The fossil fuel industry is cheap and reliable and vast. But coal is on the way out — “phasing down” was the expression agreed at COP26 in Glasgow in November 2021. By the year 2050, oil and gas will still be abundant: about 40% of the world’s energy consumption, down from roughly 53% now.

But the oil and gas industry is responsible for around 50% of greenhouse gases (GHG) that cause global warming. It follows from simple algebra there will be a lot of GHG still hanging around by 2050 – about 38% of current emissions which are approximately 35 billion tonnes of GHG per year — and this amounts to 13 billion tonnes per year.

Carbon capture and storage.

This is a lot of “leftover” GHG that has to be disposed of in some way if the world is to achieve net-zero by 2050. An escape hatch is needed, and carbon capture and storage (CCS) is the method that has been studied the most and is the most viable.

Essentially carbon dioxide, CO2, is captured from power plants or steel or cement factories, or even from the air itself, and injected deep underground into oil oilfields.

There are myriad old oilfields across the world to handle this, but the process is expensive. Its less expensive if additional oil is produced but this oil just adds more GHG when its burned. Federal tax credits are unlikely to motivate a huge expansion of CCS. A carbon tax will almost certainly be required to meet the goal of net-zero by 2050.

But there is another headwind: to meet this goal a new industry would be needed that grows by 20% per year for every year up to 2050. And this would lead to a CCS industry as big as the present oil and gas industry. So to keep one gigantic industry going, we would need to create another enormous industry of similar size. It doesn’t make a lot of sense.

A new storage scheme.

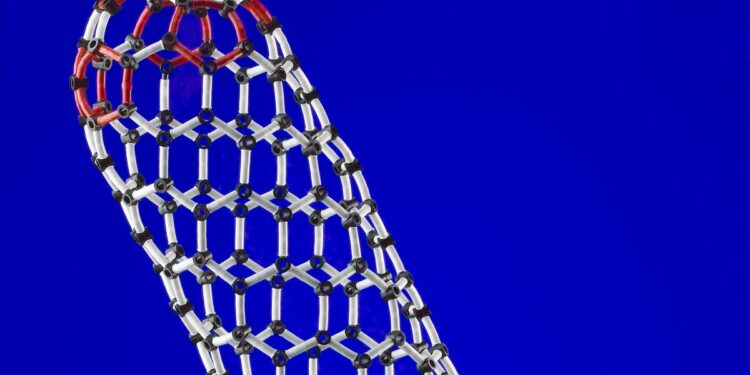

Carbon nanotubes are hollow tubes of carbon with size in nanometers. They are tough, and used in armor for vehicles. They can carry electric currents, and are used in transmission cables. They are flexible, and used in woven fabric.

A company called SkyNano, begun in 2017, uses an electrochemical process to convert CO2 to carbon nanotubes rather than a thermochemical process in conventional nanotube production. The only byproduct is oxygen in contrast to carbon monoxide from other methods.

The company uses point source capture technology to extract CO2 from the atmosphere, and then creates carbon nanotubes that can be used in many ways, rather than having to dispose of the CO2 deep underground by CCS.

The concept of making carbon materials that can be used in a variety of ways is more sustainable and less expensive, according to the company owners. The company receives federal funds as well as customer support to further develop and optimize the process.

If the process can also be used to convert streams of CO2 emitted from cement and steel-making factories, it holds out big promise for removing the huge leftover greenhouse gases to achieve net-zero by 2050 when significant oil and gas production will still be needed.