Start-ups promising to use artificial intelligence to transform drug development are raising hundreds of millions of dollars and signing deals with Big Pharma, despite the recent sell-off in biotech stocks.

Owkin, a French company, is partnering with Bristol Myers Squibb to improve how the US drugmaker designs its trials in a deal worth up to $180mn, including milestone payments if the drugs pass regulatory hurdles.

The collaboration comes after three other start-ups raised a total of $150mn this week. The move comes amid a wider market rout for biotech stocks that has left investors wary of companies focusing on developing one or two drugs.

Hussein Kanji, a partner at Hoxton Ventures, said there was a “new rush of money” into this budding market from both tech and life sciences investors because of the “compelling” prospect that you could build a platform that speeds up and cuts the cost of the lengthy drug development process.

“The genuine newness brings in a bunch of new money that may or may not know what it’s doing,” he added. “Everyone is running experiments right now on what’s going to work and what’s not going to work.”

Hoxton Ventures invests in Peptone, a London-based start-up that uses machine learning to fix “disordered proteins” that traditional drug discovery methods have struggled to target. The company announced a $40mn series A round led by healthcare and technology venture capital group F-Prime Capital and Bessemer Venture Partners.

F-Prime Capital also co-led a $50mn round in another London-based company Charm Therapeutics, which was set up just last September, alongside healthcare-focused investor OrbiMed.

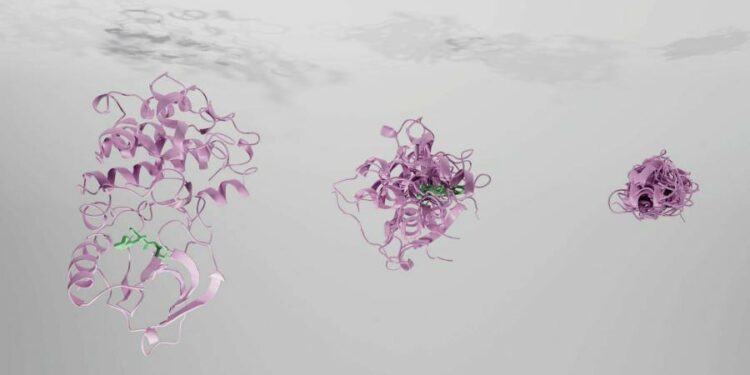

Charm’s platform DragonFold is built on Alphabet’s AlphaFold and RosettaFold, developed at the University of Washington in the lab of David Baker, a co-founder of Charm. They use AI to determine the three-dimensional structure of proteins.

Charm has extended them to predict how proteins will fold around ligands — small molecules that could have pharmacological effects — and is searching for new cancer drugs.

Earlier in the week, Insilico, a Hong Kong-based start-up, raised $60mn in a round led by BCG, following a $255mn round last year. Insilico has its first drug candidate — a treatment for lung-scarring — in an early-stage clinical trial.

All three start-ups plan to spend some of their funds on new facilities, which will help create new biological data.

Vishal Gulati, founder of VC firm Recode Health, said originally many companies thought they could apply new data technologies to publicly available data sets. But they found the data was not good enough to provide “fruitful” insights, he added. “Smart companies started generating their own data for the purposes of discovering new drugs.”

Investors are also tempted by the prospect of partnerships with large pharmaceutical companies, which are recognising they do not have all the skills they need in-house. Bristol Myers Squibb already signed a $1.2bn deal with AI company Exscientia last year, and both Owkin and Exscientia recently signed partnerships with French drugmaker Sanofi.

Venkat Sethuraman, head of global biometrics and data services at Bristol Myers Squibb, said the company was “very bullish” on how AI could help improve the designs of clinical trials and wanted to work with Owkin because of its “complimentary data set”. Owkin uses federated learning, a machine learning technique, to train its algorithm on hospital data, without ever seeing the data itself.

Thomas Clozel, Owkin’s chief executive, said pharmaceutical companies were more interested in investing in a way to “hack the system”, than acquiring a biotech’s single potential drug. “Everybody really wants to believe there is a way to find not one treatment in 10 years, but 10.”