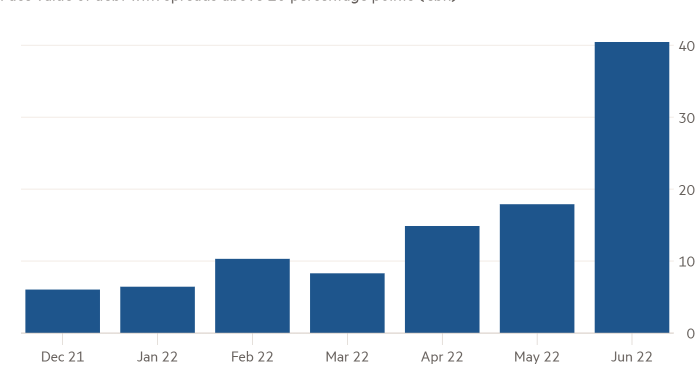

More than €40bn of European corporate bonds are now trading at distressed levels, highlighting how the worsening economic outlook has triggered rising angst about companies’ ability to pay their debts.

The pile of euro-denominated corporate bonds flashing warning signs has jumped from €6bn at the end of 2021, according to Financial Times calculations based on Ice Data Services indices.

The stock of distressed corporate debt more than doubled from May 31 to June 30 alone, underscoring how quickly concerns are mounting that central banks’ decisions to tighten monetary policy could tilt major economies into recession. Investors are also fretting that high levels of inflation will increase companies’ cost of doing business.

“Credit markets have rapidly moved towards pricing in a recession,” European credit analysts at JPMorgan said on Friday.

The cautious sentiment from the investment bank followed a report earlier this week from S&P Global, which warned on the “increasingly murky outlook for credit quality” in Europe.

“Credit ratings are likely to come under pressure into 2023 as supply constraints keep food and energy prices elevated, households increasingly struggle with falling real incomes, and central banks prioritise inflation over growth,” the rating agency said.

The dour sentiment marks an abrupt shift from the rush into risky assets that was set off by the huge stimulus measures central banks and governments put in place to counter the 2020 coronavirus crisis.

Bonds trading at distressed levels — with a yield above government benchmarks, or spread, of more than 10 percentage points — now account for 8.8 per cent of the Ice index of euro-denominated junk bonds, compared with 1.3 per cent at the end of 2021.

This shows investors are pricing in the chance they will not receive money when bonds mature, pushing up the yield of companies’ bonds.

Meanwhile, the iTraxx Crossover, which tracks the cost of junk bond credit default swaps — insurance-like products that protect against defaults on Europe’s riskiest bonds — has risen to levels last seen in April 2020.

The lack of demand for riskier bonds suggests Europe’s least creditworthy businesses could struggle to refinance debt and will have to guarantee higher returns to investors to attract funding. Highlighting those worries, the JPMorgan analysts noted on Friday that there had been an “alarming freeze in capital market lending conditions, which has gradually spread up the quality curve.”

Demand is also falling for high-yield US debt. Marty Fridson, chief investment officer at Lehmann Livian Fridson, whose calculations show that the distress ratio for US high-yield debt stands at 7.8 per cent, said the rise is a sign of intensifying economic jitters.

He said: “This rise is not unusual [for periods of economic uncertainty] but that kind of rise has often, if not always, been associated with an oncoming recession.”