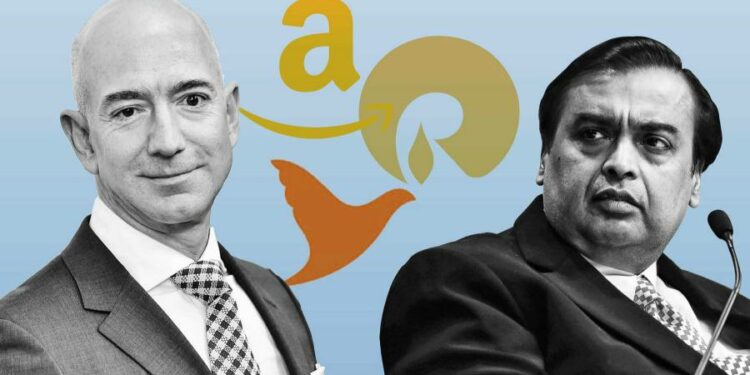

Reliance Industries chair Mukesh Ambani has outmanoeuvred Amazon founder Jeff Bezos in India after taking over more than 800 stores of Future Retail in defiance of a two-year legal battle for control of the country’s second-largest retail chain.

The long-running saga has pitted two of the world’s richest people against each other for the future of Indian retail. It highlights the difficulties for overseas ecommerce companies seeking to expand in a country that has 1.4bn consumers, but where regulations give local players an advantage.

Amazon is not giving up. On Tuesday, lawyers for Future and Amazon told India’s Supreme Court that out-of-court talks between the two parties had broken down yet again. Amazon had filed a new case at the High Court of Delhi to counter the store takeover. “Only 300 shops are left,” said Amazon’s lawyer.

Amazon took out advertisements in national newspapers claiming the store takeover had been done clandestinely by “playing a fraud on” Indian courts and authorities. Future has argued the deal with Ambani should be cleared but on Wednesday the company said Reliance had “forcefully taken over control of hundreds” of stores, insisting it was “a surprise”.

“Mr Bezos is also not used to giving up that easily,” said Arvind Singhal, founder of retail consultancy Technopak. “He’s a street fighter, so is Mr Ambani.”

Reliance had announced in 2020 that it was acquiring Future in a $3.4bn deal to give it a national network of grocery and fashion stores including Big Bazaar and Foodhall. Amazon argued that an indirect minority stake it bought in Future a year earlier gave it the right to stop competitors from buying the retailer and took Reliance to court.

“Going against Reliance was never a good idea,” said Prachir Singh, an analyst at consultancy Counterpoint Research. “Reliance wanted this deal because they wanted to be the offline retail kings of India.”

He added: “On a strategic side, I think [Amazon] have lost. They will cut their losses and get whatever they can from this deal.”

Lawyers for Amazon declined to comment. Future and Reliance did not respond to requests for comment.

Two people familiar with the store takeover said Reliance has offered fresh contracts to Future’s staff, planned to continue working with the same vendors under new deals, and was rebranding the stores under its own marques.

Analysts suggested that Amazon, one of India’s largest online retailers, could seek joint ventures with other companies that have physical stores. Amazon also has an investment in a physical store network, More, through an investment vehicle.

Future had been hit by pandemic-related shutdowns and weighed down by high debt. New Delhi’s harsh lockdown at the start of the pandemic in early 2020 accelerated its collapse, threatening to put Future’s 30,000 workers out of work. Reliance’s acquisition of Future was intended to deepen its retail network as a counterpart to JioMart, its online store.

That hit Amazon’s ambitions in India. The company, alongside other foreign ecommerce players such as Walmart-owned Flipkart, is barred from operating physical stores under Indian rules. Its minority stake in Future was intended to be a launch pad for an offline expansion if regulations changed.

Nigam Nuggehalli, a law professor, described Amazon’s scheme as pushing “the outer margins of foreign investment regulation”.

The fight has played out in multiple venues, including an arbitration tribunal in Singapore — which in 2020 issued an order blocking the deal from closing — India’s Supreme Court, and India’s competition commission.

Promod Nair, a senior advocate who regularly appears before the Supreme Court, said Amazon would be “disappointed” that the order it won from the emergency arbitrator to block the tie-up was not being honoured.

“A lot of effort has gone into erasing the image of India as an arbitration-unfriendly destination,” said Nair. “But the pendulum has now quite unfortunately swung back in the wrong direction,” he said about the Amazon case.

He added: “I think the damage it will do to India’s ambitions to become a reliable and credible arbitration destination will not easily be reversible.”

People familiar with Amazon’s strategy have stressed that it will continue to defend its rights in court. But its efforts to develop a meaningful bricks-and-mortar presence in India have been severely undermined.

“It’s a missed opportunity for Amazon,” said Neil Shah, vice-president of research at Counterpoint. “The power of local competition is another thing which Amazon will learn . . . to make a move to acquire something, they have to do it quickly and smoothly before some other competitor that has more buying power and political clout.”