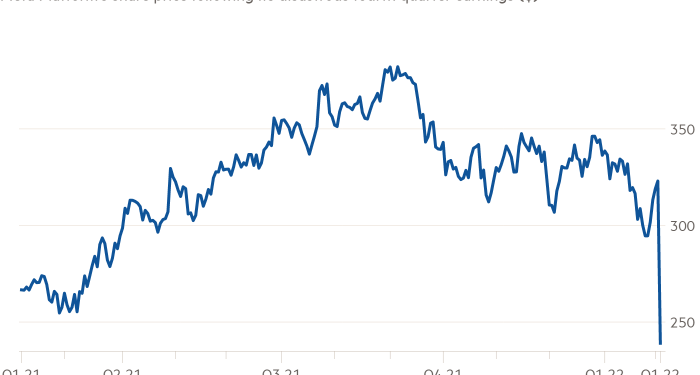

There’s stock crashes, and there’s this:

At pixel time, the shares of Meta Platforms — aka Facebook and its family of surveillance capitalism apps — are down 24 per cent on the day following what can only be described as a disastrous fourth-quarter earnings.

If you don’t know what happened (which if you’re reading this blog, we find unlikely) slowing user and revenue growth due, in part, to Apple’s new privacy policy and competition from TikTok has caused investors to get the heebie jeebies. Further worries about its capital intensive crusade into the “Metaverse” — for all intents and purposes, an attempt to rebrand VR — haven’t helped matters much either.

But what we’re focused on here is that market capitalisation drop.

$216bn smackeroos.

We believe it’s the single largest market capitalisation drop from one company in history. (Market data experts feel free to prove us wrong.)

If you can’t quite compute that figure, some context. That’s a fall of two IBMs, two General Electrics, just over one McDonald’s, close to one Netflix and nearly three General Motors.

So who is holding the bag?

Although the natural assumption would be that Meta would be popular with growth funds, the artist formerly known as Facebook has actually become been a popular pick with value managers over the past year due to its apparently cheap valuation (23 times forward earnings before last night’s results), double digit revenue growth and a history of high returns on capital.

According to DataRoma, a site that collates the investment positions of storied fund managers from the latest official filings, these are the masters of the universe with Meta as a core position in their portfolios:

Among the names there you might spot John Armitage of Egerton, Seth Klarman of Baupost, Terry Smith of Fundsmith, David Tepper of Appaloosa and Stephen Mandel of Lonepine. All legends in the investment community.

Much has been made in the press recently of inexperienced retail investors crowding into stocks, which then proceed to crash. It seems, however, they weren’t the only ones exhibiting Lemming-like behaviour.