Russia’s invasion of Ukraine is presenting a new threat to the unwinding of global semiconductor supply shortages, with higher prices and a fresh squeeze on production looming.

The two countries are big producers of many gases and precious metals — neon, palladium, platinum, nickel, helium, argon, krypton and xenon — used in chipmaking, smartphones and electric vehicles.

As Lex points out, Ukraine is especially important since it is responsible for most of the world’s supply of neon gas. The country produces more than 90 per cent of the semiconductor-grade neon used in the US. It is a byproduct of steel production, but is only found in tiny amounts and is captured by facilities in old steel plants run by both Ukraine and Russia.

When Russia invaded Crimea in 2014, neon prices shot up by at least 600 per cent. This time around, companies have said they can tap into reserves, but the rush to find suppliers that are not in eastern Europe is causing shortages and price rises, not only of neon but also other industrial gases such as xenon and krypton.

Forty per cent of the global supply of krypton comes from Ukraine. Our Tokyo team reports that the price of the gas rose even before the invasion, from ¥200-¥300 ($1.73-$2.59) per litre to nearly ¥1,000 ($8.64) per litre by the end of January.

There have been efforts to diversify production since the Crimea crisis; companies have been stockpiling and replacements can be found for some gases, where gas mixtures that include neon are used to power lasers for etching patterns into silicon wafers.

But analysts at investment research firm CFRA said in a research note this week that they were “concerned that once stockpiles are gone (we estimate the industry has about six to eight weeks of supply), the industry could begin to see the strains . . . Countries like the US and China have the capacity to produce neon, but the timing/pace of ramping up production could prove to be an issue “.

BMO Capital Markets analysts say the motor industry could again be hit hard, both from chip shortages and a lack of wire harnesses. The latter bundle up the miles of cable in every car and Reuters reports production at Volkswagen, BMW and Porsche is being affected. Twenty-two car companies have invested more than $600mn in 38 plants in Ukraine — many, though not all, producing wire harnesses — and they employ over 60,000 people. Right now, being in a war zone, they are the motor industry supply chain’s weakest link.

The Internet of (Five) Things

1. Microsoft closes Russian Windows

Microsoft has joined the growing band of tech companies to announce they have suspended selling their products and services in Russia, cutting off sales of Windows, the PC operating system used on more than half of Russian computers. Meanwhile, Ukrainian ministers have urged Big Tech companies to take more meaningful action to stop Russia’s disinformation campaign, accusing them of “profiting off Putin’s lies “.

2. Sony and Honda combine to tackle Tesla

Sony and Honda said they would form a joint venture to produce electric vehicles, with sales starting in 2025. Lex says catching up with Tesla is a tall order, but supporting each other’s carmaking efforts makes sense. Tesla’s first European “gigafactory” in Germany has just received the conditional approval of local authorities to start production in a matter of weeks.

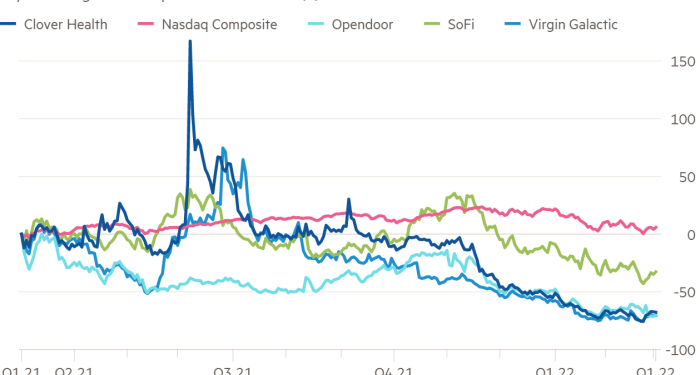

3. Borrowed money funded Spac king

Chamath Palihapitiya, the most vocal promoter of a new wave of blank-cheque companies, financed two signature deals with borrowed money, while emphasising the importance of sponsors having their own “skin in the game”. Borrowing arrangements viewed by the FT indicate that Palihapitiya put less personal cash into his deals than was previously obvious as he built an empire in Spacs.

4. Three boosted by towers sale

The UK’s competition watchdog has approved Spanish mobile tower operator Cellnex’s acquisition of CK Hutchison’s 6,000 British assets. The deal will provide mobile operator Three UK, owned by Hutchinson, with €3.7bn to invest in a network that has been significantly underperforming its competitors.

5. Video: Raspberry Pi at 10

The Raspberry Pi promised to bring computing skills to children, but instead became the go-to machine for hobbyists and tech projects. With an IPO planned this year, Cristina Criddle visits the founders to tell the story of Pi, and ask: is it really a success?

Tech tools — TCL’s folding phones

Folding-screen phones may have taken a step backwards at this year’s Mobile World Congress in Barcelona, judging by the reaction to the latest on display. Engadget saw two prototypes from TCL and was not overly impressed by the technology. The Ultra Flex (above) has a 360-degree hinge and flexible display that means it can be folded to have the screen on the inside or the outside. But it made “unsettling noises and felt like crunching cereal” when the reviewer tried to close it either way.

The second, “Fold n’ Roll” concept device, used a motorised mechanism that unfurled more of its screen at the push of a button. However, “sometimes it worked as expected, sometimes pushing the button did nothing and sometimes the mechanism would whirr away but the screen would struggle to move”. CCS Insight analysts believe TCL will undercut rivals with the commercial release of a foldable this year, but these two devices still seem to need a lot of work.