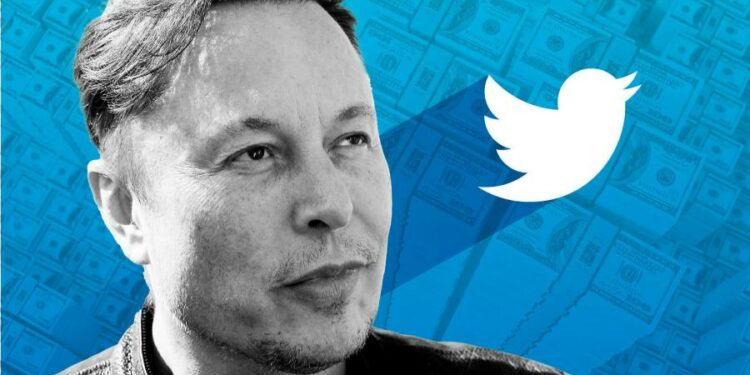

Elon Musk is proving himself an exception to yet another rule. Blockbuster takeovers are usually the preserve of large corporations, not individuals. Undeterred, the entrepreneur has disclosed that he has rustled up $46.5bn of committed capital for his proposed acquisition of Twitter.

Fans of the Tesla chief executive will be thrilled. Liberals will be appalled by the growing prospect of Musk curbing moderation of tweets. Musk himself must relish disproving critics who suggested his boast “funding secured” might prove to be hollow once more.

The mercurial entrepreneur has picked a good time to submit legal documents confirming he can get the money if Twitter’s board and shareholders accept his offer. Tesla is hitting its targets.

Twitter’s directors must now match Musk’s seriousness and consider his proposal. But just because he can fund a $54.20 per share buyout does not make that the right selling price for Twitter.

Morgan Stanley, which is advising Musk, has committed to put up $13bn of debt financing in the form of loans and credit facilities along with several big banks. That figure is a steep 9 times Twitter’s 2022 estimated ebitda. But not all the debt would necessarily be drawn down immediately. Some might moreover be syndicated as loans or junk bonds.

The balance of $33.5bn would fall to Musk himself. Lenders have extended a $12.5bn margin loan secured against his Tesla shares at a loan-to-value ratio of 20 per cent. This implies that Musk will pledge $62.5bn of his Tesla holdings. After Tesla shares rallied six per cent on Thursday, that stake was worth $180bn.

Musk has already pledged a large stake, according to filings last year. How many shares remain unencumbered is unclear.

This is interesting because the final piece of the financing puzzle is a commitment of $21bn of equity. That could come from cash Musk has on hand, Tesla shares he sells or, most intriguingly, portions he syndicates to private equity sponsors or sovereign wealth funds. It is Musk’s problem where he finds the money.

Twitter has the bigger head scratcher. Until now, its directors could ignore Musk. With financing seemingly secured, they must seriously consider what best generates value for shareholders. That could be wringing out a higher bid from Musk, finding a white knight buyer or deciding that the company remains independent. With Tesla’s share price so resilient, Musk can afford to keep Twitter bosses sweating.

The Lex team is interested in hearing more from readers. Please tell us what you think of Musk’s one-man M&A blockbuster in the comments section below.