Luxembourg-based satellite operator SES is in talks with US group Intelsat about a potential combination as both companies seek to ensure they are not left isolated in a fast-consolidating industry that is battling challengers such as Elon Musk.

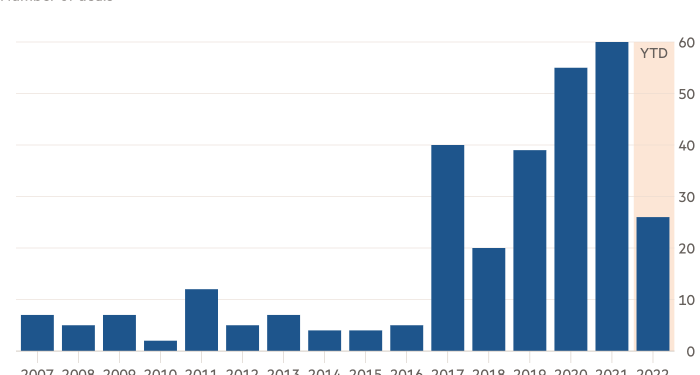

The companies are in active discussions about the structure of any potential deal, according to three people familiar with the matter, as a wave of mergers and acquisitions sweeps across the satellite industry.

“Neither wants to be the last one standing,” said one person close to the matter.

A merger would create a group boasting around $4bn of annual revenues but the discussions are at an early stage and there is no guarantee of a deal being reached, the people stressed.

New rivals such as Musk’s SpaceX have shaken up the old order of an industry previously dominated by nation states, betting big on cheaper, smaller satellites that operate from low-earth orbit (LEO). Older players in the industry have become increasingly conscious of the need to achieve scale — and a multi-orbit strategy that spans different altitudes — to compete.

Last week, French satellite operator Eutelsat announced its intention to acquire smaller UK rival OneWeb, causing its shares to fall 30 per cent across two days of trading as investors baulked at what they viewed as a highly risky deal.

In November, US satellite company Viasat announced a takeover of UK group Inmarsat in a $7.3bn deal, combining two of the largest geostationary satellite operators globally in what the industry regarded as a harbinger of more consolidation.

Privately-held Intelsat said that it did not comment on rumours and speculation, but added: “We generally believe that partnerships among satellite communications companies and bringing together complementary capabilities can drive competition, which benefits customers and people around the world who rely on seamless connectivity.”

SES, which has a market capitalisation of €3.5bn and is carrying €3.6bn in net debt, declined to comment.

Headquartered in a castle in Luxembourg, SES has already received a chunk of cash as part of $4.7bn it is due to receive from US regulators for freeing up spectrum for 5G services.

Analysts at Credit Suisse wrote in April that synergies from a potential combination between SES and Intelsat could generate $2.6bn in value for shareholders, which they predicted could provide a 30 per cent uplift to SES’s share price.

SES beat profit estimates in the first half of the year, in results announced on Thursday. It posted a 2.8 per cent year on year increase in revenue to €899mn and adjusted earnings before interest, tax, depreciation and amortisation of €545mn.

SES’s share price dropped more than 9 per cent in early morning trading, and are marginally down in the year so far, at close to €7, well below a 2015 peak of over €34.

The analysts noted that one barrier to a tie-up could be the Luxembourg government, which owns 33 per cent of the voting rights at SES, although a deal would offer voting rights in an enlarged company.

Satellites have suffered weak returns for the past five years, in part because of declining revenues from traditional satellite businesses like broadcast and fragmentation in the sector, with about 55 satellite operators around the world.

Intelsat filed for bankruptcy protection in the US in early 2020, arguing that it could not manage the transition to new technology required to free up the air waves while carrying $16bn in debt. It emerged from bankruptcy earlier this year with $7bn of debt.

The group, which provides broadband services to business and government customers, is exploring the possibility of launching a network at lower altitudes, focusing predominantly on so-called medium earth orbit (MEO), situated more than 2,000km above earth.

These satellites could be integrated with its existing geostationary communications network of 52 satellites flying more than 35,000km above earth. SES already has a MEO constellation, which it is currently upgrading.