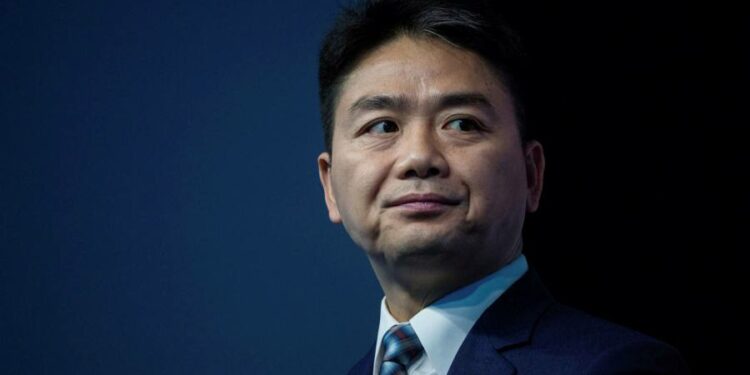

Richard Liu is the latest founder to vacate the position of chief executive at a Chinese tech giant. The billionaire is stepping back to chair at JD.com, the country’s second biggest ecommerce company.

Liu’s switch to a lower-profile role is just the latest in a string of abrupt founder exits. Beijing’s crackdown on the tech sector means wealthy, powerful bosses such as Liu are under critical scrutiny. But the handover to the next generation of leaders could not come at a riskier time.

Alibaba’s Jack Ma was the first prominent tech boss to take cover from the brickbats. He was followed by Colin Huang of food business Pinduoduo. The founders of short video platforms ByteDance and Kuaishou Technology have also stepped down amid regulatory pressures.

Liu had already distanced himself from daily operations following allegations of rape four years ago which he has denied. But he is still seen as important to his company’s success. JD shares, down 30 per cent over 12 months, fell more than 3 per cent in Hong Kong on Thursday.

The crackdowns have not been all bad for JD. Antitrust regulators picked market leader Alibaba as their main target, allowing JD to increase market share. JD fully controls its supply chain, warehouses and transport. That means it offers a slicker experience for customers than peers dependent on third-party services. That also makes it a big employer, another plus in Beijing’s eyes.

Unfortunately, an asset-heavy business model becomes a weakness when prices and wages are rising. In the fourth quarter, JD posted a quarterly loss. General expenses rose 89 per cent. Fulfilment costs rose more than a tenth.

China’s slowdown amid lockdowns in Shanghai and other big cities is a further threat to sales. Alibaba has already reported the slowest quarterly growth since going public in 2014.

JD’s depressed shares reflect growing risks. But at a steep 28 times forward earnings, more than double peer Alibaba, there is scope for further declines. Xu Lei, an executive with more than a decade at JD who will take over the top spot, faces a tall order turning that round.

Beijing gets two of its wishes. Liu has promised to help revitalise rural areas in support of China’s common prosperity goals. His retreat also means one less founder at the top of influential tech companies. But pressure on JD.com, as on other tech giants, will persist.