“Semiconductors are a small appetizer to what we are about to feel on battery cells over the next two decades,” RJ Scaringe, CEO, Rivian, April 18, 2022

If we’ve learned one thing from Putin’s illegal war, it’s that Energy Security is our most invaluable strategic advantage.

The Europeans ignored it for decades, and it has exploded on them in the worst possible way.

In fact, Energy Security is now being seen for exactly what it has always been: the basis of National Security.

Japan’s bombing of Pearl Harbor should’ve taught us that reality over 80 years ago.

So, the silver lining in Putin’s illegal war is that it’s been a great wakeup for the West.

The goal to pursue more and more self-sufficiency on energy is a constant.

Energy-Climate is an equation, of course, and we’ve had far too many smart and important people ignoring the first part.

The disaster that has been unfolding in Europe, where supply shortages and incredibly high energy prices continue to wreak havoc, show us exactly what happens when energy policy becomes utterly unrealistic and over reliant on precarious outside forces.

It demonstrates the essential to “produce as much as possible at home.”

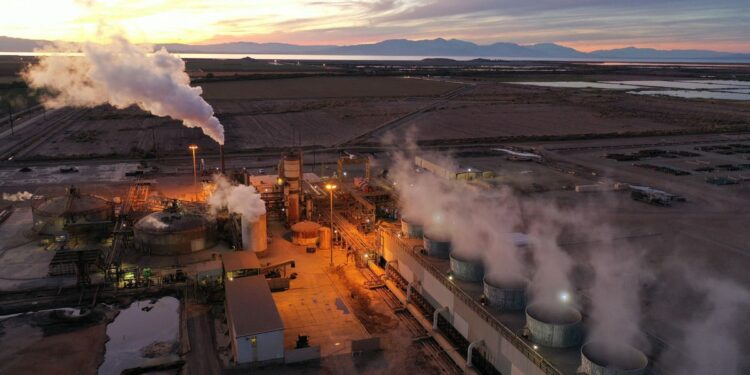

For the U.S., there’s no better area for this now than our need to rapidly expand the American mining and processing system.

As the Great Energy Transition marches on, mining will increasingly become the driving force behind our Energy Security (i.e., National Security).

When we think about adding much more wind, solar, and electric vehicles (EVs), we must immediately think about mining, for the minerals and metals that comprise them (hereafter “critical materials”).

In pursuing renewables, EVs, and their associated infrastructure (e.g., charging stations), we’ve no choice but to build up the industrial base to build them.

Without these critical materials, we risk losing our Energy Security just like Europe did.

As our OECD energy advisor, the International Energy Agency has made clear that the Great Energy Transition that we are embarking on is far more materials intensive than our current energy complex built on fossil fuels.

From energy to climate, we really do face a moral imperative to substantially grow our domestic mining and processing of critical materials.

Ethically, how can we ever justify relying on slave labor from China for solar panels or child labor in the DR Congo to mine the cobalt for EVs?

It’s all horrifically wrong.

This all becomes even more obvious because most nations are also fiercely competing in the energy race for the critical materials that will dominate the energy world of tomorrow: “China Targets 33% Renewables Power Share By 2025.”

Demand for a long list of Rare-Earths, lithium, steel, graphite, nickel, copper, graphite, and dozens of other essentials is already starting to soar.

Our response to the Energy-Climate challenge must be a domestic one because existing supply chains and markets are less secure and have single points of failure.

S&P Global reports on Russia’s strategic hoarding: “Russia is home to 16.8% of global rare earth reserves, but it contributed less than 1% of global production in 2021.”

The West’s fight against Putin could use a lot more EVs right now: Russia is making some $20 billion per month on oil sales to fund its illegal war.

We must better position ourselves because our reliance on imported critical materials is already a clear vulnerability.

According to the U.S. Geological Survey, imports meet more than 50% of U.S. consumption for 47 nonfuel mineral commodities, and we’re 100% net import reliant for 17 of those.

China controls the most important supply chains, holding 80% of the global Rare-Earths market and 60% of the lithium market.

The U.S. mining industry, for instance, could help erase the lithium shortage that’s pushing up the costs of batteries and slowing the EV revolution.

The key problem is the dangerous lag time in mining approvals.

Unfortunately, Natural Resources Chair Raúl Grijalva (D-Ariz.) has led a group of lawmakers to upend the General Mining Law.

It’s a proposal of high taxes, sweeping fees, and duplicative regulations that will block climate progress by blocking the domestic mining of the critical materials needed for more renewables and EVs.

While we do need mining policy reform, we need it to cut barriers and encourage more U.S. production, not the exact opposite.

When it comes to fighting climate change, we all know that time is of the essence.

The demand being created for critical materials continues to outpace our ability to bring the supply online to meet those needs.

For example, it can take just a few years to build a battery mega-factory but about a decade just to gain the permits for a mine needed to supply just one of the metals for those batteries.

Our mining policies are contradicting our clean energy goals: on copper and nickel, “Biden administration revokes Trump-approved Minnesota mining lease.”

The good news is that there’s growing bipartisan recognition that the global market will not slow our rising reliance on imports.

Senators Lisa Murkowski (R-Alaska) and Joe Manchin (D-West Virginia) were the ones to ask President Biden to invoke the Defense Production Act to provide federal money to help jump-start new mines or expand existing ones, for at least five metals.

But much more is needed.

Ultimately, the environmental groups themselves should be the biggest supporters of a U.S. mining revolution.

Our industry is as environmentally responsible as any in the world, as many suppliers lack even basic climate safeguards.

ESG scores in the sector will continue to favor us.

Not to mention that “producing more here means that the critical materials we use won’t have the emissions associated with transporting them here.”

Fortunately, estimates are considerable.

We have over $6 trillion in known mineral resources, spread across a number of states.

And more E&P is bound to find more: “Saudi Arabia of lithium’ is in Southern California.”