Finally, belatedly, Elon Musk has filled out the appropriate form and we have clearer view of his Twitter special operation.

The Tesla CEO had previously taken advantage of the SEC’s abbreviated filing regime and lodged a Schedule 13G, so was committed to not changing or influencing the control of the issuer. Given Musk’s regular lobbying of his 80.7mn Twitter followers for changes to Twitter’s user interface and/or senior management, the use of a 13G appeared questionable.

Likewise, timings. To remind, Elon’s Schedule 13G landed on April 4 and showed a 9.2 per cent stake, along with a date of event for when the filing became required of March 14. A lot about that didn’t make sense, including the seemingly ignored ten day requirement for timely filing and the improbability of moving so far above the >5 per cent disclosure threshold in a single day.

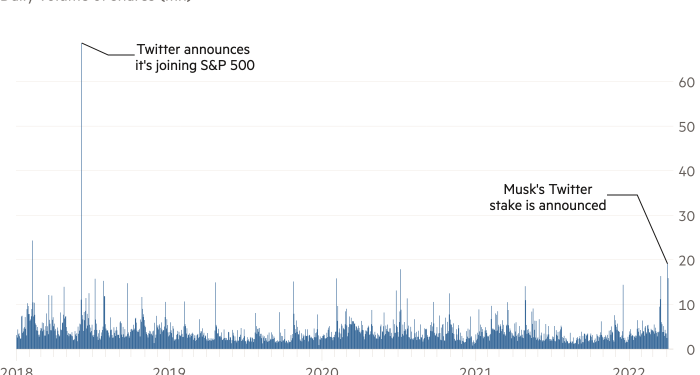

It all caused consternation among those whose options expired in the window between when Musk might have disclosed his interest (when Twitter shares were below $40) and when his 13G form landed (after which they’ve traded around $50). There’s also the question of whether Musk’s knowledge — we presume! — that he was a Twitter shareholder amounted to significant non-public information. Going beyond the disclosure deadline might, in theory, allow him to keep adding to his Twitter stake at cheaper prices than if his interest were public.

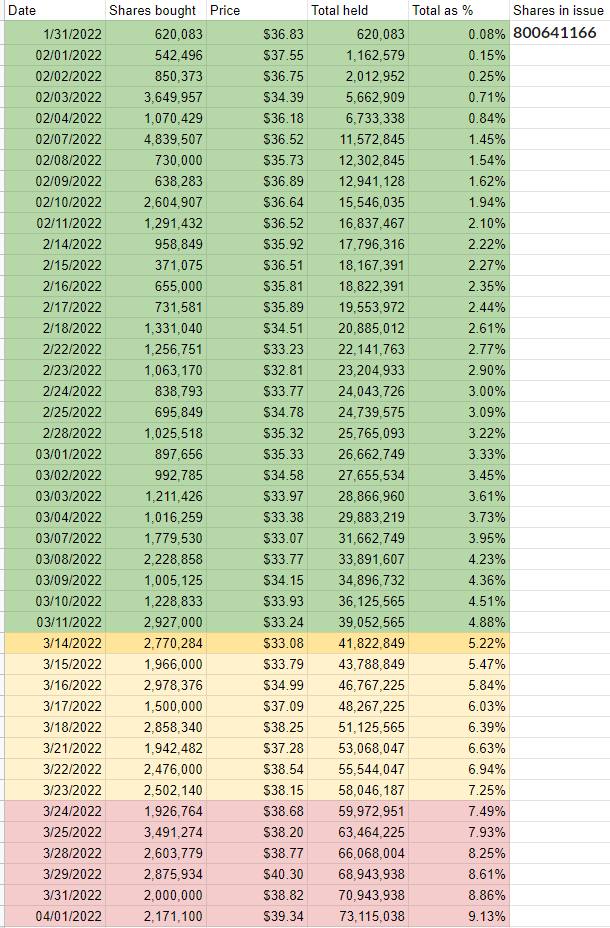

Board members cannot reasonably claim to have no influence on the companies they manage so Musk’s appointment on Tuesday required a fresh, more detailed filing. Here it is with a cumulative holdings column added:

A few landmarks to note include:

January 31, 2022: Musk’s opening investment in Twitter is slightly more than 620,000 shares at a price just shy of $36.83. Musk’s most trenchant recent criticism of Twitter had come ten days earlier, prompted by its introduction of NFT profile pictures. His culture war of choice on the relevant day was the Joe Rogan-Spotify thing.

March 14, 2022: Musk’s Twitter stake crosses the 5 per cent threshold meaning a disclosure would normally be required within ten days.

March 24, 2022: Musk, now an undisclosed 7.5 per cent Twitter shareholder, voices concerns on Twitter about the platform’s “de facto bias” and polls Twitter users on whether the Twitter algorithm should be open source. He buys more than 1.9m shares that day.

March 25, 2022: Musk polls his followers on whether Twitter “rigorously adheres” to the principle of free speech, while buying a further nearly 3.5m shares to raise his undisclosed stake to 7.9 per cent. He pays an average of $38.20 a share.

March 28, 2022: Musk raises his still undisclosed stake to 8.3 per cent with the purchase of a further 2.6m shares at $38.77 apiece, a day after tweeting that he’s “giving serious thought” to building a new anti-censorship social media platform.

April 4, 2022: Musk reveals in a regulatory filing that he’s a 9.2 per cent Twitter shareholder. Twitter shares end that day’s trading at $49.97. Musk’s average purchase price across 44 trades is $35.89. Starting at the apparent disclosure deadline of March 24, 2022, he bought more than 15mn shares at an average price of $35.94, approximately 28 per cent below the prevailing price after his stake-building had been revealed.

April 5, 2022: Musk joins Twitter’s board.

April 6, 2022: Musk’s 13D filing reveals he’s holding 73,115,038 Twitter shares as of April 4. Oddly, this is lower by 371,900 than the total disclosed in Musk’s 13G filing on April 4, which showed a holding of 73,486,938.

Might that mean he has already sold some? We should find out in ten days, but maybe we won’t.