Nvidia shares were down as much as 10 per cent on Monday before ending the day flat as part of the Nasdaq rollercoaster ride, but they are off more than 5 per cent today on the company-specific news that the deal to buy chip designer Arm may be dead.

Bloomberg reports that Nvidia is “quietly preparing to abandon

its purchase of Arm Ltd. from SoftBank Group Corp. after making little to no progress in winning approval”.

Regulators in the US, UK, Europe and China would have to give the green light, but there has been mounting opposition to the cash and stock transaction originally valued at $40bn in September 2020.

Last month, the US Federal Trade Commission sued to block the deal in order “to prevent a chip conglomerate from stifling the innovation pipeline for next-generation technologies”. The UK launched an investigation into the deal on national security grounds in November after its Competition and Markets Authority expressed “serious competition concerns” in the summer. The European Union launched a probe in October saying Nvidia ownership “could lead to restricted or degraded access to Arm’s IP”.

There were major doubts from the outset that this deal would ever get done. Arm is the Switzerland of the semiconductor world, supplying the basic chip designs that everyone in the industry depends upon to use and adapt. The prospect of one chip company controlling it raised a massive red flag with regulators and created a storm of criticism from Nvidia’s rivals.

The collapse of the deal would hurt both Nvidia and Arm’s owner SoftBank. Nvidia would lose its “deposit” of a $1.25bn break fee and $750m licence consideration paid to SoftBank, while the Japanese company would have missed out on Nvidia’s booming stock price doubling the value of the transaction to more than $80bn.

SoftBank’s Plan B is expected to be an IPO for Arm. That could still represent a good return on its investment. It paid £24bn ($32bn) for Arm in 2016, but the company’s value has been enhanced by the semi shortages of the past two years. They have highlighted the critical importance to nations and multiple industries of chips, and of those that design their beating hearts.

The Internet of (Five) Things

1. Google changes course on cookies

Google is scrapping the Floc technology it was building to replace advertising cookies, and will instead use a method for tracking users’ interests known as Topics, in order to ease industry concerns. On Tuesday, Google conceded that Floc might not do enough to protect the identity of individuals online and did not make it easy enough for web users to understand or control how their data are being used.

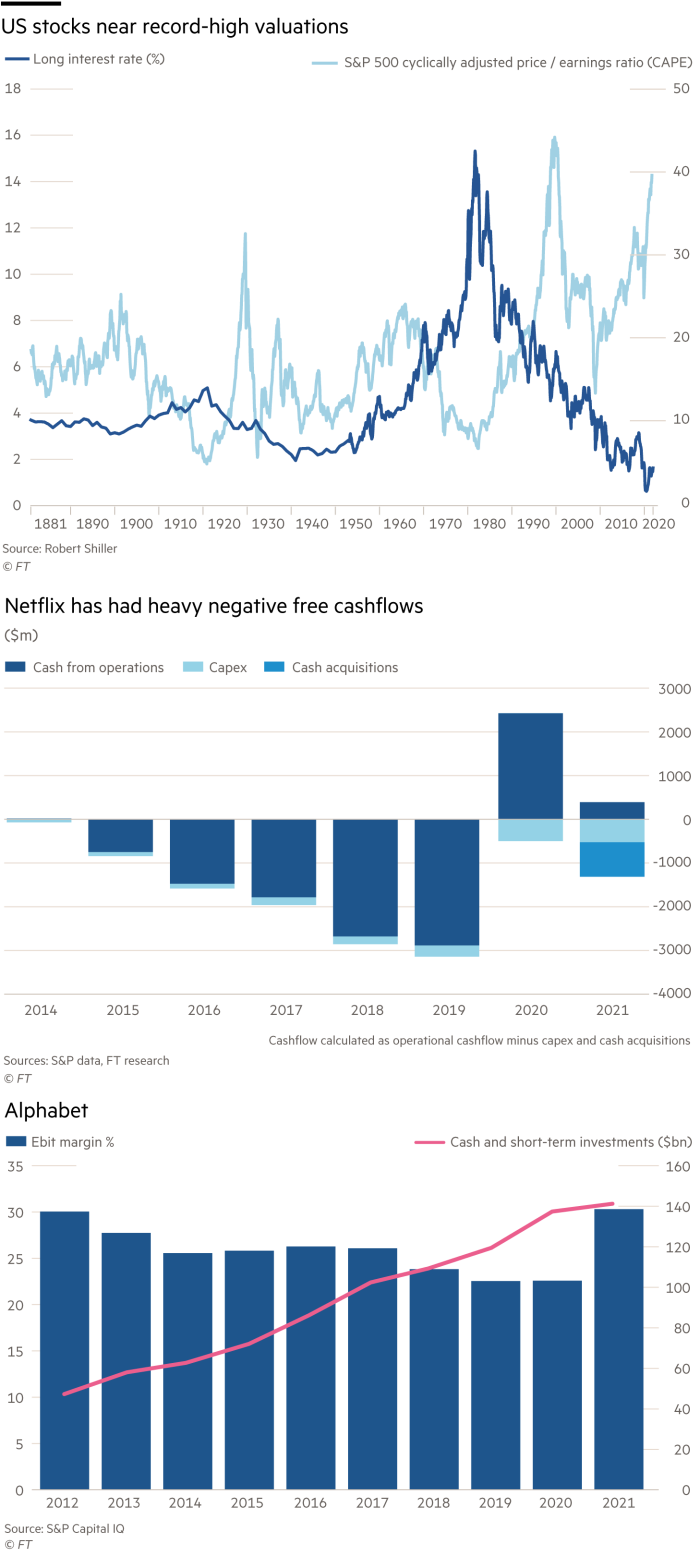

2. Tech reset is uneven

The great tech stock rout is proving uneven, says Lex. Cryptocurrency platform Coinbase is off 45 per cent, following the trajectory of bitcoin’s decline, but tech giants such as Alphabet have lost about a tenth of their market value. The latter is a safer bet with rising free cash flow and a large net cash position.

3. Justice department’s antitrust warning

Jonathan Kanter, in one of his first speeches as head of the US justice department’s antitrust division, has warned that it will seek to block more anti-competitive deals. The FT View is that Microsoft has served up a juicy challenge with its deal to buy Activision Blizzard. Things are also getting tougher for Big Tech on Capitol Hill.

4. China launches web ‘purification’ campaign

China has launched a month-long campaign to clean up online content during next week’s lunar new year festival, in its latest effort to reshape behaviour on the internet. The Cyberspace Administration of China, the country’s top internet regulator, has instructed officials to sweep away “illegal content and information” and target celebrity fan groups, online abuse, money worship, child influencers and the homepages of media sites

5. Muzmatch in naming tiff with Match

Over the past year, the Muslim marriage app, with 5m users worldwide, has been fighting a lawsuit that threatens the company’s future brought by Match Group, the dating giant that owns far bigger services including Match.com, OkCupid, Tinder and Hinge. The UK’s intellectual property court is expected to decide on the matter in the next few weeks.

Tech tools — Music out of thin air with Mictic

Mictic wristbands let you rock out, without the hassle of installing a noisy drum kit and guitar in your living room, writes Cristina Criddle. The Swiss start-up has created a pair of wearables that, along with an app, allow you to play different invisible instruments while jamming to a backing track, using the motion of your hands to change notes and speeds.

The wristbands use Bluetooth to connect to your smartphone and have sensors to detect motion and gestures. Depending on the instrument, users will have different motions to play around with. Each option comes with a short video tutorial, but it takes a bit of practice to master. At the moment, users can select from Hip Hop, Trap, Latin and EDM genres for backing music, and choose to play the guitar, drums, cello, piano or theremin.

The product launched in November and has attracted investment from musician Moby. It hopes to add new genres, tracks and instruments to its app this year.