As Masayoshi Son tried to persuade investors of the wisdom of purchasing one of the most successful chip companies in the world in 2016, the SoftBank chief had one clear message: “For the era of the ‘internet of things’, I think the champion will be Arm.”

But the concept of connecting billions of everyday and industrial devices to the internet has been much slower than anticipated to materialise.

Son’s drive to capture the chip design market for the internet of things (IoT) was the first bet he made on Arm that has not paid off. The second was a $66bn sale of the company to Nvidia that unravelled last week.

Arm remains the dominant player in designing chips for smartphones, still the most ubiquitous form of computing but a source of much slower growth in recent years. Ahead of an initial public offering that could come as soon as this year, the company is racing to solidify its position in new markets that it has underexploited to date, while trying to drive up profits to appeal to a new set of investors.

Rene Haas, Arm’s incoming chief executive, told the Financial Times that its products were now “far more competitive” in data centres and cars than when SoftBank bought the Cambridge-based company.

“Making trade-offs about where to invest, where not to invest . . . those are the trade-offs that public companies and even private companies have to do every day,” he said. “The company is in great shape.”

When Son spearheaded the $31bn purchase of Arm, he saw it as a wager on the future of the entire technology industry, which was crystallising at that time around the IoT concept. He proceeded to push the executive team firmly on the course to designing chips for this future of machine connectivity.

Five-and-a-half years later, it has become increasingly clear that the IoT gamble was a costly misadventure. Moreover, it distracted Arm from attacking Intel’s dominance in the much larger data centre market.

As Son’s vision collided with reality, SoftBank quietly revised its market calculations. A presentation from 2018 forecast that by 2026, the IoT controller market would be worth $24bn, and the server market $22bn.

But, a similar presentation from 2020 predicted that by 2029, the IoT chip market would reach only $16bn, while the server market — of which Arm had so far only captured a 5 per cent share — would reach $32bn. The Japanese technology group also revised down its estimate of the value of the IoT market, from $7bn in 2017 to $4bn in 2019.

Tudor Brown, who co-founded Arm in 1990 and was an executive at the company for 22 years, described its heavy investment in IoT as “strange” given that “there was never going to be any money in that market”. He added: “Focusing on that, they didn’t focus on the big prize, which was the server.”

In Arm’s regulatory filings in December, the company made a strong case against pursuing an IPO and in favour of a Nvidia sale, outlining how shareholder pressure could stifle the company’s ability to invest in the data centre and PC markets, which had been “difficult to crack” and where it had made only “limited inroads”. Public-market investors would “demand profitability and performance”, meaning cost-cutting and a lack of financial firepower to invest in innovative new businesses, Arm’s filing added.

“We always felt that the Nvidia acquisition would give us a fantastic opportunity to invest and do more,” said Haas. “Now that we are on to the [IPO], I feel very good about our prospects.”

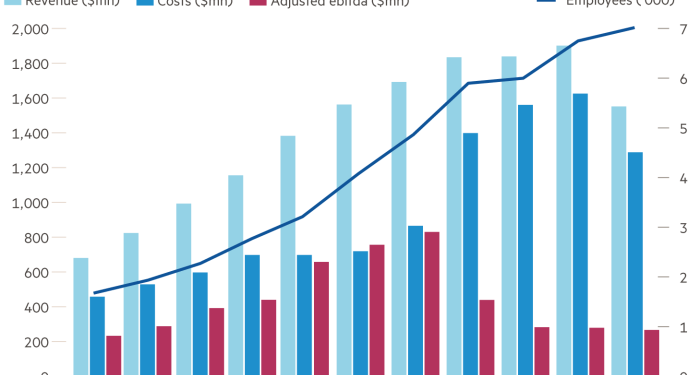

Son also underestimated just how expensive delivering innovation in semiconductors can be, even though Arm does not manufacture its own silicon. Arm’s costs increased from $716mn in 2015 to $1.6bn in 2019, according to SoftBank data. Revenues gained 20 per cent to $1.9bn while profits plunged almost 70 per cent to $276mn by 2019.

Arm has more recently begun to course-correct, investing more heavily in the growing server and PC market over the past four years, winning allies such as Amazon Web Services, which is now on the third generation of its Arm-based Graviton chip, and Apple, which is shifting its entire range of Mac computers from Intel to its own M1 processors, built on Arm’s designs.

Haas conceded: “While IoT is still a hugely important area to us, we are very, very focused on the computer space,” he said, referring to chips for servers and PCs. He refused to disclose what portion of Arm’s revenues came from areas outside its core mobile business, citing the “heavy regulatory process” surrounding the Nvidia deal.

Arm’s executives argue they are only now beginning to reap the rewards of strategic investments made several years ago. Arm’s chip designs are licensed to semiconductor companies and electronic manufacturers as they begin to develop new products; it can take several years for initial design wins to translate into royalties from product sales.

The company’s royalty revenue, which accounts for more than half of its total sales, rose 22 per cent in the past nine months, supporting Haas’ claims of a turnround. These were “numbers unlike Arm has ever seen before and higher than it was pre-SoftBank”, he said.

“Masa had always said that having Arm be a public company some day was certainly the goal,” Haas said, adding that now the Nvidia deal had fallen through, Arm was “back to the original Plan A”.