Investors dumped stocks and bet on less aggressive policy from the Federal Reserve yesterday after comments from social media group Snap and disappointing economic data fanned fears that growth in the US was poised to slow dramatically.

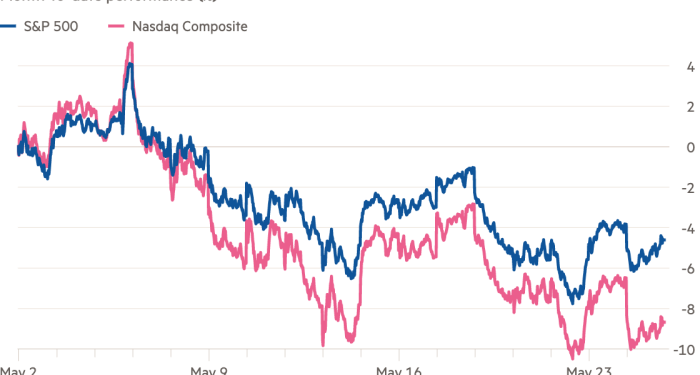

The Nasdaq Composite, which is weighted towards big US tech companies, fell 2.3 per cent by mid-afternoon in New York. The more evenly balanced S&P 500, which tracks the fortunes of the largest publicly traded companies, declined 0.8 per cent. By the closing bell, however, both indices had eased off lows plumbed early in the session.

US stocks have been hard hit this year, with the average stock in the broad-based Russell 3000 down more than 40 per cent from recent highs, as the Fed has raised interest rates in its bid to tamp down inflation. Recent data pointing to slower growth has added to the pressure on stocks, as investors warn that the US economic recovery that followed the coronavirus pandemic could be waning.

Money managers have instead hoovered up US government debt as they have swapped riskier investments for safe havens. The 10-year Treasury yield, which moves with economic growth and interest rate expectations, fell 0.09 percentage points to 2.76 per cent, its biggest one-day rally in price since late April.

Snap shares plummeted 43 per cent yesterday. The group said its sales and profits for the current quarter would come in below its previous expectations and that the “macroeconomic environment has deteriorated further and faster than anticipated” since it issued guidance in April, leaving investors with rattled nerves.

Thanks for reading FirstFT Asia. Here’s the rest of the day’s news — Sophia

Five more stories in the news

1. Chinese and Russian nuclear bombers fly over Sea of Japan Although Moscow said the 13-hour flight was carried out “strictly in accordance with the provisions of international law”, Japan yesterday denounced the joint exercise as “unacceptable”. It is the first such manoeuvre to occur with a US president in the region.

2. Hungary declares state of emergency caused by Ukraine war Prime minister Viktor Orbán has given his government rights to rule by decree in response to an “economic crisis” caused by war in neighbouring Ukraine and sanctions against Russia. Orbán will set out measures to be adopted today. The announcement follows his refusal to discuss the proposed Russian oil embargo at next week’s EU leaders summit.

3. Quad unveils satellite-based maritime initiative to counter China The US, Japan, Australia and India have launched a satellite-based initiative that uses near real-time intelligence to help countries in the Indo-Pacific region track illegal fishing and unconventional maritime militias. It will also boost capabilities to tackle human and weapons trafficking.

4. Airbnb gives up on China as zero-Covid policy crushes tourism The online travel group has announced that it will close its business in China this summer. After a six-year push to crack the market, Airbnb has been throttled by the impact of Beijing’s harsh zero-Covid strategy on domestic and international tourism.

5. Soaring steel prices hit South Korean shipbuilders’ turnround hopes Despite surging orders and rising prices for new container ships and gas tankers, higher steel prices are set to delay South Korean shipbuilders’ return to profitability. The price recently bumped up another 8 per cent after doubling in the past two years.

The day ahead

Meta board of directors Peter Thiel retires from Meta Platform’s board of directors at today’s annual shareholder meeting. He has served on the board since 2005, a year after Facebook was launched.

Amazon shareholder vote At today’s annual shareholder meeting, Amazon shareholders will vote to approve a 20-for-1 stock split. If approved, then new shares will commence trading on 6 Jun, with shareholders receiving 19 additional shares for every share they own.

European Union economy ECB publishes its twice-yearly stability review today, plus OECD will publish its economic outlook for the eurozone.

Davos ECB president Christine Lagarde, Ireland’s taoiseach Micheál Martin, Dutch prime minister Mark Rutte and the president of the European Parliament Roberta Metsola join a Davos forum on the EU’s unity in response to Russia’s invasion of Ukraine.

Remembering George Floyd Today marks the two-year anniversary of the killing of George Floyd. His murder by a police officer sparked worldwide protests and led to more focused attention on US racial disparities.

What else we’re reading

South Korea turns against the ‘Lunatic’ crypto leader Do Kwon, the brash 30-year-old behind the terraUSD, is now the most “hated man in South Korea” after the collapse of the stablecoin. Kwon’s high-profile backers, global marketing strategy and bruising social media persona helped attract attention and retail investors. But now many savers have lost everything.

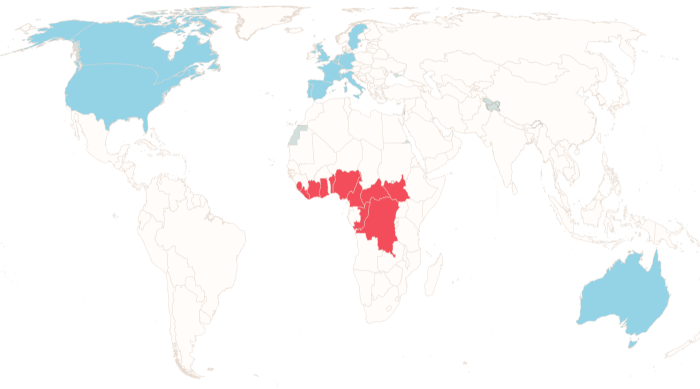

Monkeypox: what to know about the virus Discovered in lab monkeys in 1958 and in a human 12 years later, monkeypox typically emerges from close contact with animals in sub-Saharan Africa. Almost 100 cases have been recorded in at least a dozen countries, the largest outbreak of the virus outside sub-Saharan Africa, and EU officials are looking to procure smallpox vaccines to suppress it.

The west is divided over how the war in Ukraine must end As the Russian war enters its fourth month, western leaders ponder the prospect of a prolonged conflict. The possibility of a Ukrainian victory has raised multiple questions. What does “winning” mean? Is it a matter of pushing Russians back to where they started in February — or also taking back territories occupied since 2014?

-

Further reading: The World Economic Forum has been fundamentally changed by the Ukraine war. Financiers and CEOs are no longer the masters of the universe as nationalism and militarism take over in Davos.

The rise of the Middle East and hope for sustainability Luxury companies are seeing a flurry of spending in the Middle East thanks to rising oil prices, strong economic growth and a return to shopping locally. While luxury’s two most important markets — the US and China — look less than rosy, the Gulf Cooperation Council countries, which include Saudi Arabia and the UAE, are set to see a 6.1 per cent increase in GDP this year.

‘Exxon of the past is dead’ after shake-up Activist hedge fund Engine No. 1’s long-shot victory a year ago — winning three seats on the board of the conservative supermajor — shook ExxonMobil and Big Oil. Targets to make operations net emissions free by 2050, spending limits on fossil fuel projects and a new low-carbon business are all signs of change.

FT Globetrotter

The Financial Times’ insider guides to great cities travels to Singapore and visits the five best places for brunch, from an ex-British army barracks to the key locations for plane and superyacht spotters.