Shit is getting real. Picture of trader with head in hands real.

Much ink has been spilled on the decline of speculative tech stocks since the end of last year. But disappointing results out this week from the very much profitable and absolutely massive Apple, Alphabet and Amazon suggest a wider malaise may be setting in. Peloton, Coinbase and Car***a these companies are not.

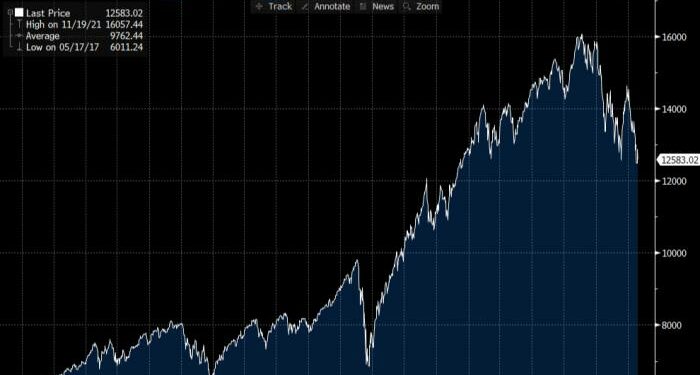

The Nasdaq is down another 2.3 per cent at pixel time, nearly reversing all of Thursday’s mega 3.1 per cent rally, dragging the index’s 2022 loss back to over 10 per cent and its drop since the November 2021 peak to over 20 per cent (bear market territory yada yada). The market cap drop since that autumn peak is now over $6tn.

Each of the big tech titans underwhelmed for different reasons. Supply chain issues and factory closures in China did for Apple, while a slowdown in sales weighed on Amazon and a pullback on ad spending in Europe hurt Alphabet.

Yet the fact that all three got hit at the same time — and just as the US economy contracts — should give investors pause for thought. Even Microsoft, which reported solid results earlier this week, is down 2.1 per cent today amid the general miasma.

The FANG+ index — which includes Tesla and Baidu as well as Facebook et al — may be only down a little at pixel time, but it has plunged by just over a quarter since the turn of the year. Goldman Sachs’ non-profitable technology index has fared only slightly worse over the same period.

Here’s JPMorgan’s assessment of the issues affecting Apple, for example. (The US bank remains overweight on the stock).

Year-over-year revenue growth in F3Q22 impacted by a plethora of headwinds. While Apple did not provide specific revenue guidance for F3Q22 it disclosed year-over-year revenue growth will be impacted by: 1) supply constraints in the range of $4-$8bn due to COVID and silicon shortages (larger than in F2Q22); 2) FX headwinds of roughly 300 bps; 3) the stoppage of sales in Russia resulting in a ~150 bps headwind; and 4) COVID-19 disruption of demand in China (unquantified).

A plethora of headwinds indeed, and the bad news doesn’t stop there. Figures out on Friday show US inflation, measured by the personal consumption expenditures index, rose 0.9 per cent in March from the previous month, while a separate report showed labour costs in the world’s largest economy rose by the most on record in the first three months of the year.

When Meta puked earlier this year it could be shrugged off as a unique issue for a fairly unique company. But the roster of shaky big tech names is growing now. Yes, these are still mostly idiosyncratic issues, but when a lot of major stock market pillars all start to look shaky at the same time then it’s worrying.

And of course, it looks like the Federal Reserve is getting serious about jacking up interest rates aggressively this year, which will be a headwind to all highly-valued companies.

Analysts at Capital Economics, writing before Friday’s US data dump, sound decidedly downbeat on what the darkening economic environment means for the growth stocks that have propelled markets higher for much of the past decade:

. . . We expect equities in the US to see smaller gains than those outside the US over our forecast horizon. In the near term, there are factors pulling in different directions: recession risk is probably lower in the US than elsewhere, but the relatively high valuation of its stock market makes it more vulnerable to the higher yields we expect. But as recession fears fade, we think the highly valued “growth” sectors — which have large weights in the US market — will begin to lag other sectors again, meaning US equity indices underperform.

Apple’s shares were down 0.9 per cent at the time of writing. Amazon and Alphabet are off 12.4 per cent and 1.4 per cent, respectively. Spec tech may be getting rekt, but there are clouds on the horizon for the big boys, too.