Marcelo Claure, one of SoftBank’s highest-paid executives who led a turnround at WeWork, has left the Japanese technology conglomerate after a falling out with founder Masayoshi Son.

SoftBank said in a statement on Friday that there was a mutual agreement to “part ways over a successful nine-year partnership”, but gave no explanation for the move.

Claure’s exit as chief operating officer and possible successor to Son came after months of frosty negotiations over pay, according to people close the situation.

“We do not comment on the reason [for Claure leaving]. We do not disclose the content of the agreement,” the company said, adding that SoftBank would not comment on Son and Claure’s relationship.

Three people with direct knowledge of the matter said the Bolivian billionaire, who had been spearheading SoftBank’s $5bn Latin America investment fund, was leaving after a dispute over his pay and the group’s strategic direction. The people said Claure’s exit deal was expected to be worth “hundreds of millions of dollars”.

One person close to the company said that before his departure, Claure’s importance at SoftBank had waned significantly, with his portfolio of businesses curtailed and his influence diminished.

“It is an environment where what counts at that level is your relationship with Son, and once that had broken down, the role of COO was more in name only,” said the person, who added that Claure’s compensation demands had at one stage included a “10-figure” sum.

A spokesperson for Claure declined to comment.

His departure will intensify scrutiny of SoftBank’s plunging share price and what some investors have said was a developing leadership crisis beneath its powerful founder, Son.

Shares in SoftBank have dropped more than 50 per cent since their peak last March, falling sharply in recent days as technology-focused stocks have sold off globally.

The company’s stock rose about 2.2 per cent in Tokyo trading on Friday, in line with the day’s 1.9 per cent gains for the broader Topix, which tracks the Japanese market.

French telecoms executive Michel Combes will take over Claure’s duties overseeing SoftBank’s Latin American funds, its Opportunity Fund and several non-Japanese portfolio companies.

Claure was recruited to SoftBank through the acquisition of his telecoms start-up Brightstar and quickly worked his way into Son’s inner circle, first serving as the chief executive of US mobile group Sprint and later orchestrating the rescue and revival of lossmaking property group WeWork.

During his tenure, Claure repeatedly clashed with other SoftBank executives including the head of its private investing arm, Rajeev Misra, a former Deutsche Bank trader.

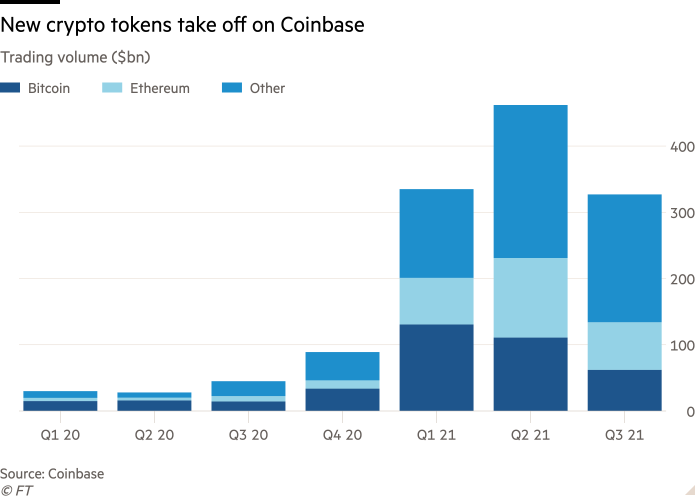

People close to senior SoftBank leadership said another source of friction had been Claure’s efforts to increase the company’s exposure to cryptocurrencies.

Claure was one of three executives, along with Misra, who were regarded as possible successors to Son. The other, former Goldman Sachs banker Katsunori Sago, quit as strategy director last year after less than three years. Sago’s exit was preceded by the departure of the company’s chief compliance officer, chief legal officer and chief communications officer.