Tuesday proved another bleak day in what is quickly turning into an annus horribilis for speculative tech.

The rot, of course, began in February 2021 but really took hold last November, when a hawkish volte-face from the US Federal Reserve dragged down equity markets which had been on a tear since the early days of the pandemic. This year’s subsequent sell-off has hit the riskiest companies particularly hard.

Tuesday brought further doom and gloom, with the Nasdaq Composite posting its biggest single-day decline since September 2020 even before Alphabet’s disappointing results after hours. Futures tracking the tech-heavy index are up a touch at pixel time but few expect the respite to last. When a company like Google sneezes, the whole tech world tends to need a few days in bed drugged up on Lemsip.

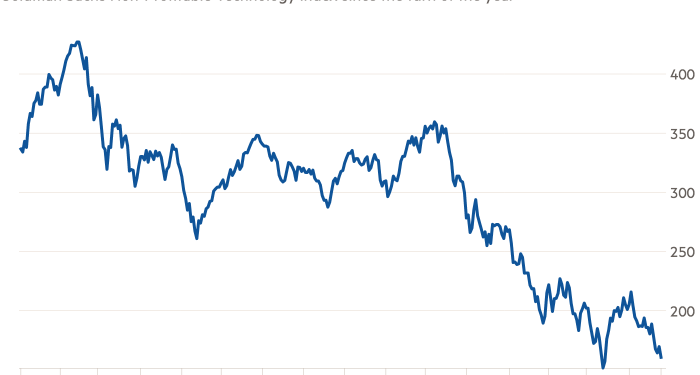

Goldman Sachs’ non-profitable technology index has meanwhile slipped more than a third since the start of January, and endured another torrid session on Tuesday, declining over 5 per cent.

Cathie Wood’s ARK fund fared even worse — falling 6.8 per cent on the day to $50.68 for a year-to-date loss of nearly 50 per cent — though Wood herself seemed in a chirpy mood at a crypto conference in the Bahamas (where else?):

Fangirling hard. @CathieDWood’s landed at #cryptobahamas 👸 pic.twitter.com/tQieLArJAM

— Amy Wu (@amytongwu) April 27, 2022

What exactly triggered yesterday’s market drop is unclear. “We’re not dealing with fear,” said Mike Zigmont, head of trading and research at Harvest Volatility Management, “we’re dealing with an acceptance of pessimism.”

“I think most longs are throwing in the towel, sentimentally speaking,” Zigmont added. “Higher future rates seem like an impossible obstacle and the earnings season isn’t turning out to be the miracle antidote.”

The breadth of the sell-off on Tuesday underlines just how jittery a chunk of growth-focused investors have suddenly become. Retail investors who once delighted in dip-buying are “increasingly hedging downside risks by shorting tech and volatility proxies rather than buying traditional safe-havens”, according to data provider VandaTrack.

Not even Tesla escaped unscathed: shares in the electric carmaker yesterday slid 12 per cent to $876 over fears that our Elon might have to shift some of his stock to fund the $21bn of equity required to fund his purchase of rage-as-a-service company Twitter. In market cap terms, that drop was some $125bn, or roughly two Fords.

Stocks which soared during the first year of the pandemic also took a battering. Peloton fell 6.8 per cent, while gambling trading apps Robinhood and Coinbase lost 3.7 per cent and 5.9 per cent respectively.

There is one move, however, which warrants further attention. $12bn used car dealer Carvana — which counts Tiger Global, Baillie Gifford and T Rowe Price among its largest shareholders — fell 13 per cent to $70.

This seemingly wasn’t just because spec tech get rekt. On Monday, Moody’s downgraded Carvana’s credit rating to Caa1. The reasons stated don’t make pretty reading:

The downgrade reflects Carvana’s very weak credit metrics, persistent lack of profitability and negative free cash flow generation which we expect to continue as the company embarks on building out, adequately staffing and ramping up acquired sites and existing locations to where they are cash flow positive on a sustained basis. The downgrade also reflects governance considerations particularly Carvana’s financial policies which support its external floor plan facilities going current despite the expectation for significant negative free cash flow as well as its decision to finance the ADESA acquisition partially with debt despite its very high leverage.

That might not be an issue if Carvana wasn’t in the midst of raising capital. Following weak results last week, the company announced it was planning to raise $4.3bn, $2bn split between ordinary and preferred stock, with the balance made up by $2.3bn of unsecured notes. The latter is to fund its purchase of car auction business Adesa, which was announced back in February.

Here’s the wrinkle: late Tuesday Bloomberg reported that JPMorgan is struggling to find buyers for the bonds, despite the securities offering a whopping 10.5 per cent yield.

We’re just spitballing here, but that might have something to do with the fact the $750mn worth of bonds it raised last August at a yield of 4.75 per cent are now priced at 76c on the dollar, according to S&P Global data. Or that it recorded negative ebitda of $326mn over the past 12 months despite an unprecedented run up in used car prices. Or, as the WSJ reported in December, that the company has rather convoluted business ties with the family of its founder, Ernie Garcia III.

Just another day in madcap markets eh?