Shares in Micro Focus International almost doubled after Canada’s OpenText agreed to buy its UK rival in an all-cash deal that values the software developer at £5.1bn.

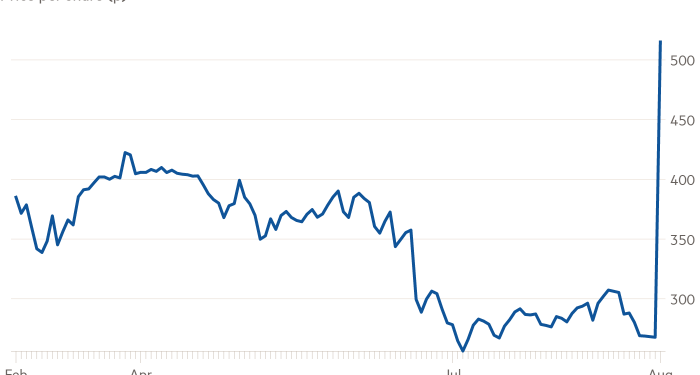

Micro Focus shares rose 91 per cent in early London trading on Friday to 515p. That has turned their decline for the year into a 23 per cent rise.

OpenText’s 532p per share offer is roughly twice Micro Focus’s closing price on Thursday before news of the takeover came to light.

The deal is the latest in a flurry of recent interest in UK tech groups, which include Schneider Electric’s possible buyout of Cambridge-based Aveva.

“Micro Focus brings meaningful revenue and operating scale to OpenText, with a combined total addressable market of $170bn,” said the Canadian group’s chief executive Mark Barrenechea.

“Upon completion of the acquisition, OpenText will be one of the world’s largest software and cloud businesses,” he added. “With this scale, we believe we have significant growth opportunities.”

OpenText, one of Canada’s largest software makers, said it expected cost savings of $400mn from the deal.

Newbury-based Micro Focus develops enterprise software for businesses, focusing on cyber security, IT management, communications and messaging. Its software is used by retailers, banks and airlines.