As social media influencers go, they do not get any bigger than Elon Musk, Tesla chief, and Donald Trump, former US president, in the way they have been able to move markets and political opinion, respectively.

Banned from Twitter, Trump ensured a stake and an online megaphone for himself in social media with his own network, Truth Social. However, it has been labelled a disaster and he himself appears to be too embarrassed to post on it.

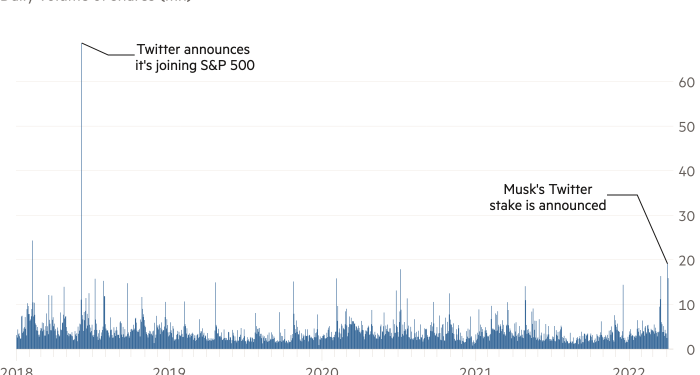

Musk continues to post at will on Twitter, despite run-ins with regulators and a high-profile defamation case, and Richard Waters has been looking at the implications of him now having a 9.2 per cent stake in the company and a seat on the board (see Alphaville’s Twitter timeline on his growing investment).

Musk has pressed Twitter to relax its content moderation policies and abandon restrictions on what people can say on its service, in the interests of returning it to a “free speech” ethos that held sway in its early days. That might include reversing Twitter’s lifetime ban on Trump.

But while the Tesla chief’s new position of influence has boosted the share price significantly this week, and may increase engagement on the platform, his strategy could damage revenues in the longer run.

Free speech can mean harassment, and misinformation abounds. And as Brian Wieser, global president of business intelligence at advertising group GroupM, points out: “Large advertisers don’t like toxic environments.”

Lex’s Elaine Moore says that Musk does not have a background in advertising and has not suggested anything that will help Twitter to reach its goal of $7.5bn in revenue and 315mn monetisable daily average users by the end of 2023. To get there, it is going to have to increase its user base by about a fifth each year. Last year, user numbers rose 13 per cent.

There is excitement about the possible introduction of an edit button that would allow users to go back and rewrite posts. But this alone is unlikely to drive new sign-ups or advertising revenue.

On the subject of influencers, Cristina Criddle reports that Instagram has cut the amount it pays makers of short videos as it continues to compete fiercely with TikTok. Its invite-only scheme pays a rate based on the views received on clips called “Reels”. No reasons have been given for the revised payouts, and the move comes despite the company publicly saying that it was increasingly focused on video.

The Internet of (Five) Things

Uber’s planes, trains and automobiles

Uber plans to add long-distance travel bookings to its UK app this year, including intercity trains, coaches and flights, as Dara Khosrowshahi, chief executive, reboots the “super app” strategy that he first outlined several years ago.

SEC backs Amazon shareholders

Amazon investors who want the tech giant to provide greater tax disclosures have been handed a victory after the US Securities and Exchange Commission supported their demand for a shareholder vote on the issue.

Binance trails FTX in US valuation

Binance’s US affiliate has been valued at $4.5bn in its first fundraising round, far less than its main rival FTX, as regulatory concerns muddy the outlook for Changpeng Zhao’s sprawling network of crypto companies. Meanwhile, Binance and other crypto firms have been rushing to set up shop in Dubai after it started to offer virtual asset licences, making the Gulf state the latest jurisdiction to seek to become a haven for the global crypto industry.

Sky Mavis raises cash to refund hack victims

Binance was also involved on Wednesday in a refinancing of the Vietnam-based company Sky Mavis, which runs the game Axie Infinity. More than $600mn had been stolen from the digital ledger that powers the popular cryptocurrency game. Sky Mavis said it would reimburse the lost money through a combination of its own balance sheet funds and $150mn in new funding from investors, including Binance and VC firm Andreessen Horowitz.

Toshiba take-private support grows

Toshiba’s second-largest shareholder, 3D Investment Partners, is pushing for the company to open talks on a take-private deal, after it was revealed last week that Bain Capital was poised to submit a buyout proposal for the $17bn Japanese conglomerate, with the backing of the largest shareholder, Effissimo. 3D, a Singaporean hedge fund, said Toshiba had become “a corporate governance embarrassment for Japan” as it lurched from crisis to crisis.

Tech tools — Husqvarna’s robot lawnmowers

Swedish company Husqvarna is the market leader in robotic grass-cutters, and two of its latest smart mowers, the Automower 405X and 415X, are ideal for home use, says Jamie Waters in his review of the latest garden gadgets.

The 405X (£1,799) works on lawns up to 600 sq m, whereas the 415X (£2,299) can tackle larger 1,500 sq m expanses. While neither asks much of its owner, you need to place a boundary wire around your lawn so the machine knows its limits. And the charging station requires access to an outdoor socket — or its plug can be snaked through a window.

Beyond that, everything is controlled via an app, a physical button, or voice activation: you can choose your desired grass length between 20 and 50mm; monitor your robot’s progress on your mobile phone and put it on a strict schedule. It checks the weather forecast and, if there is likely to be frost, will delay its start time so as not to damage the grass.

The mower does not inhale clippings — the point is to use it so regularly that the tiny offcuts can be left on top of the lawn, where they act as a natural fertiliser.