Zurich, one of Europe’s largest insurance companies, has enjoyed its best start to a year since 2008 as commercial insurance prices continued to outpace cost inflation, while an imminent disposal paved the way for a SFr1.8bn ($1.9bn) share buyback.

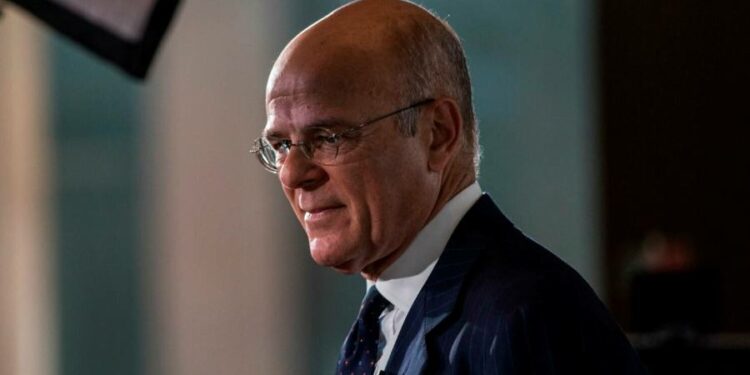

Chief executive Mario Greco told the Financial Times that Zurich would have excess capital even after the “special” return, which was linked to the forthcoming sale of a portfolio of German life policies, and that the preference was to invest any surplus funds in the business or to fund deals.

“We have excess capital, we don’t deny that,” he said. “It gives us flexibility should we ever find an opportunity to deploy more capital in businesses or [to make] acquisitions.”

Zurich’s key measure of operating profit rose by a quarter to $3.4bn in the first half, exceeding analysts’ consensus expectations and representing the best interim performance since 2008.

Its solvency ratio — capital as a percentage of the regulatory minimum — reached 262 per cent at the end of June, having increased by 51 percentage points in the period. The group targets a ratio in excess of 160 per cent.

Zurich’s shares rose about 2 per cent by mid-morning trading in a flat market.

Rising interest rates have lifted insurers’ solvency positions and paved the way for capital returns. The UK’s Aviva announced its latest buyback on Wednesday, citing the macroeconomic tailwinds.

Zurich’s first-half performance was driven by its property and casualty division, which posted its best-ever combined ratio — a key measure of underwriting profitability that tracks claims and expenses as a proportion of claims — at 91.9 per cent.

In particular, natural catastrophe-related claims were well down on last year, although still slightly above the group’s expectations. At the group level, net income, up 1 per cent at $2.2bn, undershot analysts’ forecasts because of adverse market movements.

Greco also highlighted a significant shift in appetite from the reinsurers on which Zurich relies, amid a tightening in the global reinsurance market.

Such companies’ appetite to offer so-called global aggregate reinsurance cover — designed to protect insurer clients against years of multiple bad US storms, for example — had fallen, he said, meaning Zurich now would retain about $200mn extra losses under such a scenario.

Elsewhere, Dutch insurer Aegon’s shares rose 9 per cent as it boosted its cash flow and capital generation guidance.

The group now expects to generate cumulative free cash flow of at least €2.2bn between 2021 and 2023, ahead of the €1.6bn top end of the target range it set two years ago.

Chief executive Lard Friese told the FT that Aegon had a “clear priority” for excess capital, which was to return it to shareholders, most likely through buybacks. It announced on Thursday that a third €100mn tranche of a previously announced buyback programme would begin in October.

“We want the balance sheet to be in a good place,” he said, but added that a key deleveraging target had been met in the second quarter, supporting the case for further returns.

The insurer’s solvency had been boosted by a mixture of rising interest rates and better cash generation through cost savings and growth initiatives, said Friese.