Despite the disruption of the pandemic, 2021 is set to be an incredible boom year in investment in European technology companies.

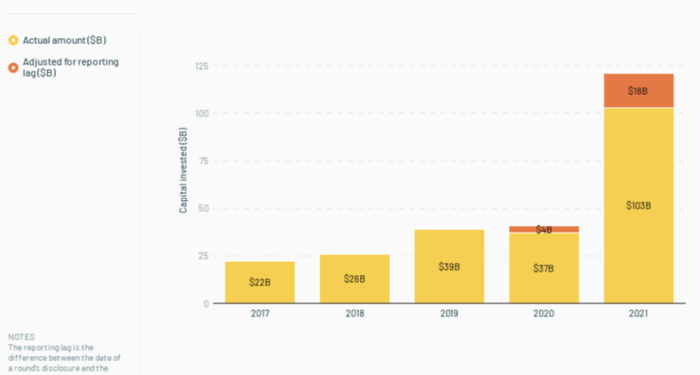

Atomico, the VC firm founded by Skype’s Niklas Zennström in 2006, published its annual State of European Tech report today, with a headline number of $121bn invested this year — nearly three times the 2020 figure of $41bn and 10 times what it recorded in its first report in 2015.

Getting past the $100bn mark for the first time was largely thanks to bigger rounds for later-stage companies of more than $250m, which grew by a factor of 10 in the past 12 months. In the first nine months of 2021 alone, there were 57 funding rounds of $250m-plus, part of more than 150 rounds of $100m or more. There were 68 rounds of $100m-plus in the UK, equating to 37 per cent of all rounds of this magnitude in Europe.

There were 98 new unicorns — start-up companies valued at more than $1bn — added in Europe this year for a cumulative total of 321, but the main takeaway from the report is the growing depth of more substantial tech companies.

Fintech is leading the way. The Dutch payments company Adyen is now worth $87bn, while five fintechs — Klarna, N26, Mollie, Revolut and Trade Republic — were in the Top Ten of largest raises of the year.

The Internet of (Five) Things

1. Bravo for more buyouts

Buyout firm Thoma Bravo is looking to raise $35bn to continue its software spree, reports Antoine Gara. Its biggest deals this year were the $10.2bn buyout of real estate software company RealPage in April and the $12.3bn buyout of cyber security firm Proofpoint in August.

2. Intel to list Mobileye

Intel says it is planning to seek a separate stock market listing for Mobileye, its driver-assistance and autonomous vehicle unit, as it looks to shore up its battered stock price. Intel paid $15bn for Mobileye in 2017 as part of a race to diversify into newer markets for chips.

3. Samsung’s big shake-up

Samsung Electronics has reshuffled its management for the first time in four years as it steps up its push into non-memory chips and artificial intelligence. Kyung Kye-hyun, chief executive of affiliate Samsung Electro-Mechanics, will be the new head of its semiconductor business, while its consumer electronics and mobile divisions will merge under Han Jong-hee, who has been head of Samsung’s visual display business.

4. New EU rules on gig economy

Gig economy companies will be forced to prove their workforces are self-employed contractors rather than employees, for the first time, under new draft legislation being published by Brussels this week. Lex says Monday’s UK court ruling against Uber further weakens a business model that was shaky to start with.

5. Bitcoin’s rocky weekend

Bitcoin’s 20 per cent flash fall on Saturday marked one of the first times a storm in traditional financial assets triggered big waves in cryptocurrencies, underscoring how large investors are playing an increasing role in digital asset markets. Meanwhile, The Big Read looks at how a new breed of money managers is hoping to shake up the corporate credit market using processing power, models, algorithms and big data to systematically wring cash out of pricing anomalies.

Tech tools — Death’s Door

In this role-playing game now released on multiple platforms, you are a fledgling crow who is a new employee at a supernatural bureau of avian grim reapers. Your job is to collect the souls of those who have passed on. Yet when a soul you have collected is stolen, your own immortality is compromised, meaning you will age and ultimately die if you cannot recover it. Tom Faber says indie publisher Devolver Digital has created an engrossing world with Death’s Door: “This game is an exercise in minimalism: it gives players a precise dose of every element they need for a transporting experience.”