imports came from Canada last year, with none from Russia.

That’s not the real story, however. The real but not new story is that the United States is the world’s largest producer of both oil and natural gas.

In other words, we have some weight to toss around.

While the United States still imports more oil than it exports, the value of oil imports has fallen more than 60% since 2008 while the value of exports has increased nearly 3,000 percent in that same time frame.

This is due to former President Barack Obama’s decision to end the four-decade-old virtual ban on such exports that grew out of the Arab oil embargo and the advent of hydraulic fracturing.

Petroleum gases is another story.

In 2021, U.S. exports of petroleum gases totaled $67.62 billion. Total imports totaled $12.90 billion, or about one-fifth the total for exports.

How important are energy exports for the United States?

For the first time since 2013, the category of gasoline and other refined petroleum products (jet fuel, for example) was the United States’ most valuable export in 2021, oil ranked third and the category of petroleum gases — natural gas and LNG — was fourth.

Looking at just those three categories, the United States was a net exporter in 2021, with an outbound total of $221.91 billion and an inbound total of $208.21 billion.

That is the result of the fracking boom, pure and simple. It was still surprising, nonetheless, that Elon Musk went all “Sarah Palin” on Twitter.

While he didn’t exactly adopt the former vice-presidential candidate’s “Drill, baby, drill” line, the Tesla

TSLA

founder and poster child for moving the world away from petroleum-based vehicles did reluctantly admit that it was time for the United States to produce as much oil and gas as possible, given the situation in Ukraine.

“Extraordinary times,” he tweeted, “demand extraordinary measures.”