British engineering company Renishaw expects the semiconductor shortage that has wreaked havoc on global manufacturers to persist for another two years, as the supplier to chip production sites plans to expand its workforce to meet soaring demand.

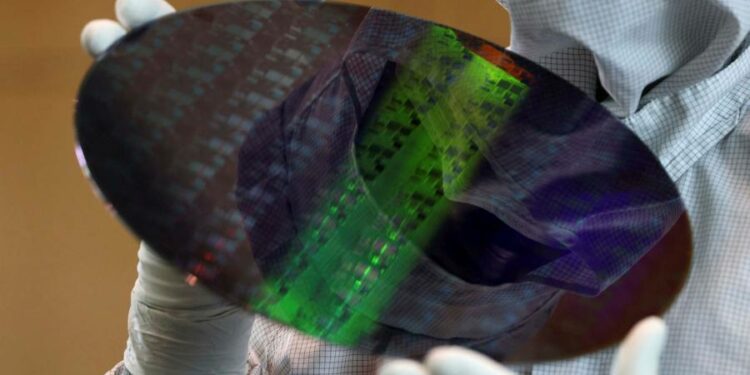

The FTSE 250 group, which makes precision measurement equipment used by the electronics, automotive and aerospace industries, overcame supply chain issues bedevilling many industries to capitalise on strong semiconductor demand and post record first-half earnings this week. Renishaw uses chips in its own products but is more important as a machine parts supplier for semiconductor plants, providing encoders that enable precision manufacturing to the nanometre.

Will Lee, Renishaw chief executive, said that strong investment by chipmakers to increase production is likely to persist with years of tight supply ahead for the vital electronic components essential for the automotive, appliances and medical device sectors.

“Talk is of supply challenges going on another couple of years,” he told the Financial Times. “That’s interesting in terms of demand. The fabs [semiconductor fabrication plants] we supply to are very complicated and sophisticated facilities.”

The semiconductor industry is a cyclical industry, swinging between overcapacity and undersupply, but Lee said that those booms and busts were evolving. “It feels like this is going to be an investment wave going on for some time . . . each time these waves get longer and stronger and the baseline is higher,” he said.

Large semiconductor manufacturers have said that no quick end to the supply issues is in sight. In October, Arvind Krishna, IBM chief executive, said that supply shortfalls would “more likely” continue to 2023 or 2024, while Taiwan Semiconductor Manufacturing Company, the world’s largest contract chipmaker, is investing up to $44bn this year to bolster production.

A surge in industrial automation and recovery in spending on machine tools also helped Renishaw almost double pre-tax profits to £84mn on revenues of £325mn in the six months to the end of December.

However some analysts are sceptical of a lasting boom in industry investment that would benefit Renishaw. Sanjay Jha of Panmure Gordon raised his full-year revenue and profit forecasts for the company in 2022, but lowered them for the following year arguing that the semiconductor capital equipment sector is still “highly cyclical” and higher pandemic spending on electronics is likely to unwind.

Renishaw, which has kept most of its workforce in Britain, has expanded to almost 5,000 staff to keep up with demand, reversing cuts made before and at the start of the pandemic. This year it plans to hire a record 180 graduates and apprentices, as well as experienced engineers to develop new products and commercial strategies.

Octogenarian founders Sir David McMurtry and John Deer put the Gloucestershire-based business up for sale last year with conditions that in effect ruled out private equity ownership amid a flurry of buyouts of UK-listed groups. The majority shareholders subsequently ended the process after finding no appropriate stewards for the company.

The lack of clarity over future ownership has weighed down on the shares, which hit a high of £69 in March last year but have slipped lower since to trade at about £48.