The world’s biggest contract chipmaker significantly extended its lead on Thursday in its arms race with the semiconductor industry’s two other superpowers.

Taiwan Semiconductor Manufacturing Company said it would spend $44bn this year on its foundries, or “fabs”, and equipment — a 32 per cent increase from the $30bn spent in 2021 and triple the amount in 2019. Analysts had expected capex of around $36bn after TSMC announced a $100bn investment over three years last April.

Its rivals Samsung and Intel are also making big investments in fabs and the next generation of miniaturisation. Samsung announced in November the location for a $17bn plant it is building in Texas. In March, Intel said it would spend $20bn on two new fabs in Arizona and would set up Intel Foundry Services to produce chips for other companies.

TSMC’s news boosted its share price and other semiconductor stocks as markets saw further growth for the industry despite the expected easing of a chip shortage. “We observe end-market demand may slow down in terms of units, but silicon content is increasing,” said CC Wei, TSMC chief executive, referring to the proliferation of semiconductors across numerous industries.

Kathrin Hille in Taipei reported that TSMC is cementing its leadership position. Dylan Patel of the Semianalysis research firm said in a note: “Intel and Samsung are going to have a hard time keeping up with the sheer scale that TSMC is planning for.”

Lex says TSMC’s investment will leave it unassailable and demand for advanced chips with circuit widths of just 5 billionths of a metre will help it maintain its fat operating margin of 42 per cent.

Intel looks to be in the weakest position. It is relatively new to the game of making chips for others, traditionally using its plants for its own microprocessors for data centres and computers made by Apple or running Microsoft’s Windows.

Those face being steadily supplanted as its customers design their own chips, with Apple replacing Intel processors with its M1 chips in MacBooks and Google and Amazon making their own server chips for their data centres.

Bloomberg reported on Wednesday that Microsoft had lured away Mike Filippo, a veteran semiconductor designer, from Apple. The move suggested it was focusing on producing homegrown chips for servers that power its Azure cloud-computing services.

The Internet of (Five) Things

1. London start-ups raise record venture capital funding

Tech start-ups in London raised a record $25.5bn in funding last year, more than double the total in 2020. The UK ranked fourth for such investment, behind the US, China and India, according to a report by London & Partners and Dealroom.

2. The changing role of VCs

John Thornhill has been examining just how successful VC firms have been in investing in start-ups and Sequoia’s decision often to remain invested well beyond any IPO. John Gapper reviews The Power Law, Sebastian Mallaby’s history of the venture capitalists who powered a technological revolution.

3. Flipdish gets Tencent fillip

Chinese tech group Tencent has led a $96m investment round in Dublin-based restaurant technology company Flipdish, raising its value to $1.25bn — more than 10 times the value it achieved in its previous funding round last year. Flipdish provides the tech for creating food ordering apps and the deal highlights investor interest in companies serving the fast-growing home delivery sector.

4. Judiciary seeks to keep pace with crypto and AI

Professor Richard Susskind, technology adviser to the Lord Chief Justice and a director of think-tank LegalUK, has proposed the creation of a new institute of legal innovation that would spot gaps in the law thrown up by technologies such as crypto assets and AI, and promote the greater use of English law in global business contracts.

5. Second Life founder’s second chance at metaverse

With the metaverse all the rage, Second Life appears to be planning a comeback. Linden Lab founder Philip Rosedale is returning to the company that developed the online world. He stepped down as CEO in 2008, but is coming back with some virtual reality expertise from his latest company High Fidelity.

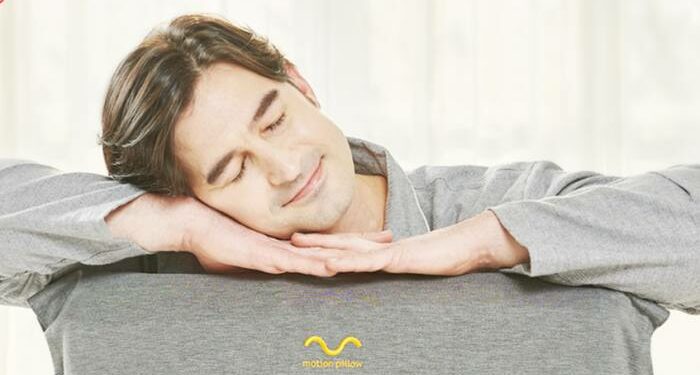

Tech tools — Motion Pillow 3

There was no shortage of healthtech at CES in Las Vegas last week and 10Minds’ Motion Pillow 3 won an innovation award for its headtech anti-snoring smarts. Its AI system can recognise the sound of you snoring and sense where your head is resting. Four airbags inside can then inflate to secure the optimum position of your head for airways to be opened up and normal breathing to resume. You also get an app to track and analyse your sleep. The product itself is a sleeper, with no news yet on pricing or availability.