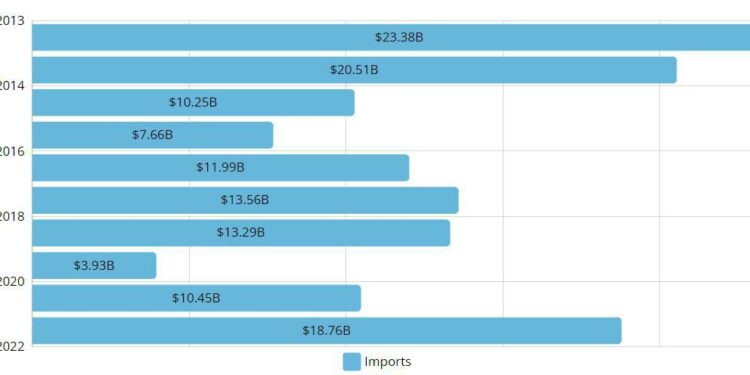

The United States imported 22% of its oil from Saudi Arabia as recently as 2014, a percentage that has dropped to 8% this year, according to my analysis of the U.S. Census Bureau data released last week.

That year, 2014, Saudi Arabia would go on to rank as the United States’ 12th most important trade partner. In 2021, it ranked No. 30.

With that in mind, certainly President Biden’s somewhat controversial trip to Saudi Arabia this week should be less about oil, on track to end 2022 as the nation’s leading import for the first time since 2014, and more about Yemen, human rights, and its role as a counterweight in the region to Iran.

Unfortunately, that might not be the case. Americans care more about the price of gasoline than they do about continuing the Saudi ceasefire with Yemen, any role of Crown Prince Mohammed bin Salman in the murder of Washington Post journalist Jamal Khashoggi and other issues, or its disagreements with the U.S. approach with Iran and nuclear weapons.

Problem is, the Saudis are believed to have limited additional capacity to help thwart the impact on oil prices resulting from OPEC+ member Russia’s invasion of Ukraine and subsequent embargoes.

And, again, that has an ever-shrinking direct impact on the United States. Any agreement for the Saudis to release more oil will not be without some impact, and certainly not without symbolic impact since it would be thumbing its nose at Russia.

What has changed over the last decade is two things.

First, the United States is now a major oil producer.

Second, most U.S. imported oil today comes from two countries: Canada, at 58.3% of the total through May, according to government data released last week, and Mexico, at 10.91.

For Canada, that is the largest percentage ever through May, and the third year above 50%. For Mexico, it is the third year above 10% and the highest percentage since May of 2014, when its total stood at 11.24%.

Saudi Arabia fell behind Mexico on an annual basis as a U.S. oil importer in 2019.

Which ports have seen the biggest declines in the value of oil they import from Saudi Arabia since 2014?

The Port of Morgan City, down $5.18 billion. Since the total through May of this year is $0, that is a 100% decline. Looking at the comparable May YTD-data, the port that is the self-described “birthplace of the offshore oil exploration industry,” hasn’t imported oil from the Saudis three of the last five years. For all of 2021, its oil imports from the world fell below $1 billion for the first time. The record total came in 2012, when it led the nation at $34.21 billion.

Port of Houston shipping channel, down $2.26 billion. That’s a 70.8% decline.

Port Arthur, Texas, down $2.08 billion. That’s a decline of 38.64%.

Overall, U.S. imports of oil from Saudi Arabia have fallen $18.05 billion from 2014, when looking at comparable May YTD data. That is a decline of 57.07%.