US and European stocks turned higher on Thursday as investors balanced risks of a global slowdown with the potential for central banks to scale back their plans for interest rate rises.

The S&P 500 added 0.6 per cent in early dealings, putting the US equity benchmark on track for its fourth consecutive day of gains after it ended June with its sharpest first-half drop in more than 50 years. The technology-heavy Nasdaq Composite gained 0.5 per cent.

Those moves came as the US Treasury market continued to flash a warning signal of recession, with the yield on the benchmark 10-year bond staying below that of the two-year security, in a pattern known as an inverted yield curve.

For most of this year, financial markets have been dominated by expectations of major central banks rapidly tightening monetary policy in response to surging inflation. However, the mood has changed in recent weeks after purchasing managers’ indices highlighted a sharp slowdown in growth in eurozone business activity and the Institute for Supply Management reported that new orders and employment in the US manufacturing sector were declining.

“Over the last few weeks, recession fears have been so strong that markets are expressing that whatever central banks say, they won’t have the runway to raise rates to the extent they have indicated that they will,” said Tatjana Greil Castro, co-head of public markets at Muzinich & Co.

Minutes from the June meeting of the US Federal Reserve showed its top officials felt tighter monetary policy remained necessary if inflation — now running at 40-year highs — continued to rise.

But since the Fed’s last meeting, investors have scaled back their expectations of how far it will raise borrowing costs. Futures markets indicate the Fed is now projected to lift benchmark rates to 3.41 per cent by early 2023, down from expectations of 3.9 per cent just over three weeks ago.

Following losses for global stocks in April to June, Citi strategists led by Robert Buckland now predict a 17 per cent gain for the MSCI World share index by mid-2023. “However, shorter-term risks remain considerable,” they said, as companies’ earnings come under pressure from weak consumer sentiment and inflation.

In Europe, the regional Stoxx 600 share index gained 1.6 per cent, remaining more than 15 per cent lower for the year to date. London’s FTSE 100 added 1.1 per cent.

The euro hovered just above a 20-year low against the dollar, having fallen as low as $1.016 on Wednesday as recession jitters continued to drive investors into the US currency.

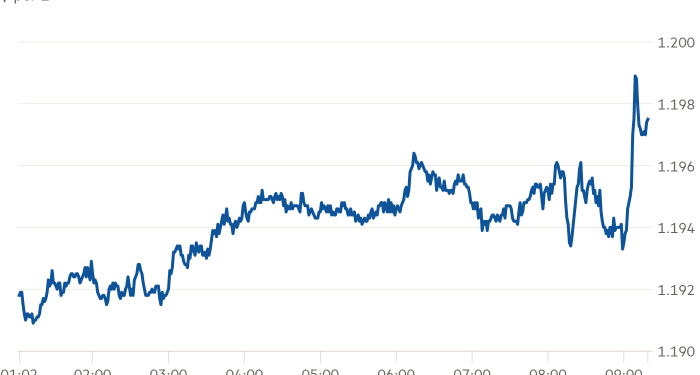

Sterling rose 0.3 per cent against the dollar to just below $1.20. UK prime minister Boris Johnson on Thursday confirmed he would resign following an exodus of government ministers but traders held back from strong bets until his successor was named. The pound had fallen to more than a two-year low in the previous session.

Brent crude oil, which has found strong support this year from sanctions against major producer Russia over its invasion of Ukraine, rose 4.1 per cent to $104.9 a barrel, but remained well below its levels of more than $120 in mid-June.

In bond markets, the yield on the 10-year Treasury note, which moves inversely to the price of the benchmark bond and underpins loan pricing worldwide, stood at 2.95 per cent, down from almost 3.5 per cent in mid-June. The two-year Treasury yield, which tracks monetary policy expectations, traded at 3.02 per cent.