One of Hong Kong’s enduring puzzles has been how the city managed to miss Asia’s tech boom for so long.

Situated next door to the world’s fastest-growing market and boasting Asia’s leading financial centre, Hong Kong hosts a multilateral business community and several good universities. And yet in terms of homegrown technology start-ups, the city’s performance has been anaemic.

“I will be honest. I am a Hong Kong local. We have lost 20 years,” says Albert Wong, chief executive of the Hong Kong Science and Technology Parks Corporation. “We have never been putting so much emphasis . . . on research and development and, to be honest, I think it will take a generation to fix it.”

A fix is now under way. Wong is leading a strategy to turn HKSTP into the city’s leading tech incubator. In the five years since he took the helm, the park has nurtured a start-up ecosystem and launched initiatives to establish R&D programmes with some of the world’s top universities.

According to its own data, the park now hosts 540 tech start-ups, of which three are “unicorns” valued at more than $1bn, 10 are “centaurs” valued at more than $100m and 58 are “ponies” valued at more than $10m. Such numbers represent a step change: Hong Kong did not have a single “unicorn” to its name until 2017.

Adding impetus to the transformation is a science park culture that Wong describes in unsparing terms. The park has no time for “bullshit” R&D and has created a system to weed out about 10 per cent of its tenants every year, following an annual review to check, among other things, if each company has more than half of its staff engaged in R&D.

“We have a team of people looking at their business plan and checking that they are doing what they say they are going to do,” Wong says. “If they do not satisfy the review, we have all the rights to terminate their lease after three years.”

Such a system helps create a brand name. “If you have a science park business card, it is a kind of proof that you are doing real R&D,” Wong says, noting that, out of a total of 15,000 people who work at the park, about 10,000 are in R&D.

Reinforcing this approach, the park is helping to set up 27 joint research projects between overseas universities — including Harvard and Stanford — and local counterparts to conduct research into areas such as health tech, artificial intelligence and robotics. The initiative is backed by HK$10bn ($1.3bn) in funding from the Hong Kong government.

All this feeds into what Hong Kong is hoping will be a makeover. For at least the past two decades, much of the energy of the city’s entrepreneurs was sucked into a factory boom over the border in China’s Pearl River delta.

The game was simple: outsource manufacturing to Chinese factories to take advantage of low labour costs and then re-export cheap products through Hong Kong’s port to the rest of the world. “Now everybody knows that this is a game you can no longer play, but it will take a bit of time to turn around,” says Wong.

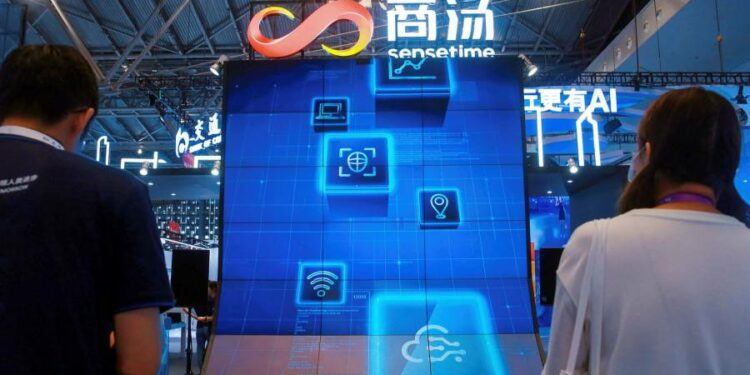

Nevertheless, signs of progress towards a future as a tech hub are mixed with growing political complexity. SenseTime, a Chinese artificial intelligence start-up that was valued at $17bn in early December, got its start in HKSTP and ranks as the park’s most successful alumnus to date.

SenseTime postponed its share offering on Hong Kong’s stock market in December after the US added it to an investment blacklist. Washington has accused the company, which specialises in facial recognition software, of enabling human rights abuses against Muslim Uyghurs in China’s northwestern region of Xinjiang.

SenseTime, which has denied the charges, revived plans for an initial public offering this week with the help of Chinese state-backed entities. But the episode raises questions about the extent to which Silicon Valley tech giants and overseas funds can feel free to participate in Hong Kong’s emerging tech scene.

The imposition of a national security law on Hong Kong by Beijing in 2020, for instance, means that Hong Kong police can demand that online platforms take down content deemed undesirable by China’s security state. Global tech companies, which used to regard Hong Kong as a safe gateway through which to access the China market, may have to think twice.