US stocks have shed more than $9tn this year as the Federal Reserve’s attempt to rein in runaway inflation and mounting concerns over global growth have sent investors dashing out of the world’s biggest equities market.

The market value of the S&P 1500 index, a broad barometer of the US stock market, has tumbled from $45.8tn at the end of 2021 to $36.6tn at the Wall Street closing bell on Wednesday, Bloomberg data show.

The benchmark S&P 500 index, which tracks shares in America’s biggest companies, has slumped 21.2 per cent in 2022, leaving it on course to record its worst performance for the first six months of a year since 1962.

“The market mood is dominated by the possibility of recessions in the US and Europe,” said Bastien Drut, strategist at Paris-based asset manager CPR. “It is very negative,” he added, warning that the days of being able to rely on central banks easing monetary policy to support economic growth were “gone”.

The S&P 500 dropped 1.4 per cent in the first few minutes of New York trading. The technology-heavy Nasdaq Composite fell 1.5 per cent, taking its losses this year to just under 30 per cent.

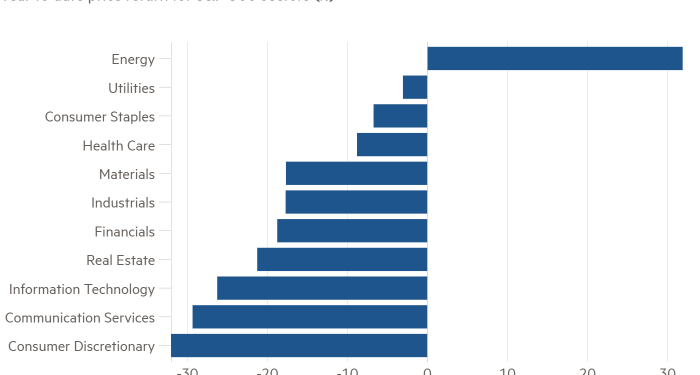

All sectors of the S&P have dropped during the half-year, with the exception of energy stocks, which are 31 per cent higher. Consumer discretionary stocks have fallen the most, registering a 33 per cent decline. Utility stocks, seen as an inflation hedge because of companies’ stronger ability to pass higher costs to consumers, have fallen the least, down 3.6 per cent this year.

“Everything has been very inflation-driven,” said Paul Leech, co-head of global equities at Barclays. “It has been the theme of the year and it has just intensified, really.”

Across the globe, major stock indices have pulled back sharply this year. Europe’s Stoxx 600 was 1.8 per cent lower on Thursday, leaving it down about 17 per cent this year. MSCI’s index of Asia-Pacific markets has slumped 18 per cent in 2022 in dollar terms.

Top policymakers at the European Central Bank’s annual conference on Wednesday warned that the era of low interest rates and inflation had come to an end following the inflation shock caused by Russia’s invasion of Ukraine and the pandemic.

Fed chair Jay Powell has warned that if the central bank does not raise interest rates high enough to combat inflation quickly, the US could face severe and repeated bouts of price rises that policymakers could struggle to rein in. “The process is highly likely to involve some pain, but the worst pain would be from failing to address this high inflation and allowing it to become persistent,” he added.

Markets have been rattled this month by interest rate rises from the Fed and Bank of England, with the former raising the federal funds rate by 0.75 percentage points to a new target range of 1.5 to 1.75 per cent with policymakers signalling another big rate increase next month.

The ECB is also planning a quarter-percentage point rise in July for the first time since 2011.

“Stubborn inflation readings have precipitated an increasingly hawkish Fed response, tilting the policy focus to fight inflation despite potential economic consequences,” said Scott Chronert, US equity strategist at Citigroup. “Investors are deservedly hesitant to buy ahead of ongoing Fed rate hikes and fear of earnings expectation resets.”

Citi also lowered its year-end forecast for the S&P 500 from 4,700 to 4,200 on Wednesday. While that new target implies a roughly 10 per cent rise from the benchmark’s current level, economists at the bank also placed the odds of a global recession at 50 per cent.