The UK and French governments will each have a seat on the board of a new satellite operator aiming to take on billionaire space entrepreneurs Elon Musk and Jeff Bezos under merger terms being thrashed out on Sunday between Eutelsat and OneWeb.

Paris-listed Eutelsat and OneWeb, the space-based internet pioneer rescued from collapse by a $1bn British-led bailout in 2020, are close to agreeing an all-share deal that aims to create a company with the financial firepower to compete in the rapidly growing market for space-based connectivity.

A merger would address Eutelsat’s need for growth to offset a declining satellite video business and OneWeb’s requirement for $2bn-$3bn in investment to complete its network and update its technology, according to people close to the deal.

A deal could also help to revive co-operation between Brussels and London on space projects after disputes over the post-Brexit deal between the EU and UK damaged relations. Tensions over the Northern Ireland protocol governing trade between the province and the rest of the UK have led to a stand-off over issues such as the UK’s participation in Copernicus, the earth observation programme.

People close to the deal cautioned that while many issues had been resolved, final agreement had not yet been reached by Sunday evening. But many expect a deal to be unveiled as early as Monday.

Under the terms being discussed, Sunil Bharti Mittal, OneWeb’s chair and its biggest shareholder through his Bharti Global group, is expected to be co-chair of the combined company. Bharti will hold a share of roughly 18 per cent, according to two people with knowledge of the deal.

Eva Berneke, Eutelsat’s chief executive, is expected to remain in her post.

The UK and French governments are expected to have similar stakes of roughly 10 per cent and one board seat. France’s stake will be held through the Banque Publique d’Investissement, a state-backed business development bank.

Britain will also retain its golden share in OneWeb, giving it a veto over sales on national security grounds and rights to the location of the headquarters and any technology transfer. France will also receive guarantees about the headquarters of Eutelsat.

OneWeb and Eutelsat declined to comment.

The deal is the culmination of a long-held ambition by Eutelsat to integrate OneWeb more closely into its offer.

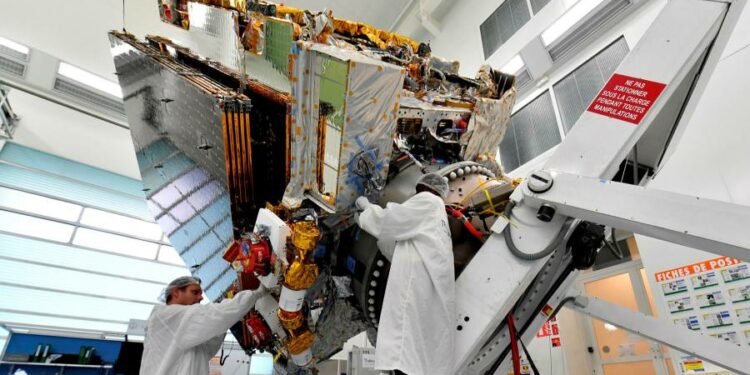

The French company took a 24 per cent stake in OneWeb in 2021 and in March announced a joint marketing deal to bring the UK operators’ low earth orbit capabilities to its customers.

Dozens of companies around the world are racing to stake a claim to the emerging commercial opportunities in LEO. Musk’s Starlink has already launched more than 2,000 satellites into LEO and is developing a commercial service in many parts of the globe. Jeff Bezos’ Project Kuiper is also planning to launch a mega-constellation of satellites in the coming months.

Eutelsat is also hoping the deal will encourage Brussels to consider OneWeb as a platform for the EU’s proposal to build its own space-based internet service from low earth orbit. This had been deemed difficult under the previous ownership structure.

Nevertheless, it is a big gamble for Eutelsat and could raise challenges from investors, said one analyst.

“Eutelsat has nearly €500mn discretionary free cash flow — most of which it could probably spend on a project like OneWeb,” said Armand Musey, founder of consultancy Summit Ridge Group. “The bottom line is that the [traditional] industry is in decline and Eutelsat apparently sees OneWeb as a way to generate growth. It’s a big ‘bet the farm’ risk.”

It could also prove politically “tricky,” said another analyst.

“The British government had viewed its investment in OneWeb as a way to advance the UK’s space sovereignty, but these goals could be subsumed by Eutelsat’s ownership,” said Chris Quilty of Quilty Analytics. OneWeb’s ability to secure an Arctic communications contract with the US Department of Defense could also be at risk as “France is not a member of the Anglo Five Eyes security coalition”.

Officials said the deal valued the UK government’s stake at $600mn, a paper profit of $100mn.

A merger will relieve the UK government of any responsibility for the sizeable investment still required to complete OneWeb’s business plan. Many senior officials expressed relief that the burden had been shifted. Officials said that Ben Wallace, defence secretary, had not been in favour of the UK government taking a stake in the company in the first place.

“The MoD wasn’t planning to use it — we had no interest in it,” said one senior official. “Ben always thought it was a fantasy by Dominic Cummings [Boris Johnson’s former chief adviser] because he was obsessed about space.”