In December, a cryptocurrency issued by the social networking start-up Decentralized Social soared in value after Coinbase allowed it to begin trading on the company’s exchange.

The listing provided a jolt to the start-up’s fortunes, with its token price briefly doubling to a high of $187. It also boosted the fortunes of another key partner, Coinbase, which had backed the start-up as part of a $200m round of funding announced three months earlier.

DESO, as the token is known, is one of at least 20 cryptocurrencies that Coinbase has listed for trading while holding an investment in a related project, according to a Financial Times analysis of the company’s disclosures, PitchBook data and public announcements.

The findings show that, of those 20 projects, Coinbase listed only 12 as holdings on the website of its in-house investments arm, Coinbase Ventures, as recently as this week.

Andreessen Horowitz, one of Silicon Valley’s leading venture capital groups, is an early investor in Coinbase and holds a seat on the company’s board. The VC firm has also invested in at least a dozen projects whose tokens later gained approval to trade on Coinbase.

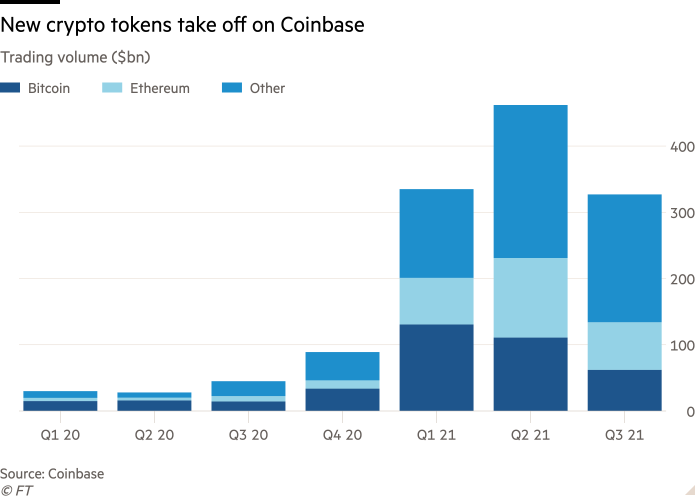

The analysis shows how freewheeling cryptocurrency exchanges blur divisions that are more strictly enforced in traditional capital markets. Coinbase is the largest cryptocurrency exchange in the US, making it a key player in the past year’s boom in digital asset trading, with more than 7m monthly transacting users.

After the FT sent a detailed list of questions to Coinbase last week, the company published a blog post on Saturday in which it promised to make its holdings “even more transparent”.

Coinbase said it did not co-ordinate listing decisions with its board or outside investors. The company added that Coinbase Ventures, its start-up investment arm founded in 2018, has “no influence” on decisions about asset listings.

After the FT subsequently sent a list this week of eight projects that had not been disclosed as receiving backing from Coinbase Ventures and listing their tokens on the exchange, Coinbase added seven of them to its website, including Decentralized Social.

“In the securities world, conflicts of interest have to be identified, disclosed and managed,” said Tyler Gellasch, executive director of the investor trade group Healthy Markets. “In crypto, it seems to be a free-for-all.”

A Coinbase spokesperson said the company maintains policies to mitigate conflicts of interests and any assets in which it holds a financial interest are “evaluated based on the exact same criteria as all other assets”.

Coinbase’s investments could attract scrutiny as the company pursues chief executive Brian Armstrong’s goal of becoming the “Amazon of assets”.

Shares in Coinbase have fallen more than half since the company listed on the Nasdaq exchange in April, trimming $50bn from its market value. The slide has increased pressure on Coinbase to list new digital assets, which bring in fresh sources of revenue from traders hungry to bet on speculative cryptocurrency projects.

Company executives have quickened the pace of new investments from Coinbase Ventures. Coinbase held $280m in strategic investments at the end of the third quarter, more than 10 times the amount it had at the end of the previous year.

In announcements for new token listings, Coinbase includes a disclosure statement that says Coinbase Ventures “may be an investor in the crypto projects mentioned here”, linking to a web page showing investments made by the venture arm.

Earlier this week, the web page listed fewer than 90 investments, without providing specific details about whether Coinbase owned shares or tokens in each of the projects. By Friday, dozens more investments had been added to the web page. Coinbase has said publicly that it has more than 200 investments through the venture arm.

A Coinbase spokesperson said it was “actively in the process” of updating the website but not all investments would be made public, citing “common practice within the venture capital community”.

For years, Coinbase applied a conservative approach to listing new cryptocurrencies, offering under half a dozen available for trading as recently as 2018.

However, the boom in decentralised finance apps and other cryptocurrency projects has spawned a litter of new digital assets, forcing Coinbase to play catch-up to software programs such as Uniswap that allow anybody to list tokens without permission from central authorities. Offshore exchanges such as Binance and FTX have also moved quickly to list the new tokens.

Last year, Coinbase began automating parts of the listing process, paring back its legal reviews and developing what it calls an “experimental zone” to “appropriately disclose risks to customers and enable them to make educated decisions” about new tokens.

Coinbase listed 59 new assets through September last year, and at least dozens more in the fourth quarter, according to filings and company announcements.

The streak has alarmed some lawyers and cryptocurrency watchdogs, who said the listings could attract the attention of financial regulators. Securities and Exchange Commission chair Gary Gensler said last year that several US cryptocurrency exchanges appeared to offer trading in unregistered securities.

“I think there’s eventually going to be millions of crypto assets out there,” Armstrong said on a call discussing Coinbase’s second-quarter earnings in August.

While some tokens backed by Coinbase and Andreessen have produced big returns for traders who bought on listing day, on average they have underperformed bitcoin and ethereum after joining the exchange, according to research by Faisal Khan, an independent cryptocurrency analyst.

Cryptocurrencies that Coinbase had considered listing before 2020 but did not approve have performed better on average than those it chose to list, he said.

“I think that raises a lot of questions about if insiders are dumping on retail investors, as well as conflicts of interest between VCs and exchanges, who work together with zero oversight,” Khan said.

Coinbase said the company had not sold any of its token holdings since they had listed on the exchange. Andreessen declined to comment.

Marco Di Maggio, an associate professor at Harvard Business School who has written a case study about Coinbase, said the company’s disclosure practices surprised him because traders were usually sensitive to perceived conflicts of interest.

“Since the crypto community is not particularly open to these types of things,” Di Maggio said, “I would have expected them to be very careful about this.”