India has continued a crack down on the Chinese companies that dominate its smartphone market, in a series of legal actions that have raised trade tensions between Asia’s two biggest nations.

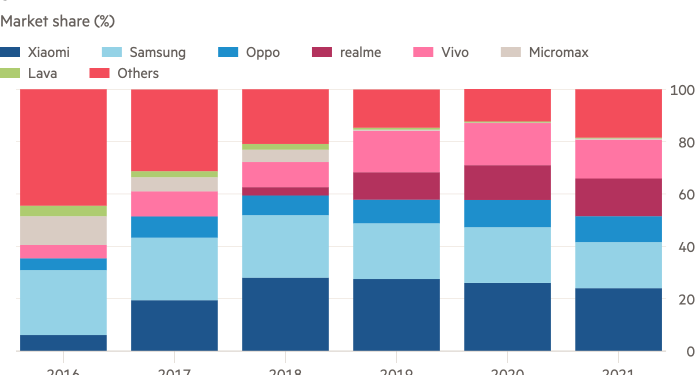

Oppo, which sells both the popular realme brand and its eponymous marque, was accused by Indian regulators of tax evasion this week. That move follows recent raids, lawsuits and sweeping asset seizures against Xiaomi and Vivo. Together, the three Chinese technology groups control around 60 per cent of India’s smartphone market.

The move comes as New Delhi seeks to build up its domestic tech sector and reduce dependence on Chinese imports, and against a backdrop of frosty relations between the two nuclear-armed neighbours over their disputed border.

While India insists the legal cases against Chinese companies are not politically motivated, the raids add to longstanding concerns about India’s climate for foreign investment.

Ashutosh Sharma, research director at market researcher Forrester, said cross-border tension had intensified India’s scrutiny of Chinese-owned companies: “The level of distrust is so high between India and China, I don’t think there’s any likelihood that these companies are not closely watched by the government.”

India’s Directorate of Revenue Intelligence (DRI), a financial enforcement agency, has alleged Oppo, which along with Vivo is owned by Dongguan-based BBK Electronics, had evaded taxes worth Rs43.9bn (around $556mn).

The DRI alleges that Oppo obtained lower customs duties through mis-declaring imported items and failing to include royalty and license fees in their value. The Revenue authority is demanding Oppo repay the full sum. The company did not respond to request for comment.

Vivo was raided across 48 locations and assets worth $60mn seized last week. In response, the Chinese embassy in India complained that “frequent investigations by the Indian side into Chinese enterprises” were disrupting their business operations. Vivo said it was cooperating with authorities.

Earlier this year, India’s financial enforcement authorities accused the Xiaomi, the Chinese group that is the market leading smartphone seller in India, of unlawfully remitting $725mn abroad. Xiaomi has denied any wrongdoing.

“It was to be expected that Chinese companies would be targeted over time,” said Jabin T Jacob, associate professor at Delhi’s Shiv Nadar University who specialises in China. “The longer the border stand-off continued, the more Chinese companies would be at risk.” It seemed unlikely allegations made by enforcement authorities were baseless, Jacob added.

Along with South Korea’s Samsung, Chinese-owned device makers grabbed market share from once prominent Indian phone brands, undercutting homegrown companies with newer technology at cheaper prices.

For India’s government, the dominance of Chinese smartphone makers “is a big matter of concern,” Sharma added. “That’s why the push is on ‘Make in India’”, referring to a government scheme to incentivise local manufacturing, part of New Delhi’s plan to reduce dependence on Chinese imports. Most Chinese-owned phone makers manufacture devices in India and have invested heavily in factories.

India’s minister of state for information technology Rajeev Chandrasekhar has denied India discriminated against Chinese-owned companies.

“Our views of companies are not driven by whether they are Chinese or not Chinese,” he told reporters, adding: “There are laws, there are rules you have to comply with, and there is no free pass for anybody, whether you are Chinese or anybody.”

India has explicitly coldshouldered Chinese companies before. It restricted direct investment from neighbouring countries in April 2020, when the pandemic weakened Indian corporates and made them vulnerable to takeover.

Commercial hostilities escalated after deadly border clashes between Indian and Chinese soldiers erupted in summer 2020, with India banning hundreds of Chinese-owned apps including Bytedance’s TikTok, citing national security concerns.

Underlining how complex trade relations are between India and China, Soumya Bhowmick, associate fellow at New Delhi-based Observer Research Foundation, found that after a slump in 2020, Chinese investments in Indian start-ups in 2011 hit “a 3-year high, and Chinese funding is quite robust in the start-up ecosystem again.” Alibaba and Tencent are among the biggest backers.

Meanwhile, India and China’s bilateral trade has grown in China’s favour – India imported $27.7bn worth of goods from China in the first three months of 2022 but exported only $4.9bn to China, a record high trade deficit. Electronics, chemicals and car parts make up the bulk of Chinese imports.

Yet strategic sectors remain off limits. New Delhi does not want telecommunications companies to use equipment made by China’s Huawei, and this week broadened a regulatory framework for approving hardware use. Huawei is also subject to ongoing tax probes, but said it is “fully compliant” with Indian laws and is co-operating with authorities.

Freezing Chinese companies out of India’s telecommunications networks has encouraged domestic players to invest, China scholar Jacob argued, “because at least they’re assured of returns without competition from elsewhere.”

“In a lot of ways, the Indians are following the Chinese playbook,” Jacob added, by “developing their own national champions”.

Reliance Jio, the digital unit of the oil-to-telecoms conglomerate controlled by tycoon Mukesh Ambani, has upturned the mobile telecoms industry with dirt cheap data since 2016. It launched its own smartphone late last year with backing from Google and Meta.

While the device has yet to capture market share, “my prediction is in the next two to three years this will shift,” said Forrester’s Sharma, “we will probably see the dominance of local players like Reliance.”

Gucharan Das, an author and former CEO of Procter & Gamble India, said that “India tries to create a level playing field” in relation to foreign investors.

While not addressing the specifics of the cases involving Chinese companies, he warned that commerce and politics should stay separate: “We should not mix politics with economics. A smart country does not hurt its economy”.