It never ends with this guy, does it? Except in this case it might.

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

There’s an obvious reading here. It’s that Musk, having had his fun, is done. A lot of people predicted that would happen. The $1bn one-off break fee had always looked good value when compared against the approximately $1bn of annual financing costs the Tesla CEO would have to pay to take responsibility for his obsession.

An ostensible need for deal funding also meant Musk didn’t have to explain the $8.5bn he has raised by selling Tesla stock, even though the sales were inexplicably early in the process.

Nevertheless, Musk can’t just walk away for no reason. So long as financing is available, Twitter’s board can force him to close the deal. This might appear a moot point given Musk’s Plan A was to use a margin loan tied to Tesla shares, which he could collapse unilaterally, but for the world’s richest person such a withdrawal might be a bit embarrassing.

What Musk seems to be doing instead is an Othello: he’s out to kill the thing he loves. The Reuters story about bots cited is from May 2 and refers to Twitter’s 10-K SEC filing of the same date. The implication here is that Musk’s due diligence process has thrown up something that contradicts a regulated statement Twitter made to shareholders, and has been making every year.

As well as potentially triggering the deal Material Adverse Effect clause and voiding the break fee (if justified) this puts Twitter in a very bad place. It’s an even worse place than the microblogging website was in already, with management in flux and the product reportedly mothballed for its own safety.

Now, rather than going private for a bit of R&R, Twitter might end up a publicly quoted punchbag for regulators and class action lawsuits while in open warfare with its lynchpin celebrity user who’s also for the moment its biggest shareholder.

1pm GMT update, and it’s now Schrödinger’s offer, which adds the SEC to the list of people and organisations Musk has trolled this morning.

Still committed to acquisition

— Elon Musk (@elonmusk) May 13, 2022

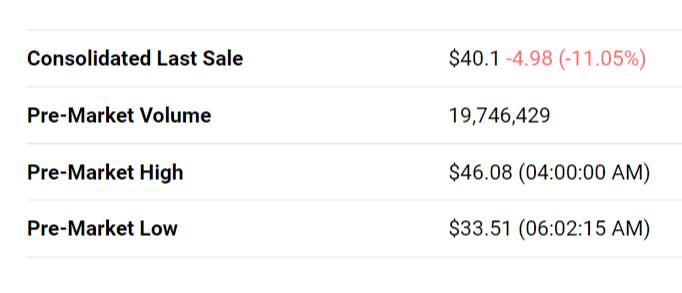

Here’s the pre-market reaction: