Intel announced plans on Tuesday to pour about €30bn into boosting chip manufacturing in Europe, marking the launch of an expensive, taxpayer-backed bid to vault the continent to the forefront of advanced chip making.

The ambitious plan is designed to make the EU less dependent on Asian chipmakers, while supporting a new technology base in advanced chips to rival the US and Asia.

However, the effort has drawn complaints from some European chipmakers, who question whether it will produce chips that match the needs of European industry. They also balk at the prospect of a large slice of the €43bn in chip subsidies recently approved by the EU being spent on a glittering new plant from a US rival.

Intel’s investment plans include €17bn for a giant new fab, or manufacturing plant, in the German city of Magdeburg using the most advanced chip manufacturing technology.

Along with related manufacturing and research efforts in France, Ireland, Italy, Poland, Belgium and Spain, the plant is the centrepiece of a decade-long investment plan that could eventually cost €80bn, subject to demand and the availability of future subsidies.

The US company also confirmed it was investing €12bn into an existing facility in Ireland that operates on less cutting-edge technology, taking the total invested there since 1989 to €34bn.

The German plant is expected to eventually soak up tens of billions of euros in aid, though Pat Gelsinger, Intel’s chief executive, told the Financial Times that the exact amount was not yet finalised.

Germany is expected to imminently approve billions of euros in state aid for the factory. France has also signalled support for Intel’s plan to make the Saclay technology cluster outside Paris its European R&D headquarters, with 1,000 researchers focused on artificial intelligence and high performance computing. Italy is in negotiations over terms for a €4.5bn Intel packaging plant, which would play an important role in turning the part-finished chips from the German facility into final products.

The Magdeburg “mega fab”, which is due to start operating in 2027, is intended to produce chips with features that are two nanometres or less in width — a miniaturisation that Intel and its main rivals, TSMC and Samsung, hope to first put into production elsewhere by 2025.

It represents a bet that the US company, after squandering its longstanding lead and falling badly behind its Asian rivals, can claw its way back to the forefront of the world’s most technologically advanced and complex manufacturing industry.

In a sign that investors have yet to be convinced, Intel’s already battered shares have fallen 25 per cent since Gelsinger became CEO early last year. He dismissed the company’s weak stock price as a reaction to the heavy spending it is facing.

“That isn’t a very Wall Street friendly message. And it’s exactly the right thing to do,” said Gelsinger. “We’re not going to be governed by the near-term view of quarterly Wall Street.”

The EU’s political leaders, meanwhile, have not hidden the scale of their ambition.

After seeing the continent’s share of global manufacturing fall below 10 per cent, the Magdeburg fab lies at the heart of a bid to use the most advanced technology to get back to 20 per cent by the end of the decade. “When we were negotiating with the Europeans, there was a lot of sensitivity to going to two nanometres or below,” Gelsinger said.

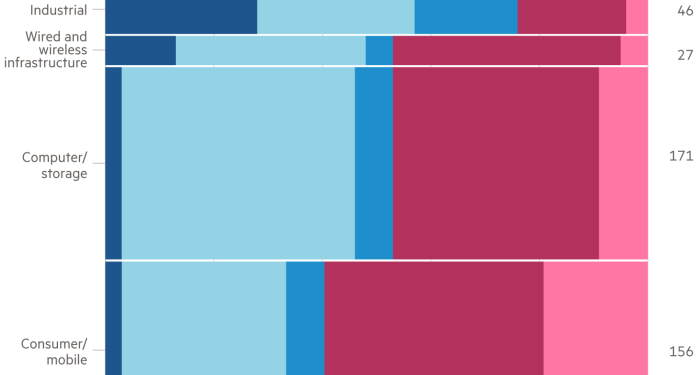

Some European executives said that chips produced with the most advanced manufacturing techniques, which are best suited for high-volume, low-power uses such as smartphones and servers, would not match the needs of European industry.

Instead, they said, investment should be directed at improving the energy efficiency and other aspects of the more mature nodes used by producers such as carmakers.

“The narrative that everything will converge to less than five nanometres is a false statement,” said one industry executive. “The main innovation for the auto industry is happening on mature nodes. They need to be very energy efficient and safe.”

“This is the strongest growing segment of semiconductors,” another executive said. “The EU should support local production.”

According to Gelsinger, the new fab is squarely aimed at Europe’s future needs. “It takes many years to build these facilities,” he said, signalling that the plant would not help solve existing chip shortages. He added that the chips from Intel’s plant would be well-suited to the electric vehicles and self-driving technology that will greatly boost automakers’ demand for silicon in the coming years.

Peter Wennink, chief executive of ASML, the Dutch company whose equipment plays a central role in the most advanced chipmaking, said Intel’s investment in advanced technology would “act as a magnet for innovation” and help to ensure Europe did not become irrelevant in the chip supply chain.

But he added that the current chip shortages showed the need for advances in more mature technologies as well and that state aid was required to help offset the higher costs of building new factories in Europe. “That needs to step up. Just one fab is not going to cut it,” he said.

However, Thierry Breton, the EU’s internal market commissioner who has been the driving force behind Europe’s chip ambitions, said EU taxpayers should not fund mature technologies.

“Some of the chip companies were probably thinking this was a good opportunity for them to have access to public money to enhance their production . . . because the demand is there,” he said. “I was always very clear. We are not here to do your job. We will not put public money to do this. We need to prepare cutting edge technology.”

Additional reporting by Joe Miller