Technology shares dropped across Europe and Asia, while banks rose, after Federal Reserve chair Jay Powell signalled that the US central bank would begin boosting interest rates from crisis-era lows in March.

Europe’s regional Stoxx 600 share index was down 0.2 per cent by the early afternoon in London, masking a powerful rotation as money seeped out of more speculative areas of the market and financials perked up on prospects of wider lending margins.

Wall Street stock market futures struggled for direction, following days of heavy volatility as traders awaited the conclusion of a Federal Reserve meeting on Wednesday that had been hotly anticipated to mark a reversal of its pandemic-era loose monetary policies.

Wall Street’s benchmark S&P 500 index has lost about 9 per cent of its value in January, with tech stocks hit particularly hard as prospects of higher returns from cash and bonds dented enthusiasm for early stage businesses.

“Fed policy is now very clearly the most prominent driver of market sentiment,” said Valentijn van Nieuwenhuijzen, chief investment officer at NN Investment Partners.

“I expect the real economy to do relatively well this year but markets will be more volatile and we could have a number of periods of correction.”

Fed chair Jay Powell said after Wednesday’s meeting that he would not rule out consecutive rate increases later in the year to stamp out inflation that has surged alongside the US economic rebound from 2020’s pandemic-driven lows. Futures markets have now priced in around five US rate hikes by December.

The Stoxx 600 technology sub-index fell 1.7 per cent, while a gauge of Chinese tech stocks listed in Hong Kong closed 3.8 per cent lower. Mainland China’s CSI 300 share index dropped into a bear market, closing more than 20 per cent below its most recent high of February last year.

Higher interest rates not only threaten corporate profits by raising borrowing costs; they also lower the present value of companies’ forecast earnings in investors’ models, in an effect that is magnified for early stage tech businesses whose peak earnings are not expected until years into the future.

JPMorgan strategists now expect the world’s most influential central bank to raise its main funds rate from close to zero to about 0.65 per cent by June and 1.13 per cent by the end of this year.

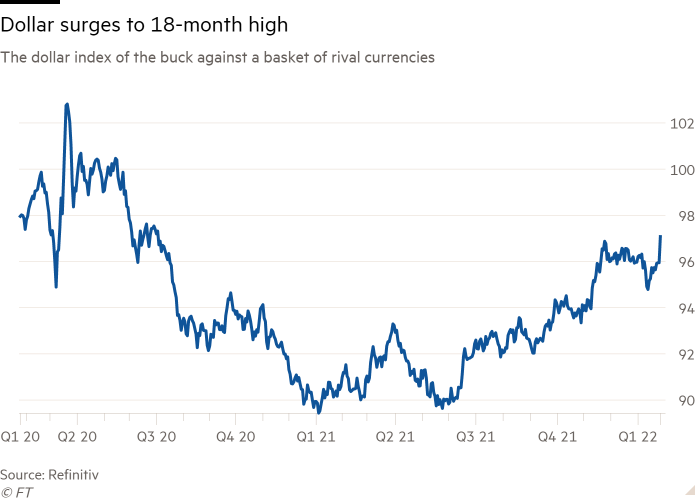

The dollar index, which measures the US currency against six others including the euro and the yen, rose 0.6 per cent and was on track for its strongest week since June.

US Treasury markets, meanwhile, illustrated concerns about a rapid rate rise cycle causing an economic slowdown.

The yield on the two-year Treasury jumped 0.08 percentage points to 1.17 per cent as the price of the government debt instrument fell. The 30-year yield fell 0.05 percentage points to 2.12 per cent as the price of the longer-term note rose.

This flattening of the so-called yield curve occurs when money managers sell shorter-term bonds because rate rises and high inflation lower the appeal of the fixed income-paying securities, then move money into longer term debt. It can also precede economic downturns.

“We’ll have to see if growth will stay strong despite the tightening of monetary conditions,” said Nicolas Forest, head of fixed income at fund manager Candriam. “But the main risk for 2023 is that it won’t.”

Brent crude, the global oil marker, rose 0.8 per cent to $90.64 a barrel.