The US dollar surged to its highest level in nearly 18 months on Thursday as currency traders reacted to Federal Reserve chair Jay Powell’s refusal to rule out an aggressive series of interest rate rises this year.

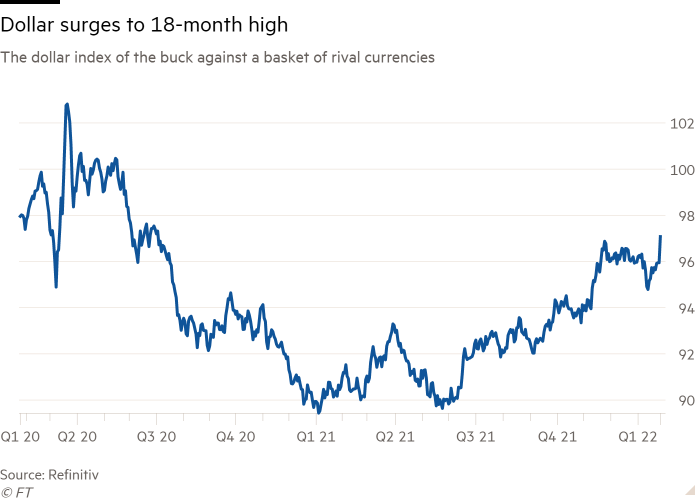

Powell said on Wednesday the US central bank would be “humble and nimble” in deciding how quickly to tighten monetary policy in the face of soaring inflation, a phrase interpreted by investors as leaving the door open to a faster pace of rate increases than previously anticipated. The dollar rose 0.6 per cent against a basket of rival currencies, eclipsing a recent high in November and reaching a level not seen since July 2020.

The gains came as markets priced in five quarter-point rate rises from the Fed by the end of this year, widening the gap in rate expectations between the Fed and other big economies, and boosting the dollar.

“There was no mention from Powell of how gradual rate increases will be,” said Francesco Pesole, a foreign exchange strategist at ING. “That leaves a lot of room for speculation, and the market is speculating that the pace of hikes is going to be aggressive.”

Analysts at BNP Paribas are expecting six rate rises this year following the more hawkish message from the Fed chair. “We read Powell’s comment that this cycle is different from the previous one as an indication that the Fed’s bias is for a steeper tightening than the markets and we had envisaged,” said Luigi Speranza, the bank’s chief global economist.

Although markets are beginning to price in rate rises from the European Central Bank this year, investors may be getting ahead of themselves given the weaker state of labour markets in the euro area, according to George Saravelos, Deutsche Bank’s global head of currency research.

“Yes, European wage growth may rise and the ECB may lift-off over the next two years,” he said. “But the pressure and urgency to do so in Europe is completely different [compared to the US].” The euro fell to an 18-month low of $1.124 on Thursday, and Saravelos expects it to sink below $1.10.

Wednesday’s Fed meeting also poured fuel on a debt sell-off that has rocked markets so far this year, leaving global bonds on course for their worst month since September. The Bloomberg global aggregate total return index is down 1.6 per cent in January.

Two-year US government bonds, which are highly sensitive to rate expectations, on Wednesday suffered their biggest one-day fall since the global market ructions of March 2020 The selling spread into other key bond markets, pushing German 10-year yields to just below zero, a level they topped earlier this month for the first time in nearly three years.

Following the latest jolt from the Fed, some investors were braced for further pain.

“Based on what Powell said yesterday, there is a reasonable probability of seven rate hikes this year, one at each meeting,” said Nick Chatters, investment manager at Aegon Asset Management. “This could cause investors to fall off chairs.”